|

[This article was originally published on 25th May 2023 while trading of the PAT II ESCerts was underway. It has now been updated to include the revised data on trading after the formal closure of the trading window in October 2023].

About 51% of the total ESCerts mandated to be purchased in the Perform, Achieve and Trade (PAT) program's cycle II were actually purchased. This is even after the trading window was extended 4 times beyond the original prescribed closure date. Furthermore, all the purchases were done at the floor price. Why did this happen, and can anything be done about it? |

Like every year, the Indian Premier League (IPL) saw a fervent bidding by the teams with star players fetching jaw-dropping prices. Alas, no such excitement surrounded the trading of the Energy Saving Certificates (ESCerts) issued under the Perform, Achieve, and Trade (PAT) program run by the Bureau of Energy Efficiency (BEE). Trading of ESCerts issued under the second cycle of the PAT program restarted on 14th February 2023 and was conducted every Tuesday till 31st October 2023. The trading was initially supposed to conclude on 1st August 2023 but was extended 4 times and finally concluded on 31st October 2023. In the 40 trading sessions, about 51% of the mandatory requirements of ESCerts have been purchased on the Indian Energy Exchange, Power Exchange India Ltd. and Hindustan Power Exchange Limited platforms. Furthermore, all the purchases have been done at the floor price issued by the Ministry of Power (MoP) indicating a lack of market and price discovery mechanism. This does not bode well for the PAT program as well as for the proposed ambitious Indian Carbon Market which is being designed on similar principles and institutional structures. We examine the various factors causing this situation and provide some suggestions on the way forward.

1. What is PAT?

Industry accounts for about 52% of India’s total final energy consumption while the energy sector contributes to around 75% of total GHG emissions. BEE estimates that about 11-16% of the energy in the Industry sector can be saved through improved energy efficiency resulting in substantial economic, social, and environmental benefits. Perform, Achieve and Trade (PAT) is an ambitious program developed and implemented by the BEE since 2012 to drive industrial energy efficiency. Under PAT, certain consumers from industry and service sectors whose annual energy consumption levels exceed a specific threshold get individual energy efficiency improvement targets. These Designated Consumers (DCs) are required to meet the targets in a cycle of three years. The targets are in terms of the specific energy consumption (SEC) i.e., the energy consumed per unit of production in case of demand side sectors. For the supply side sectors, the targets are given as reduction in the net heat rate (for thermal power plants), Transmission and Distribution (T&D) losses (for DISCOMs) and thermal energy consumed to produce a barrel of oil (for petroleum refinery). Individual targets are assigned to each DC to reduce its SEC compared to that in a baseline year. DCs are required to submit their action plans and annual energy consumption reports to BEE. At the end of three years, DCs are required to submit a performance evaluation audit report by an accredited energy auditor empanelled by BEE. State Designated Agencies verify the audit reports and submit them with comments to BEE. BEE then further verifies these reports and recommends to MoP on issuance of Energy Saving Certificates (ESCerts).

ESCerts are issued to those DCs who exceed their targets after verification by accredited energy auditors. One ESCert is equivalent to one metric tonne of oil equivalent (toe) energy saved by the DC over and above its target as per the baseline year production. The DCs that do not meet the target are required to buy ESCerts equivalent to the additional energy consumed over and above their target as per the baseline year production. These ESCerts are electronic tradable instruments and can be traded on Indian Energy Exchange (IEX), Power Exchange India Limited (PXIL) or Hindustan Power Exchange Limited (HPX) in the designated period. DCs have two and a half years after the end of the target year to submit the compliance by showing proof of purchase of mandated ESCerts. PAT rules impose significant penalties for those who do not purchase the equivalent ESCerts to account for their deficit from the targets. New targets are issued to the DCs after the end of each cycle. Eight PAT cycles have been rolled out so far (eighth cycle notification was issued on 27th June 2023). The first two cycles were notified sequentially after completion of each cycle of three years. PAT III onwards, the rollout has been happening on an annual basis with new DCs and new sectors being added in some cycles. The cycle duration continues to be of three years with no interim targets. As of date, PAT covers 1343 DCs from 13 sectors. BEE estimates that the first three PAT cycles have saved about 8.67, 14.08, and 1.75 Mtoe respectively in their target years. In addition, 13 new sectors have been recently added under PAT, as per a notification by BEE dated 6th June 2023.

