| In 2014, the newly formed Telangana state started the process of procuring power from the Marwa thermal power station in Chhattisgarh, which was under construction. A study of the Memorandum of Understanding (MoU), Power Purchase Agreements (PPAs) and the regulatory processes in both the states provide many lessons for Telangana and other states. This includes the problems created by hasty MoUs and PPAs, the relative advantages of competitive bidding over MoUs, and the regulatory challenges of multi-state arrangements like this, where Central Electricity Regulatory Commission is not involved. It also reiterates the crucial need for better transparency in such inter-state power purchase arrangements and robust power purchase planning before signing long term PPAs. |

1. Background

A major challenge faced by the newly formed state of Telangana in June 2014 was severe power shortage. In an attempt to address this, Telangana explored many possible options– power contracts from other states, higher share from central power, speeding up ongoing projects, and also initiating new projects.1 The new state government initiated purchase of power from the neighbouring state of Chhattisgarh, which had projected 22% surplus power in FY15 (2014-15).2 A Memorandum of Understanding (MoU) was signed between the state governments for purchase of 1000 MW from the 2 x 500 MW Marwa Thermal Power Station (MTPS). This power station, owned by the Chhattisgarh State Power Generation Company Ltd (CSPGCL), was in advanced stage of construction.3 The signing of the MoU was a high-profile event held at Raipur on 3rd November 2014, with Chief Minsters of both states present, indicating the full backing from the highest political powers in both states. To quote from the TSERC order 2017: “The Govt. of Telangana had taken the extraordinary initiative to tide-over the acute shortage of power that was prevailing at the time of bifurcation of the state by making advance planning in the form of MoU with the Govt. of Chhattisgarh”

By most counts, this would appear to be a win-win situation for Telangana and Chhattisgarh. But closer examination brings out many questions on the efficacy of power purchase planning and regulatory action. For instance, what was the need for an MoU and contract to firm up a 12-year long power purchase deal when the plants were not commissioned and the requisite transmission corridor was not ready? Further, given that many Power Purchase Agreement (PPA) terms were unfavourable to Telangana consumers and there were additional costs in carrying the power from Chhattisgarh to Telangana, has the regulatory jurisdiction been legally and appropriately determined?

This update gives a brief overview of these issues, with the hope to promote consumer interest in Telangana and Chhattisgarh, and also in other states, where similar arrangement exists or may be planned.

