This is the seventh post in the blog series “Plugging in: Electricity consumption in Indian Homes” by Prayas (Energy Group) and Centre for Policy Research (CPR).

Managing India’s urban transitions is a significant challenge, one that is further complicated by the need to address their energy implications. This burden is particularly relevant to the National Capital Region (NCR), with Delhi being among the highest residential electricity consuming areas in India. Yet, in spite of the scale of current and future residential electricity use, an understanding of Delhi and the NCR’s household consumption patterns and their drivers is limited. In this post, we examine electricity demand in the NCR, which comprises Delhi, much of Haryana, and parts of Uttar Pradesh and Rajasthan.

The NCR covers approximately 130 cities and towns, a land area of 22,500 square miles, and has an urban population of over 30 million that is growing at about 20% per decade. In order to capture effects that are representative of this large population, we use a detailed sampling method that covers about 5500 households. The sample was portioned with approximately 61% in Delhi, 23% in Uttar Pradesh, 13% in Haryana and 3% in Rajasthan. The survey, conducted in 2016-17, is in partnership with the Centre for the Advanced Study of India, University of Pennsylvania. We focus our findings around three questions:

- One, how much electricity does the NCR resident consume?

- Two, what are the electricity services that households in the NCR most consume?

- Three, how is the ownership of cooling appliances changing with increasing incomes and the ability of households to consume more?

How much electricity does the NCR resident consume?

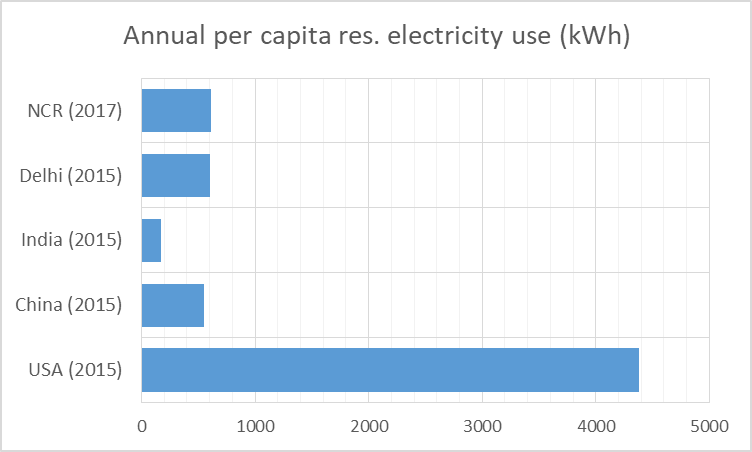

To understand the NCR’s electricity use on a per capita basis, we used the household electricity bill amount, local tariff rates, and the number of people within that household. We compared this number with recent per capita numbers from the literature for Delhi and India (Figure 1). We also compared the estimates with the USA and China to demonstrate the different contexts of developed and developing countries.

Figure 1: Comparisons of annual per capita residential electricity use

Sources: EIA, 2017; US census bureau, 2017; NBSC, 2017; Niti Aayog, 2017; NCR survey, 2017.

In per capita terms, the US’s per capita residential electricity use is about 25 times that of India’s, and China’s is about three times that of India. Within India, the residential electricity use per person, based on the survey, is broadly consistent with the statistics on Delhi from other sources, suggesting that Delhi is the driver of the NCR’s energy use. The India average, on the other hand, is 3.5 times lower than the NCR number. In purely electricity terms, the NCR resident is the highest consuming in the country – a level that is continuing to rise. As incomes rise across other urban areas, it is likely that they will follow the NCR’s current pattern of high consumption.

What drives the NCR’s high energy use?