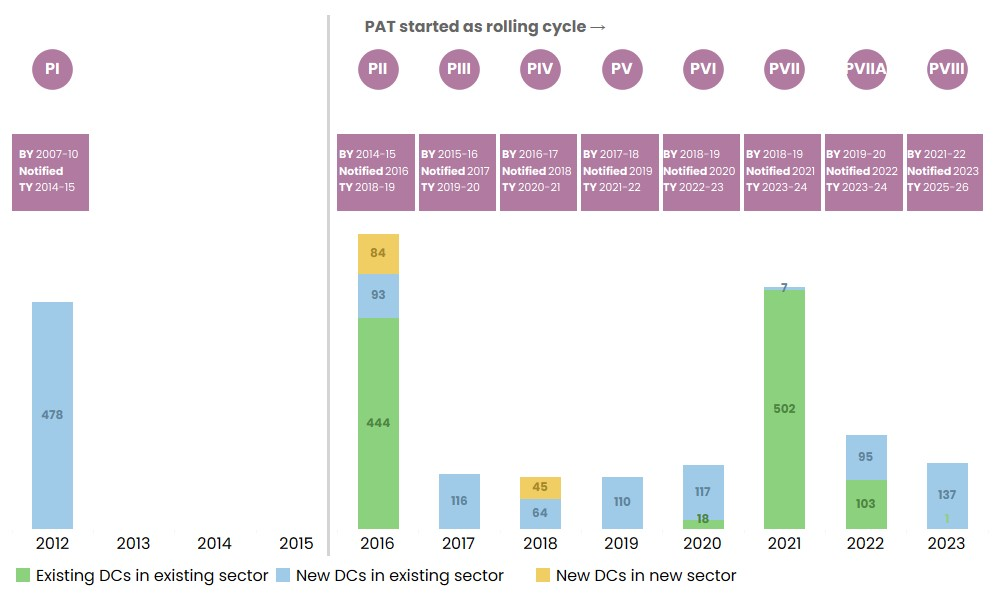

Figure 1: PAT cycles and PAT as rolling scheme since 2016

(Source: PAT Notifications)

