|

In May, 2020, SECI’s RTC auction for 400 MW RE power saw a winning first year tariff of Rs 2.9/kWh. With a minimum 80% annual CUF requirement, coupled with stiff penalties for non-compliance, this is certainly a very attractive price for the procurers. However, while the CUFs are comparable with thermal power, it does not offer its dispatchability given the must run status for RE. This article analyses one possible project structure, i.e. installing a larger sized project, that can allow provisioning of RTC-like power at such attractive rates. With significant over-sizing of RE capacity, it appears possible to supply a lower sized contract capacity with a very high CUF even without energy storage. However, this is only possible if there are viable and low risk options of monetising the high quantum of excess energy generation. In short, it is akin to a large scale RE (wind-solar) project, but with multiple PPAs wherein sale price is differentiated according to value – higher price for more reliable supply and lower price for more variable supply. It is evident that this approach of only over-sizing RE capacity to provide RTC-like power is likely to have limited scale, especially in the absence of energy storage. Coupled with storage, supply can become much more firm and flexible, but is likely to have a much higher price, at least for the next few years compared to the winning bid in this tender. Our analysis also shows that somewhat lower monthly and annual CUF requirements can significantly reduce excess energy generation and hence developer risks. Such tenders are certainly welcome and provide one approach for reliable RE integration. However instead of relying only on this approach, policy makers, DISCOMs and system operators should also actively explore options for effective integration at the system level given the diversity and scale of load and supply options they manage. |

In October, 2019, the Solar Energy Corporation of India (SECI) put out a tender for ‘Selection of RE Power Developer for “Round-the-Clock” Supply of 400 MW RE Power to NDMC, New Delhi, and Dadra & Nagar Haveli under Tariff-based Competitive Bidding (RTC-I)’. While four bidders passed the technical qualification stage and submitted financial bids, three of them were selected for the e-reverse auction held on 8th May, 2020. ReNew Solar Power Private Limited won the entire capacity on offer of 400 MW with a winning first year bid of Rs 2.90/kWh.

While the generation price of new Renewable Energy (RE) projects is certainly very low and attractive, the issue of reliable grid integration of this variable power, esp. with increasing and large shares of RE is certainly still an open question. Hence, when the auction threw up such an attractive price1 for RTC power based only on renewables, the sector took notice as this could be a potential game changer. This is all the more important since the average RTC price in IEX for 2018 was comparably higher at Rs 3.9/kWh. This article critically examines this tender and its implications for future renewable energy (RE) procurement.

1. Tender features

Subsequent to issuing the Request for Selection (RFS) document issued in October, 2019, clarifications were issued on 29th January, 2020. These were followed by five amendments to the RFS issued during January-March, 2020. The broad highlights of the RFS are as follows.

- Capacity should be from RE sources including energy storage, if any.

- Sources of generation, may be co-located, or may be located at different locations (i.e. multiple injection points allowed). However, energy storage, if any, shall mandatorily be co-located with at least one of the RE sources

- There would be single part tariff with a 3% annual escalation for 15 years after which it would be constant.

- PPA will be signed for a committed annual energy equivalent to 100% capacity utilisation factor (CUF) of the Project, in order to ensure “Round-the-Clock” energy supply.

- Project Developer shall maintain energy supply so as to achieve annual CUF not less than 80% and monthly CUF not less than 70 % for the Project, during the PPA duration of 25 years.

- For a shortfall in annual generation below 80% CUF and upto 77.5%, the amount of compensation shall be calculated at twice the PPA tariff for the shortfall in energy terms. For shortfall below 77.5% CUF, in addition to above penalty, tariff escalation shall be removed for the next year for all generation.

- For not meeting the 70% monthly minimum CUF requirement, a compensation for the shortfall in energy supply, calculated at the PPA tariff applicable for the corresponding Contract Year will be levied.

- Excess power can be sold on the market.

- In case of Change in Law on account of Article 12.1 of the PPA, the developer shall be entitled to an increase/decrease in the applicable tariff, corresponding an amount equivalent to INR 0.002/kWh (0.2 Paisa/kWh) for every increase/decrease of 1 lakh/MW in the Project cost corresponding to the Contracted Capacity.