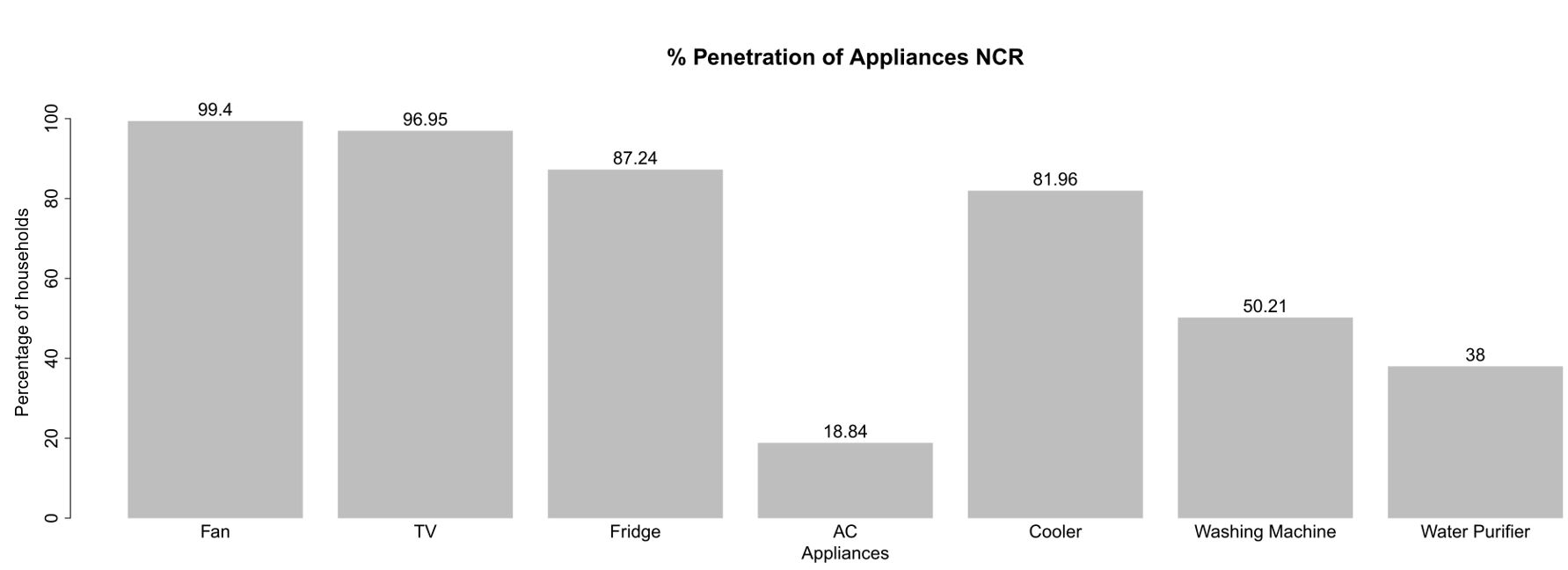

To understand the NCR’s high energy use, we examine the energy services sought in the region by assessing the appliances owned by its households (Figure 2).

Figure 2: Appliances penetration rate in the NCR

Source: Electrifying the National Capital Region. Khosla and Sircar (in preparation).

Figure 2 shows that almost every NCR house has a fan, closely followed by a TV. TVs are more ubiquitous than coolers and fridges, in spite of the hot and dry climate and peak summer temperatures of the region. This result aligns with the literature that over the past few decades, TV viewing has become the most important leisure and entertainment activity for middle class families. Washing machines and water purifiers form the next set of appliances used. And while not represented graphically, the data shows that 63% of households in the NCR have a scooter while a smaller 17% have a car.