Brief timeline

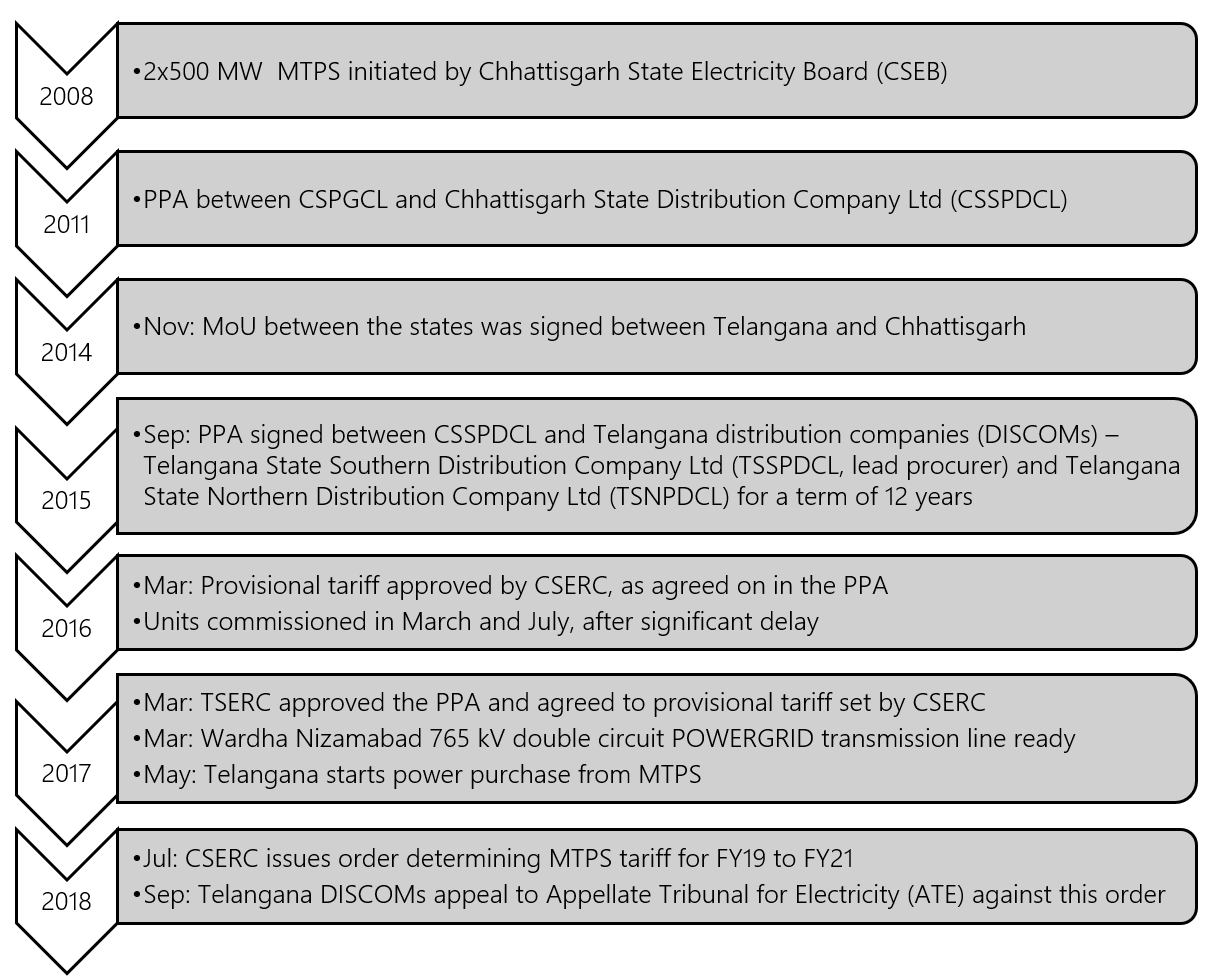

While the units of MTPS were expected to be commissioned in 2012, they faced significant delays, and were actually commissioned only in 2016. Further, Telangana began purchasing power generated by MTPS only in 2017, even though it had signed the PPA in 2015. The timeline of this power purchase is detailed in figure 1.

Figure 1: Brief timeline of the power purchase arrangement between Telangana and Chhattisgarh

Source: Compiled by Prayas (Energy Group) from Telangana and Chhattisgarh regulatory documents

2. Power purchase

2.1. Trends in power purchase

Power purchase from MTPS commenced in May 2017, and as seen in Table 1, nearly all the power generated by the station was purchased in FY18. However, the purchase has been reducing over the years, with only half the power being purchased in FY20. But the MYT petitions for the fourth control period (FY20 – FY24) filed by the Telangana transmission company still projects contracting of the full 1000 MW capacity from MTPS till FY24. A clear picture will emerge only when retail supply tariff petitions are filed by the Telangana DISCOMs. However, there have been no filings after December 2017, till June 2020.