In essence, this is a ‘hybrid’ RE RFS which mandates a very high annual and monthly CUFs, with very stiff non-compliance penalties. Further the use of the nomenclature, ‘RTC’ is not wholly appropriate since the commonly understood meaning suggests a round the clock supply for all times, which this RFS clearly does not mandate given the minimum annual CUF requirement of 80% and not 100%. Thus while the contracted capacity PLFs are comparable to thermal power, it does not offer dispatchability like thermal power. Finally, given that multiple generation locations are allowed, this may not be hybrid in the true sense of the word, wherein typically wind and solar generation capacities are located close by, thereby saving on land, transmission, permitting and transaction costs, while achieving better utilisation of transmission assets, though developer is free to co-locate wind and solar to take such advantages.

2. Results

The detailed results of the auction are tabulated below. While three bidders qualified for the reverse auction with a financial bid of Rs 3.59-4.05/kWh for the first year, the final reverse auction reduced this significantly with the winning margin for Renew Solar Power being a mere 1 paisa/kWh. Since the Rs 2.9/kWh (first year tariff) has a 3% escalation for 15 years, this works out to a levelised tariff of ~ Rs 3.6/kWh over the 25 year PPA period.

Table 1: Results for the RE RTC tender

| After financial bid opening | |||

| Bidder's Name | Capacity (MW) | Tariff (INR/kWh) | Shortlisted for e-RA |

| ReNew Solar Power Pvt Ltd | 400 | 3.59 | ReNew Solar Power Pvt Ltd |

| Greenko Energies Pvt Ltd | 400 | 3.69 | Greenko Energies Pvt Ltd |

| HES Infra Pvt Ltd | 100 | 4.05 | HES Infra Pvt Ltd |

| Ayana Renewable Power Pvt Ltd | 50 | 4.18 | --------- |

| Total capacity | 950 | ||

| After e-Reverse Auction (held on 08.05.2020) | |||

| Bidder's Name | Quantity (MW) | Tariff (INR/kWh) | Awarded capacity (MW) |

| ReNew Solar Power Pvt Ltd | 400 | 2.90 | 400 |

| Greenko Energies Pvt Ltd | 400 | 2.91 | ----- |

| HES Infra Pvt Ltd | 50 | 3.19 | ----- |

Source: SECI

Given the very high minimum CUF requirements, this appears to be quite an attractive tariff for the procurers. Further, this compares well with another hybrid RE project which has been approved by Maharashtra Electricity Regulatory Commission, MERC, in which Adani Electricity Mumbai Limited is contracting a 700 MW hybrid RE project with a CUF of 50% at a fixed tariff of Rs 3.24/kWh for 25 years. This is being developed by Rosepetal Solar Energy Private Limited (a subsidiary of Adani Green Energy) and is expected to have an energy curtailment of 13%. It is likely to be fulfilled by a combination of 650 MW of wind and 650 MW of solar capacity.

3. Examining potential project structuring possibilities

As already noted in the introductory section, a levelised tariff of Rs 3.6/kWh for RE based RTC power is extremely attractive and is perceived as a potential game changer for the sector with regard to reliable grid integration of variable RE power. This brings up questions such as, a) Could such projects be a replacement for base-load thermal power plants? b) Are such high CUF projects possible with wind and solar power (given their seasonal and diurnal characteristics) but without energy storage? c) what market prices would be needed to sell the excess power to make the project viable? d) can such capacity be procured at any scale?

To try and answer such questions and gain further insight into this auction and the implications of such types of tender on the procurers, we performed an analysis using wind and solar generation profiles for Maharashtra. For this analysis, we assumed up-front that the project would not use energy storage, but only a combination of wind and solar power. We used 15-minute resolution generation data for a sample year for wind (CUF of 38%)2 and a broadly representative 15-minute single-axis tracking solar3 (with a CUF of 26.2%) generation data. We then tried out various combinations of wind and solar capacity such that the auction requirements of a minimum annual CUF of 80% and a monthly minimum of 70% would be achieved for a contract capacity of 400 MW. We find that a one combination of 1500 MW of wind power and 850 MW of solar power meets the above requirements. Obviously, different combinations of wind and solar capacity at locations other than Maharashtra, with higher/lower individual annual CUFs, different generation profiles especially with newer technology (e.g. even taller and larger wind turbines) would be possible. Combining energy storage with RE generation is certainly a possibility and would significantly reduce the required installed project capacities but this has not been analysed here.