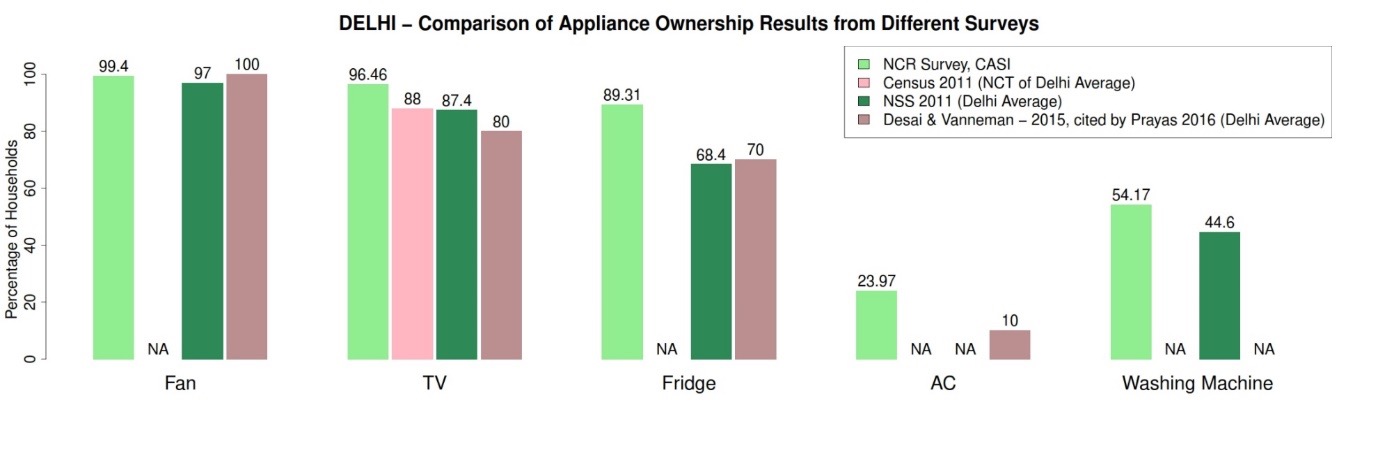

We contextualise and validate the results in Figure 2 by looking at similar appliance penetration numbers from other studies conducted for the Delhi (not NCR) region (Figure 3).

Figure 3: Comparison of appliance ownerships results for Delhi from different studies

Source: Electrifying the National Capital Region. Khosla and Sircar (in preparation).

Figure 3 is based on three studies from the literature with data collected in 2011, and on the Delhi component (only) of the NCR survey which was undertaken in 2016-17. The Delhi component of the NCR survey consistently shows the largest penetration rates of the appliances (with a small exception for fans), with dramatic differences for fridges and ACs (air conditioners). It is likely that the NCR survey is capturing the rising appliance ownership within the last five years, compared to the earlier studies.