2. What is happening in PAT II?

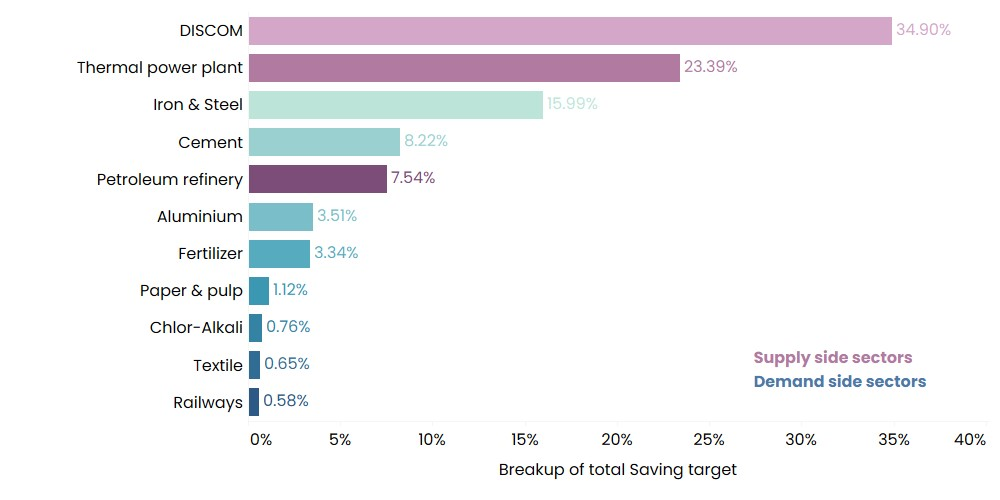

PAT II was notified on 31st March 2016. The baseline year was considered to be 2014-15 while the target year was 2018-19. PAT II gave Specific Energy Consumption (SEC) targets to 621 Designated Consumers (DCs). These DCs were spread across 8 demand sectors like Iron & Steel, Aluminium, Cement, and others, and 3 energy supply sectors, namely, thermal power plants, electricity distribution companies, and petroleum refineries. As seen in Figure 2, the supply side sectors were expected to contribute significantly to the total savings under the PAT II. On the other hand, demand side sectors contributed only to 34% of total savings. Furthermore, energy consumption of demand side DCs covered in PAT II was about 90 Mtoe, just about 37% of the final energy consumption of the Industry sector in 2014-15.

Figure 2: Sectoral share of energy saving target as per BEE calculations of participating DCs in PAT II

Data Source: BEE report on outcomes of PAT II

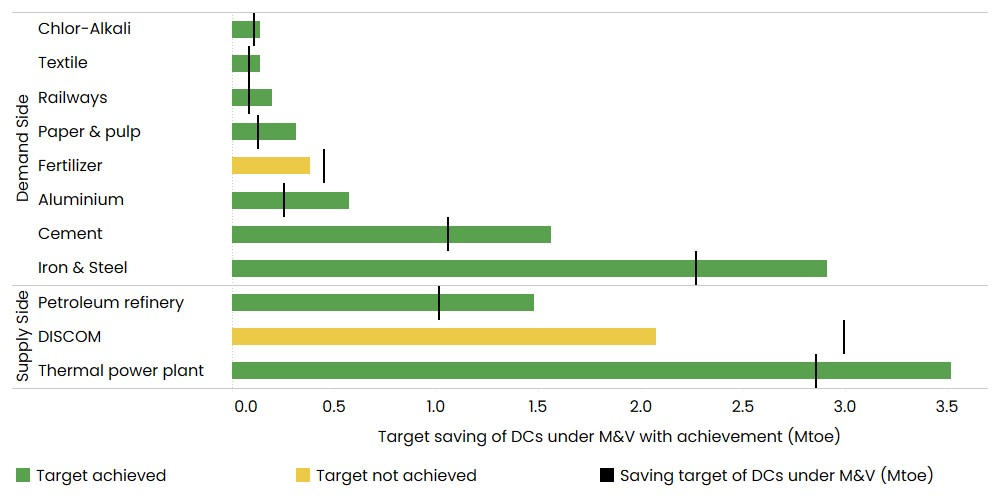

In a report published in June 2020, BEE assessed the performance of 538 DCs out of 621 DCs in PAT II. These DCs had achieved savings of 13.28 Mtoe against their target of 11.24 Mtoe. DCs from the supply side contributed to 53% of total achieved savings. Aggregated at the sector level, only two sectors (DISCOM and Fertilizer) did not meet the targets.

Figure 3: Target and achievements for 11 sectors of PAT II for 538 DCs under M&V Audit (out of 621 total DCs)