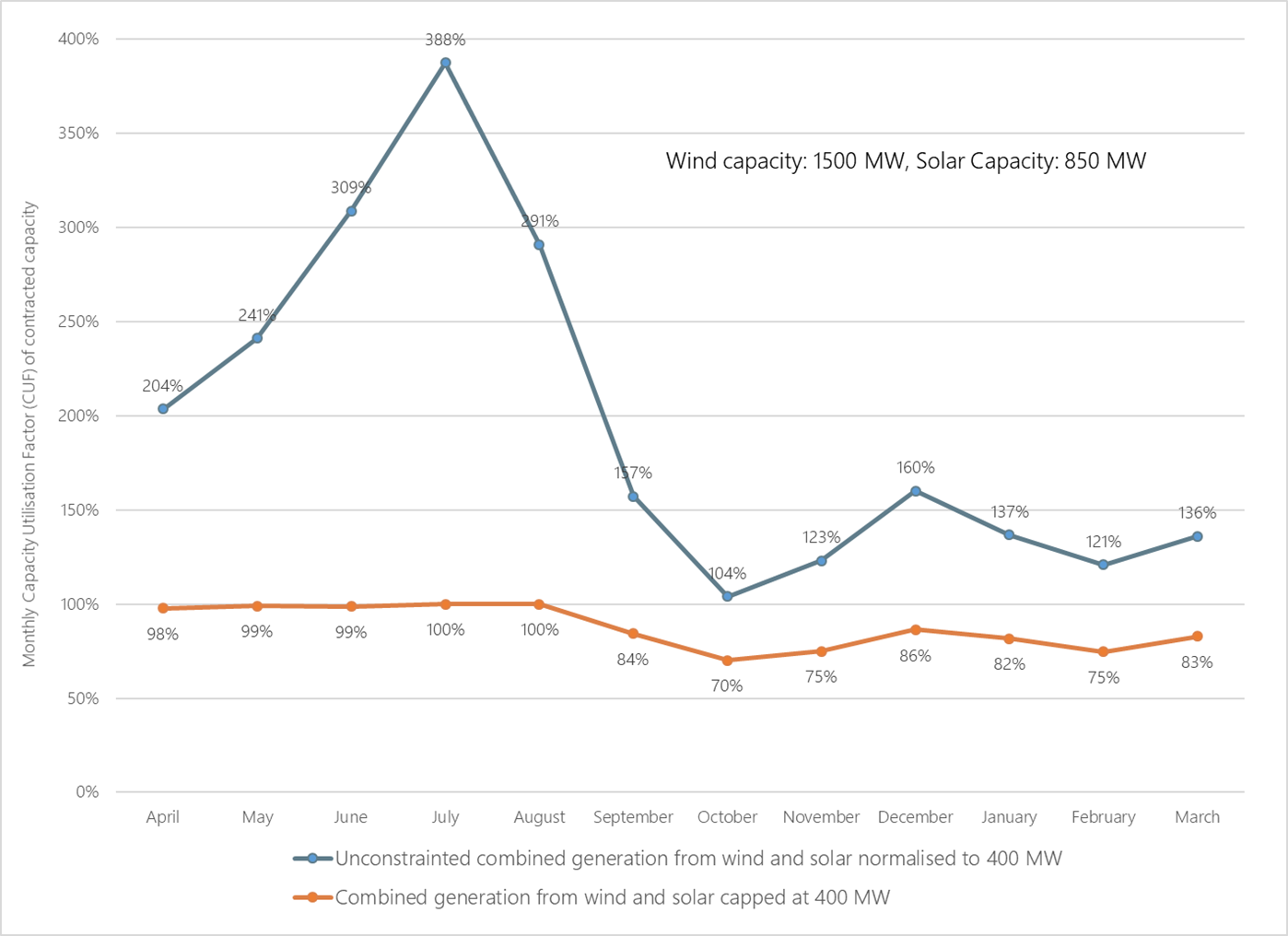

Figure 1: Monthly CUFs for the contracted capacity of 400 MW

Source: Prayas (Energy Group) analysis

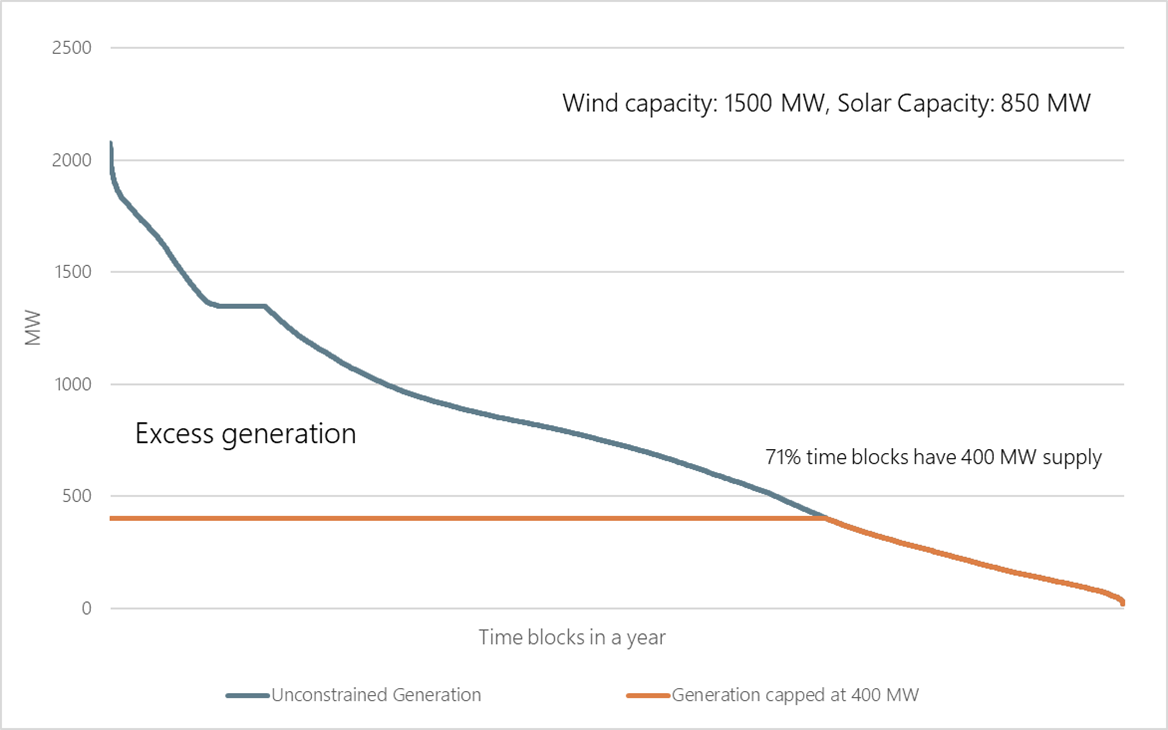

Figure 2: Load Duration Curve for unconstrained generation and generation capped at 400 MW

Source: Prayas (Energy Group) analysis

As seen from figure 1, the monthly CUF of the generation profile (capped at 400 MW) does not fall below 70% in any month. The high monthly CUFs of the unconstrained generation (blue line), especially in the monsoon months depict the excess generation availability. Further, the project achieves an overall annual CUF of 88%.

The load duration curve of the unconstrained generation and constrained generation (to 400 MW) is shown in figure 2. It shows that for 71% of the time in the year, the project can in fact deliver the entire 400 MWs. The area between the orange line (generation capped at 400 MW) and the blue line (unconstrained generation from 1500 MW wind and 850 MW solar) represents the ‘excess generation’ over and above the contracted capacity of 400 MW. The excess generation is quite high, at 56% of the total unconstrained generation from the combined wind and solar capacity.