Table 1: Power purchase from MTPS

| Year | Purchase approved by TSERC (MU) | Station generation (MU) | Telangana Purchase (MU) | Purchase as % of generation | Purchaseas % of TSERC approval | Purchase as % of total Telangana power procurement |

| FY 18 | 5,287 | 5,720 | 5,056 | 88% | 96% | 10% |

| FY 19 | 7,055 | 6,416 | 5,329 | 83% | 76% | 8% |

| FY 20 | NA | 4,356 | 2,196 | 50% | NA | NA |

Source: Compiled by Prayas (Energy Group) from TSERC tariff orders (for FY18 and FY19), CEA generation reports (gross value), Chhattisgarh Load Dispatch Centre reports and Southern Regional Load Dispatch Centre reports

Tariff, especially the variable charge for this station, has been relatively low, as indicated in Table 2. The variable charge of Rs. 1.39/kWh for FY19 to FY21 is lower than the variable charges of all contracted thermal power in Telangana in 2018, including the pit head plants.4 But this is only the generation tariff and the Telangana DISCOMs have to bear the Fuel Cost Adjustment (FCA), transmission and wheeling charges, trade margin, taxes, cess, etc. While the electricity duty and trade margin were later waived, transmission and other charges add to the power purchase cost. Telangana’s DISCOMs would have to pay power purchase charges amounting to around Rs. 5/kWh.5 If Telangana does not buy the power, it has to pay the fixed charges and since the variable cost is low, it is attractive for Chhattisgarh to sell it in the market. Telangana’s DISCOMs have filed an appeal before the ATE, contending that the capital cost approved by the CSERC is on the higher side.6

Table 2: Tariff from MTPS station

| Source | FC Rs/kWh | EC Rs/kWh | Total Rs/kWh | Remarks |

| CSERC retail supply tariff order for 2014-15 | 3 | Provisional | ||

| CSERC provisional tariff order for MTPS, 30/4/2016 | 2.70 | 1.20 | 3.90 | Provisional, and approved by TSERC in 2017 |

| CSERC final tariff order for MTPS, 7/7/2018 | 2.56 | 1.39 | 3.96 | This tariff is for FY19-FY21. In addition, statutory charges likeduty, cess, water, SLDC charges etc as actual |

Source: CSERC – Retail tariff orders (2014-15) , Provisional tariff order 2016, Final tariff order 2018

2.2. Poor power purchase planning

Generation capacity addition plans for Telangana were prepared in a hurried, non-participatory fashion in the Energy task force report (2014) and ‘Power For All’ (PFA) document (2015). These were highly ambitious, with the TSERC approved energy requirement in 2019 being around 80% of what was projected in the task force report and 60% of the projections in the PFA. TSERC could have taken up a review of the PFA plans to fine tune it.7 Urgent power contracts for a shorter duration could have been done through competitive bidding from the southern region, till the inter-regional transmission corridor was ready, after which, the bidding could have been extended to the national level. This could have resulted in lower power purchase costs and better contract terms.

Power purchase accounts for nearly 80% of the total annual cost of the DISCOMs, and it is important to examine every PPA closely. The arrangement between the power surplus Chhattisgarh and the shortage riddled Telangana was finalised in a hurry without proper public consultations. Many public comments made during the TSERC public hearing did find its way into the TSERC order, but they were limited to PPA conditions, and not the core issue of tariff.

3. Regulatory challenges and consumer concerns

3.1. Regulatory oversight

As per the CSERC 2018 tariff order on MTPS and CEA reports, it can be seen that the capital cost of the project went up from Rs 4.7 Crore/MW in 2008 to Rs 8 Crore/MW in 2016, when COD was declared. There was a delay of nearly four years, leading to very high interest during construction of about Rs. 3,000 Crore, nearly 37% of the total cost at COD. Major reasons for delay cited in the CSERC order were land acquisition, construction of barrage for water, delays in railway infrastructure, re-selection of agency for chimney and delays due to a fire accident in the crusher. Some of these were questioned and it was pointed out that other reasons for delay like Balance of Plant (BOP) and Boiler Turbine Generator (BTG) were not properly accounted for. Telangana was represented by TSSPDCL (as directed by the TSERC order) and by a consumer group – People’s Monitoring Group on Electricity Generation (PMGER), which had filed an objection, but could not participate in the public hearing conducted by CSERC. Following CSERC’s order PMGER had filed a review petition in August 2018 raising these points with CSERC order, but CSPGCL raised many objections at admission stage, including questioning the locus standi of PMGER.8