Data Source: BEE report on outcomes of PAT II

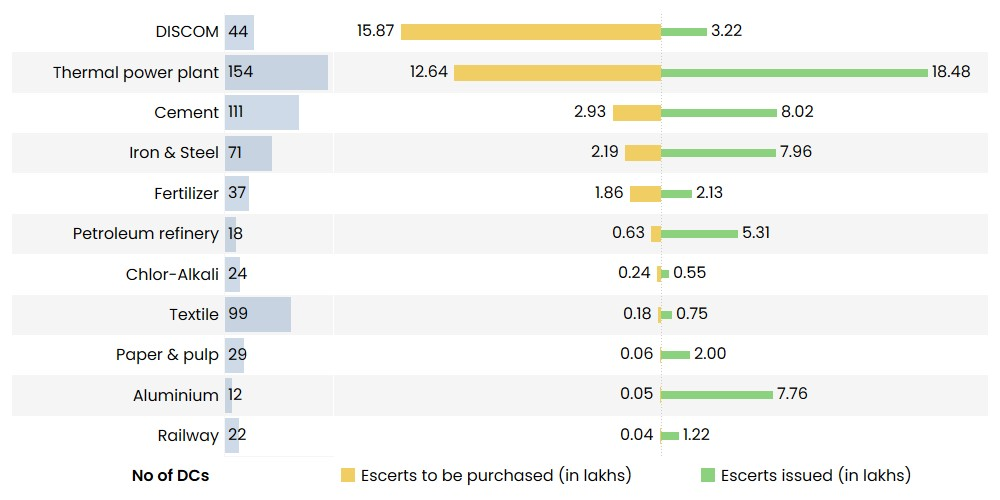

The Ministry of Power (MoP) issued the ESCerts for PAT Cycle II in August 2021. 349 DCs were issued 57 lakh ESCerts for exceeding their targets whereas 193 DCs were required to buy 36.68 lakh EScerts to account for their not meeting the targets. Sector-wise distribution of the EScerts issued and directed to be purchased is given in the figure below. While Thermal Power plants and DISCOMs together contribute to around 38% of the total issued EScerts, they are liable for 78% of the total EScerts directed to be purchased.

Figure 4. Sector-wise EScerts issued and directed to be purchased by BEE for PAT II

Data source: Notification issued by BEE in August 2021

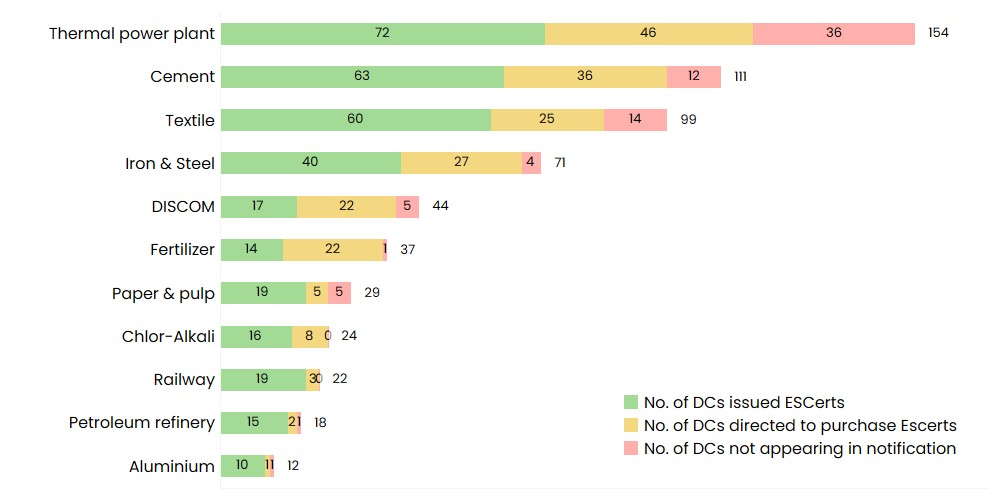

Sectoral desegregation of the number of DCs who were issued and were directed to purchase EScerts in PAT II is given in the figure below. Barring the DISCOM and Fertilizer sectors, in all the other nine sectors, the number of DCs issued ESCerts outnumber those who are given directions to purchase ESCerts, which might point to the fact that stricter target setting is required in PAT.

Figure 5. Sector-wise No. of DCs issued and directed to purchase EScerts as per the notification for PAT II