56% is a significantly high value and hence unless ways are found to monetise it, the project (with installed capacity 5-6 times higher than contracted capacity) will not be viable. Let us assume that if all the unconstrained generation from the entire project capacity is sold at a tariff of Rs 2.6/kWh (comparable to the present discovered price for wind and solar power), the project would be financially sustainable. But we know from the winning bid, that the RTC power (area under the orange line) would be sold at a levelised tariff of Rs 3.6/kWh. Hence all the excess generation, on an average needs to garner a price of at least Rs 1.81/kWh to make the project financially viable.4 As we have seen earlier, different combinations of wind and solar with their unique generation profiles may result in different levels of excess generation. The table below shows what price would be needed if the excess generation is lower at 45% or 35%.

Table 2: Scenarios of different excess generation quantum and the price needed for the excess generation to make the project viable.

| Excess Generation as a fraction of total unconstrained generation | Price(Rs/kWh) needed for all excess generation to make the project viable |

| 56% | 1.81 |

| 45% | 1.36 |

| 35% | 0.74 |

Source: Prayas (Energy Group) analysis

4. Possible revenue sources for the excess generation.

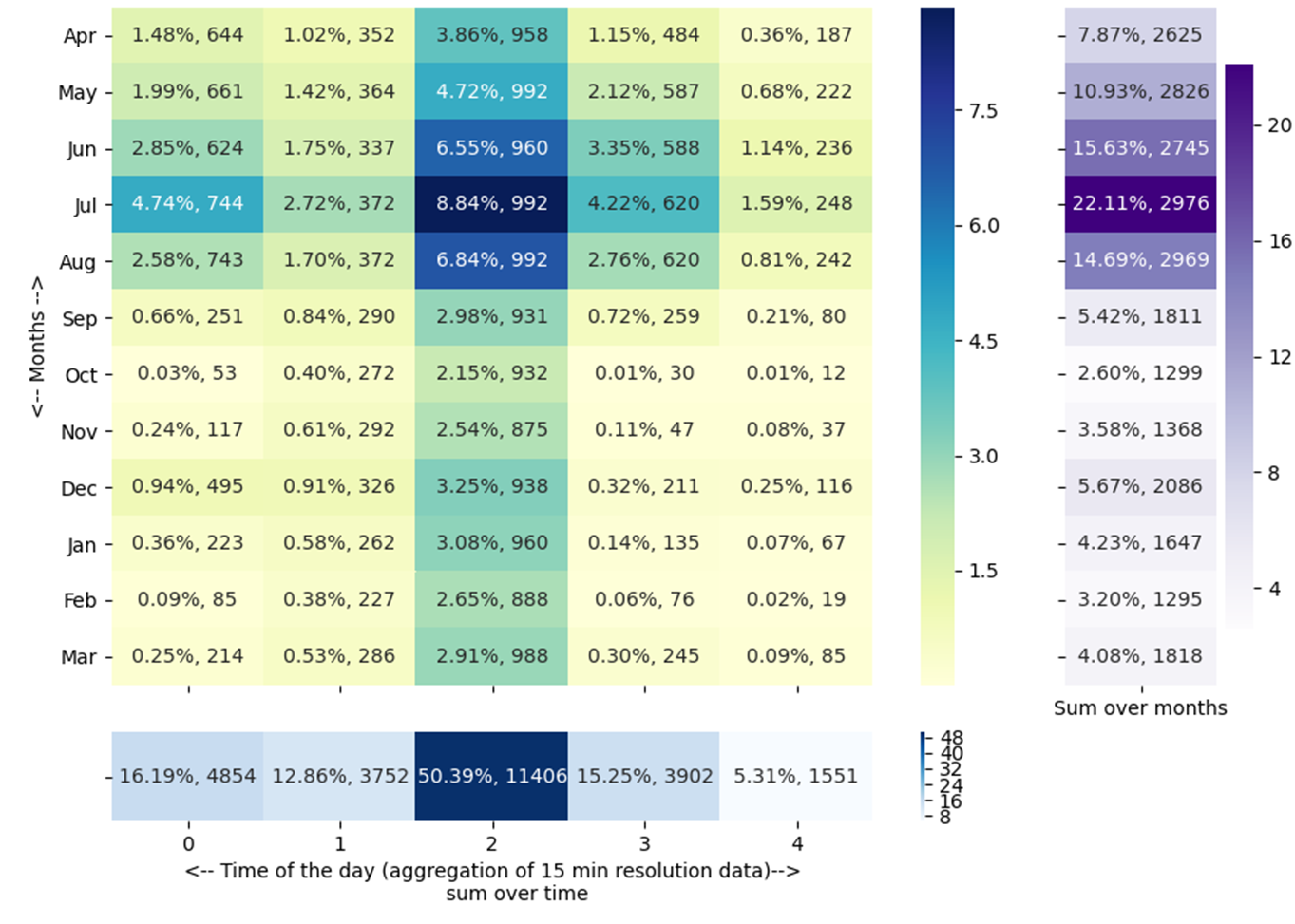

The entire question now boils down to various ways of effectively monetising all (if not most) of this excess generation to make the project viable. Given that the value and hence the price of electricity varies within the day (morning & evening peaks and off-peak) and across the months given the seasonality of demand and generation, it is important to understand the distribution of the excess energy across these dimensions. The heat map in figure 3 below shows this distribution. It shows the month-wise and Time of Day (ToD) slot wise excess generation as a percentage of total annual excess generation as well as the number of time blocks where excess occurred. The time slots within the day are divided as 0:00-6:00; 6:00-9:00 (morning peak), 9:00-17:00, 17:00-22:00 (evening peak) and finally 22:00-24:00. This gives us a grid of 12 (months) by 5 (time slots within a day). As expected most of the excess generation is during the solar hours throughout the year and this is further concentrated in the windy months of May-Sep. However, it is important to note that upto 30% of the excess generation takes place during the morning and evening peak hours, where its value will be much higher than other time slots.