Changing nature of appliance use

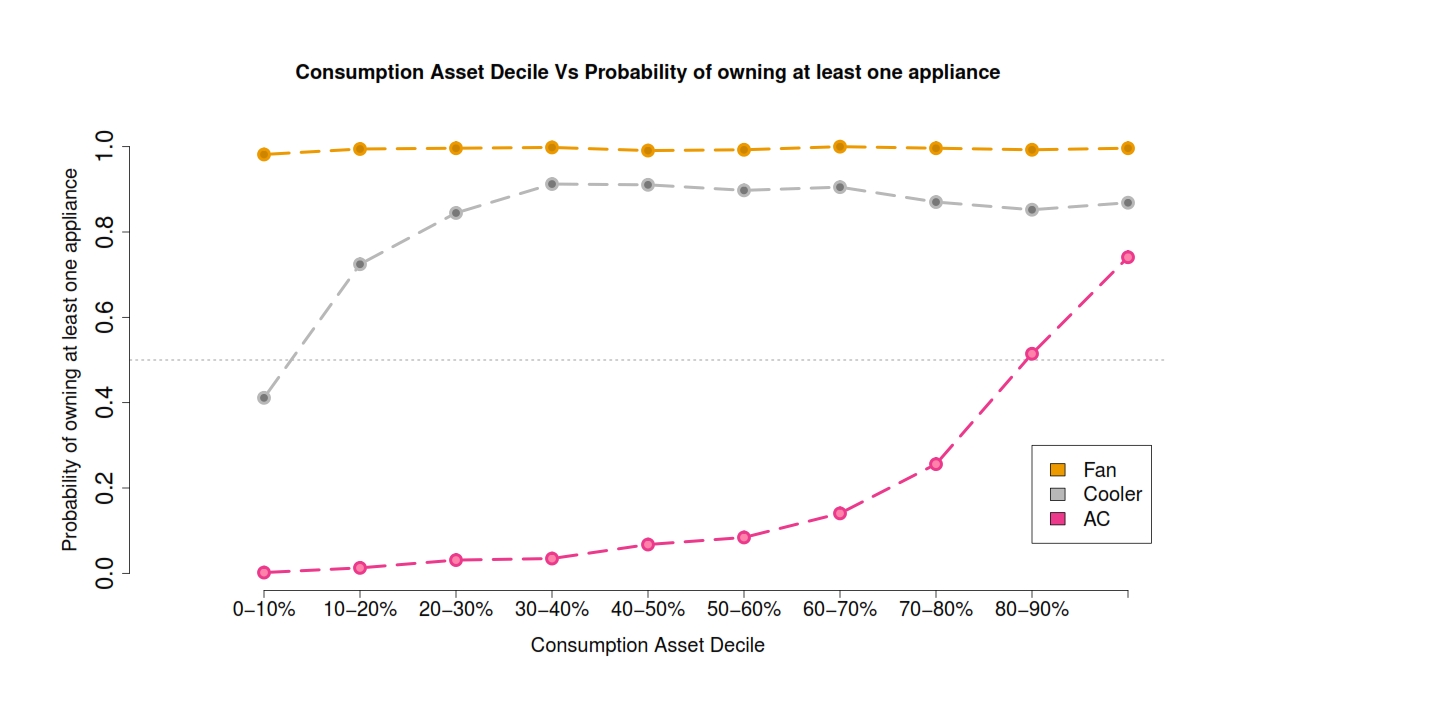

As households transition towards higher levels of income, which appliances do they buy first? We apply this question to cooling appliances, which are among the most energy-intensive.

We examine the changing nature of cooling appliance ownership by developing an asset index, which maps appliance ownership with a household’s overall assets or ability to consume. Figure 3 shows the ownership of at least one cooling device per household, ranging from a fan, cooler, and air conditioner, as per the asset index. As seen in Figure 3, almost every home in the NCR, irrespective of where it ranks on the asset index, owns a fan. The most prevalent cooling device, after a fan, is cooler, which households start acquiring as they enter the 4th decile. By contrast, only the top decile (at most) have an air conditioner.

Figure 4: Cooling appliance ownership patterns as a function of the asset index

Source: Electrifying the National Capital Region. Khosla and Sircar (in preparation).

The implications of these cooling appliance ownership patterns could be the most significant in determining the trajectory of the NCR’s, and by analogy other Indian cities’, energy use. Literature and market studies predict that India is at the cusp of an exponential growth in the AC market, and as income levels rise, the AC curve will likely mirror the current cooler curve. The impact on households of this AC penetration will be two-fold: access to cooler indoor environments as the probability of extreme temperatures rises, but also a marked increase in the household electricity bill. Furthermore, the systemic effects of increased electricity demand and greenhouse gas emissions from AC use are predicated to be dramatic.

The yet-to-be invested in cooling appliances, perhaps counterintuitively, offer a potential advantage. Since most energy-intensive purchasing decisions are yet to be made, there is occasion to still shape electricity-consuming preferences and practices. Once invested in, these consumption patterns are difficult to reverse. The current ability of households to pick energy efficient appliances (especially air conditioners), and shape infrastructure that increase thermal comfort without spiking the electricity bill, is a distinctive window to choose alternative pathways. The usefulness of this opportunity, however, will depend on the early decisions that policymakers, industry and households make. In the next, penultimate, post of this series, we explore broader usage patterns of appliances across India.

This piece is authored by Radhika Khosla at the Centre for Policy Research, New Delhi.

This blog series is also available on the Centre for Policy Research website.