Data source: Notification issued by BEE in August 2021

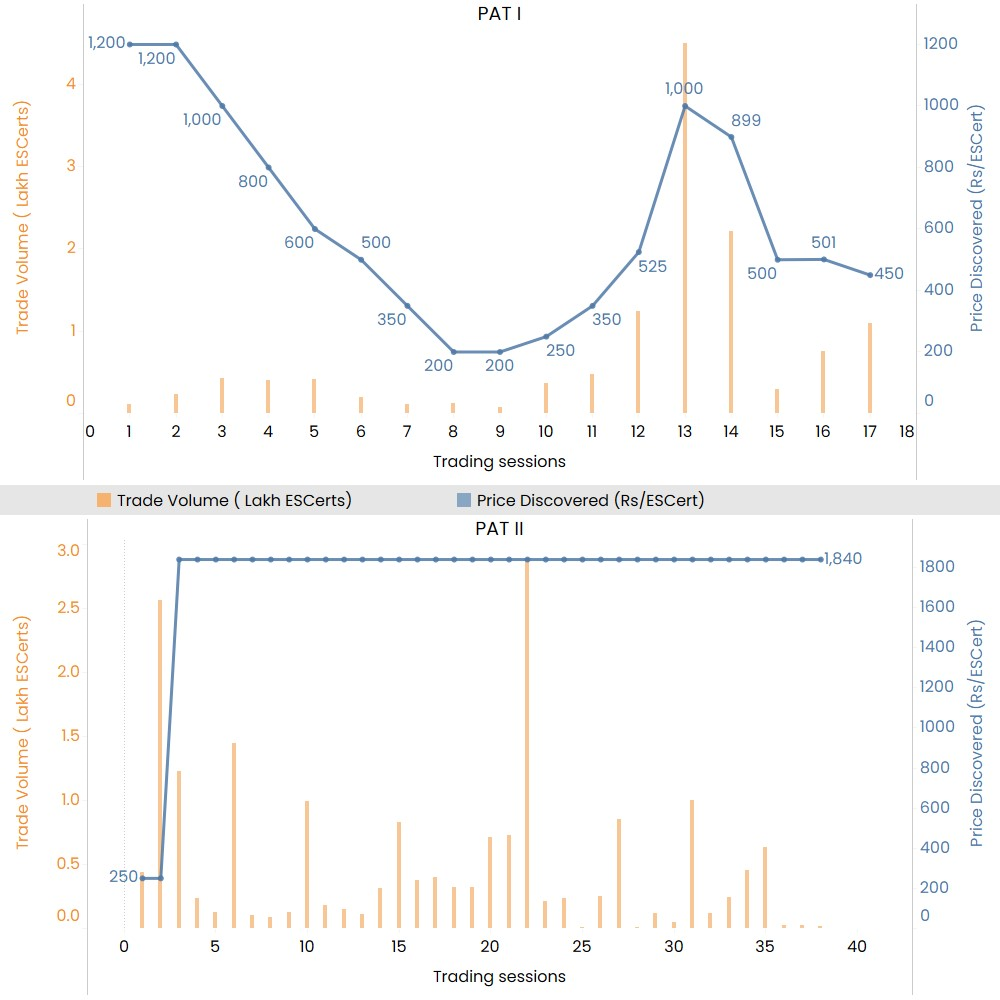

3. Trading of ESCerts under PAT II

The trading of certificates started in October 2021 and 2.99 lakh ESCerts (8% of expected volume) were traded at around Rs. 250/ESCert in 2 sessions. Trading was discontinued due to some technical issues in the trading platform but also, possibly due to the low price discovery. On 30th August 2022, MoP issued a notification which announced a floor price for 1 ESCert as Rs 1840, which was calculated as 10% of the notified price of 1 metric tonne of oil equivalent (toe) for that PAT cycle. The notified price was estimated using a formula to account for the fuel mix of the participating industries. Trading has resumed since 14th February 2023. Forty sessions have been conducted in all till 17th October 2023 and 18.9 lakh ESCerts have been traded so far, all at floor price.