Figure 3: Month-wise and time-wise excess generation as a percentage of total excess generation and number of time blocks with excess generation. Combination of 1500 MW wind and 850 MW solar.

Source: Prayas (Energy Group) analysis

Next, based on this understanding of the monthly and time-wise distribution of the excess generation, we discuss possible sources of revenue / sales avenues for this energy.

- Integrating excess generation with thermal power: One possibility for the project developer is to tie up with a thermal power plant and integrate this excess energy into the thermal schedules, to the extent that such integration is possible, given the accuracy of wind and solar forecasts and timelines of ramping down/up the thermal plant. Most thermal PPAs allow a provision for ‘Alternative source of power supply’ under which the generator can source from an alternative source to meet its obligation. As such this could be a win-win proposition if the variable cost of thermal generation (~ Rs 3/kWh) is significantly higher than the cost of this excess wind/solar energy (~ Rs 1.5-2/kWh). Just for the state of Maharashtra, data from MSLDC for July, 2020 shows that 6,575 MW of thermal capacity has a variable cost between Rs 3-4/kWh, with a weighted average of Rs 3.33/kWh. Further, 2018 MoP guidelines for ‘Flexibility in Generation and Scheduling of thermal power stations to reduce emissions’ encourage such joint scheduling. However, this is only possible to a small extent given the limited capacity to absorb such variable generation by thermal plants. Further, all excess wind and solar may not be tied up with one single thermal generator or one contract but could be done in smaller parcels with different PPAs.

- Selling excess energy to other DISCOMs/other obligated entities: The project developer could also possibly tie up long term contracts with DISCOMs and sell this excess renewable energy at a much lower price than what they generally buy wind and solar power at presently (~ Rs 2.6/kWh). Since the developer is getting Rs 3.6/kWh for nearly half of the entire generation, he has a cushion to offer some discount on the existing market price for solar/wind power. This could be valuable for DISCOMs and other obligated entities which are short on meeting their RPO compliance and are presently buying RECs. Again this is limited to the extent that procurers can integrate this excess into their overall demand schedule and considering the flexibility of their other contracts/market purchase. The potential for such trade will go up with IEX launching its green term-ahead market.

- Selling excess energy on the market: Finally, the developer could sell the excess generation on the market, which is explicitly allowed as per the RFS. We did some further analysis for this option. We have already seen that all the excess generation needs to garner a price of Rs 1.81/kWh to make the project financially viable. Further, as noted above, 30% of the excess energy is within the morning and evening peak hours. If this is valued at the same RTC discovered rate of Rs 3.6/kWh, then the balance of excess energy only needs a market price of Rs 1.03/kWh as opposed to Rs 1.81/kWh. While there is certainly a risk of getting such a price over 25 years, especially with falling wind and solar prices, this could be a potential option to generate additional revenue.

5. Insights and learnings

- The above analysis shows that with over-sizing the RE capacity, it is possible to supply a lower sized contract capacity with a very high CUF. However, this is only possible if there are viable and low risk options of monetising the high quantum of excess energy. Such over-sizing coupled with some level of excess generation are likely to become common for hybrid RE projects.

- In short, it is akin to a large scale RE (wind-solar) project at Rs 2.6/kWh, but with multiple PPAs wherein sale price is differentiated according to value – higher price for more reliable supply and lower price for more variable supply.

- Minimising the excess generation through different combinations of wind and solar such that their profiles have a high level of synergy will become very critical to reduce the project risk. Further all the excess may not be monetised only in one of the way enumerated above, but could be a combination of them.

- While SECI has acknowledged that allowing for separate generation locations was a specific relaxation, given that this was the first auction of its kind, this should not be allowed for too long if one is to truly benefit5 from the physical and not financial hybridisation of RE projects. The additional transmission costs due to separate locations is not captured and apportioned equitably, especially as the ISTS charges and losses waiver for RE projects continues to be in place and this acts like a cross-subsidy.

- While hybrid RE projects without storage are capable of delivering 40-50% annual CUF (which is significantly better than individual wind/solar projects), there is a need to critically examine whether we need to jump directly from 40-50% to an onerous requirement of RTC (100%) with a minimum of 80%. We did some sensitivity analysis in this regard with the same methodology as described above. If instead of the minimum conditions of 80% annual CUF and 70% monthly CUF, we relax it to 60% annual and 50% monthly minimums, we see that 800 MW of wind and 400 MW of solar is sufficient instead of the 1500 MW and 850 in the base case. This halves the excess from 56% to 27% as well as the required market price for excess generation from Rs 1.81/kWh to 0.96/kWh. However, the annual CUF only reduces by 15% from 88% to 75% which is valuable to the procurer and is likely to significantly reduce the discovered price, given the low excess generation. The details of the sensitivity analysis are available in the accompanying slides.

- This approach of only over-sizing RE capacity to provide RTC-like power is likely to have limited scale, especially in the absence of energy storage. Coupled with storage, supply can become much more firm and flexible, but is likely to have a much higher price in the next few years compared to the winning bid in this tender.

- Finally, an important question before the sector is of allocating responsibility of RE grid integration. One approach, as followed in this tender is to place it on the developer and mandate him to make the supply firmer/flexible or ‘RTC-like’. Such tenders are certainly welcome and provide one approach for reliable integration. However instead of relying only on this approach, policy makers, DISCOMs and system operators should also actively explore options for effective integration at the system level given the load and supply options they manage. This higher diversity and scale of resources at the system level is likely to provide cheaper, scalable and relatively easier options for RE integration.

Endnotes

1. For comparison in IEX, the RTC price for 2017-18 (Rs 3.2/kWh), 2018-19 (Rs 3.85/kWh) and 2019-20 (Rs 3.005/kWh).

2. The actual annual wind generation data was linearly scaled up so that it would be broadly representative of a new wind project with an equivalent CUF of 38%.

3. The solar data was simulated from NREL’s System Advisor Model (SAM).

4. The analysis is done assuming a levelised price of Rs 3.6/kWh, while in reality the first year tariff is Rs 2.9/kWh.

5. Saving on land, transmission, permitting and transaction costs, with better utilisation of transmission assets.