Figure 6. Traded Volume and Price Discovered in Trading sessions of PAT I and II

Data Source : ESCerts trading data from IEX , PXIL and HPX

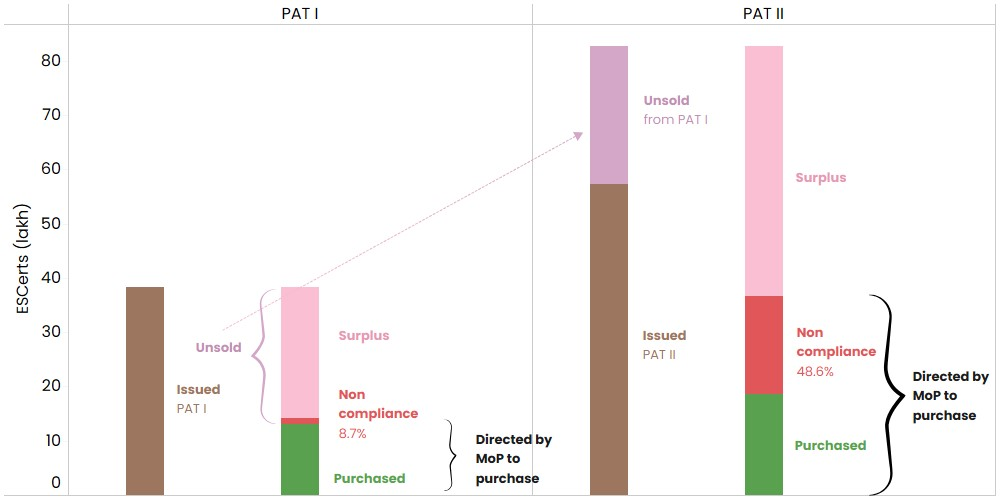

4. Oversupply of ESCerts

The most critical issue of the PAT market is the oversupply of ESCerts. In the current trading cycle, 57 lakh ESCerts were issued while DCs were required to buy only 36.68 lakh ESCerts - thus virtually guaranteeing that the floor price would not be exceeded. Targets for PAT II translated to about 5.1% of saving compared to the total baseline energy consumption of all the DCs in the demand sector whereas 5.7% in the supply sector. This may be in line to achieve BEE’s estimated savings target of 11% (47.5 Mtoe) for the industrial sector in 2031. However, the fact that 56% of DCs performed better than their target indicates that these targets were modest, leading to oversupply. PAT I cycle also saw a similar situation where 38.25 lakh ESCerts were issued while 14.23 lakh ESCerts were required to be purchased. BEE allows unsold ESCerts in one cycle to be carried forward to the next cycle. Although this ensures that ESCerts issued to DCs do not expire due to lack of demand, it has further increased the pool of certificates available for trading in the subsequent cycle exacerbating the oversupply issue. The oversupply of ESCerts will continue to expand if this trend continues in the subsequent PAT cycles as well.

Figure 7. Break-up of EScerts issued under PAT I and PAT II

Data Source: Compiled from BEE report on outcomes of PAT II, ESCerts trading data from IEX, PXIL, HPX and Notification issued by BEE

5. Strengthening Compliance

PAT Rules (2012) and subsequent amendments along with the Energy Conservation Act (2001) govern various processes related to PAT. We focus on three key aspects. First, it is critical to set adequate timelines for different processes and strictly adhere to them. The timelines were set in the PAT rules, 2012. The subsequent PAT amendments have increased the compliance period from about 6 months to two and a half years from the target year. However, the data shows that these mandatory timelines are not being met. For instance, as per rules, ESCerts for PAT II should have been issued by December 2019 and DCs had up to July 2021 to submit the compliance data after purchasing the mandated ESCerts through trading. However, the ESCerts were only issued by August 2021 and the trading of ESCerts was completed in October 2023. Although the pandemic can be cited as a genuine reason, the delay pre-dates the pandemic. This delay is being observed in subsequent PAT cycles as well, as shown in Table 1. Delay in submission of data by the DCs is often informally cited as a reason for this delay. This indicates a need for stronger monitoring, verification, and enforcement of the program.

Table 1. Delays in PAT Cycles as of November 2023

| PAT Cycle | Target Year | Deadline for MoP to issue certificates | Deadline for DCs to buy ESCerts and report compliance | Actual timelines |

| I | 2014-15 | 31-12-2015 | 31-07-2017 | ESCerts trading completed in January, 2018 |

| II | 2018-19 | 31-12-2019 | 31-07-2021 | Escerts issued in August 2021, delay of 20 months; Trading of ESCerts completed on 31st October 2023 |

| III | 2019-20 | 31-12-2020 | 31-07-2022 | Escerts still not issued, Delay of 35 months to date |

| IV | 2020-21 | 31-12-2021 | 31-07-2023 | ESCerts still not issued, Delay of 23 months to date |

| V | 2021-22 | 31-12-2022 | 31-07-2024 | ESCerts still not issued, Delay of 11 months to date |

Source: Compilation from PAT Rules 2012 and Amendments

It is critical that DCs submit the data on time and the data is thoroughly verified at multiple stages. BEE has developed rigorous sector-specific methodologies (e.g., Guidelines for Aluminium industry) to calculate the energy consumption of the DCs. DCs are required to submit energy reports audited by the accredited energy auditors. However, interactions with industry experts indicate that complexity of the methods, lack of complete data, and capacity of the accredited energy auditors may lead to inaccurate reporting. PAT rules also require check verification of DCs for verification of the data from submitted energy reports. This check verification is to be done by the State Designated Agencies (SDAs) and any act of violation should be reported to the State Electricity Regulatory Commission (SERC). However, there is no data on the number of such violations reported by SDAs and penalties levied by the SERCs. Penalties to be levied can be as much as ten times the cost of meeting the compliance through buying ESCerts. However, PAT rules do not specify graded penalties for different levels of non-compliance such as delay in submission of data. In PAT I, about 8.7% of the mandated ESCerts were never purchased. There is no data on whether this non-compliance was penalized. One reason for the weak monitoring, verification, and enforcement is limited capacity and resources of SDAs.

This brings us to the third aspect of transparency in data which can improve the overall governance of PAT. BEE publishes sector specific manuals on their website. Individual targets given to the DCs along with their baseline production are also public through gazette notifications. Recently, BEE also published data on DC-wise data on ESCerts issued/required to be purchased. Furthermore, BEE can also publish data on the SEC achieved by the individual DCs and relate it to the data on ESCerts. This data will not reveal any commercial information of DCs and hence should be easy for BEE to publish. This data is critical to hold DCs accountable. Furthermore, data on non-compliance by the DCs and details on penalties levied and collected should also be in the public domain. This can substantially improve the compliance with PAT. This is also crucial for regulated DCs such as DISCOMs and many thermal power plants because such penalties imposed should be known to the appropriate electricity regulatory commissions.

6. Is PAT really driving energy efficiency investments?

DCs are required to report the actions taken and investments made during the PAT cycle to improve their energy efficiency. This is crucial as it can be used as an additional data source to verify the change in SEC reported by the DCs. It can also be used to identify the quantum of investments made by DCs that can be attributable to PAT as compared to a Business-as-Usual Scenario. However, the data needs to be thoroughly validated before it can be used for these purposes. In PAT II, reported data shows 390 DCs invested about Rs 43,721 crore to achieve their targets. This is a substantial investment particularly since the cost of compliance through buying the certificate was very low. The total trade of PAT I ESCerts was just around Rs 100 crores, while in PAT II, it was around Rs 300 crores. Furthermore, about half of the reported investment (Rs 21,374 crore) in PAT-II has come just from the DISCOM sector, which is a recipient of substantial funds from central and state governments for investments in improving distribution infrastructure to reduce T&D losses - despite which the sector as a whole did not meet its target. This investment would have most probably happened even without PAT. It is critical to collect, validate, and analyse the data on investments since it can help in establishing the effectiveness of the PAT program.

7. Way Ahead

BEE is taking several steps to improve the PAT scheme. The setting of floor price for the ESCerts has increased their value although it may not have helped in initiating a price discovery mechanism. BEE has started PAT cells in many states to help SDAs in implementing PAT. Hopefully it will strengthen the compliance. BEE is also setting up the Indian Carbon Market (ICM). It is proposed that ESCerts would be converted to carbon credit certificates which can then be traded on the ICM. It is expected that it would substantially increase the demand for ESCerts. However, if issues like lenient target setting and lax monitoring, verification, and enforcement crop up in ICM, then it may lead to oversupply of carbon credit certificates too. Hence lessons from PAT need to be incorporated in ICM. Eventually, PAT may get subsumed under the ICM. But till then, it needs a strong push for improvement.

|

The authors thank their colleagues Ashok Srinivas, Shweta Kulkarni, Srihari Dukkipati and Abhiram Sahasrabudhe for reviewing the article and providing valuable comments.

Comments and suggestions on the series are welcome and can be addressed to |