In addition to this, there also has been a delay in the publication of tariff orders by the TSERC, since Telangana DISCOMs have not submitted tariff petitions after December 2017, till the time of writing – July 2020. This makes it difficult to study the progress in power purchase from MTPS by Telangana DISCOMs, the actual payment made by them, and the possible sale of surplus power by MTPS. The websites of Telangana transmission company or DISCOMs do not publish this. Telangana load dispatch centre does not have a separate website, unlike many other states. National portals like PRAAPTI show DISCOM dues to generators, but not to traders or other state DISCOMs.

3.2. Consumer concerns and jurisdictional ambiguity

Owing to the poor planning discussed in section 2.2, there were many PPA terms, which were not favourable to Telangana, as listed below:

- Payment of fixed cost once COD was declared (even if transmission corridor and open access arrangements were not ready)

- Lack of clarity on coal supply – implying cost escalation risks, including FCA

- Delivery point in Chhattisgarh at the MTPS station (and not in Telangana or Chhattisgarh transmission station)

- Lack of flexibility to Telangana to share power allocation between its two DISCOMs

A carefully prepared PPA or competitive bidding with proper guidelines and regulatory oversight would have prevented such clauses.

These concerns were raised in January 2016, during the public hearing conducted by TSERC to approve the PPA. Objections were raised on the need for power from MTPS in the background of evolving power surplus situation in Telangana, the method of determining tariff, possible high cost to the Telangana DISCOMs and the one-sided contract terms. On determining tariff, TSERC order argued that since the generating station and point of delivery are located in Chhattisgarh and since trading margin has been waived, CSPGCL steps into the shoes of CSPDCL, given that CSPDCL has a back-to-back PPA with CSPGCL and a PPA with the Telangana DISCOMs. MTPS is not a composite scheme where generation and sale are in more than one state, for which CERC determines the tariff, as per Section 79 (b) of the Electricity Act. Instead, CSERC should determine generation tariff as per Section 62 (1) (a) of Electricity Act. This is supported by the ATE order in case 183 of 2009, involving sale of power from a hydro plant in Uttarakhand to Himachal Pradesh, wherein Uttarakhand Regulatory Commission was required to determine the tariff.9 While, section 64 (5) of the Act has provisions for TSERC to approve the tariff, TSERC noted that it is an option which could be exercised if the concerned DISCOMs had applied to it. But TSERC still needs to approve the tariff of purchase by Telangana DISCOMs, as per Section 86 (1)(b) and can direct the DISCOMs to modify PPA conditions or even advise not to purchase this power.

In this capacity, TSERC approved the provisional tariff (decided by the CSERC 2016 order) and suggested modifications to some PPA clauses. This included changing effective date (start of PPA) to the commissioning of transmission corridor, limiting fixed charges to corridor capacity, changing delivery point to the transmission station in Chhattisgarh and giving flexibility to Telangana to allocate share among its DISCOMs. Electricity duty and trade margin were waived by the CSPDCL. It is for legal experts to comment if this argument of TSERC about tariff determination of a cost-plus project selling power to Telangana DISCOMs with a 12-year PPA, is correct. But from the point of view of consumer interest, this case raises many challenges.

CSERC is best placed to determine the tariff of MTPS power contract with CSPDCL. However, TSERC ideally should determine the tariff for the CSDPCL contract with Telangana DISCOMs, and it could have used available cost benchmarks to disallow unreasonable costs (after hearing all parties, including CSPGCL), rather than leaving the job to CSERC. Further, it could have suggested a reduction in the PPA term since the transmission corridor was ready and power supply situation had eased.

It is not easy for Telangana consumers to participate in public hearings conducted by CSERC. In all such transactions across states, there has to be a better mechanism to ensure participation of consumers from all concerned states in the regulatory processes. Lack of transparency and poor public participation in the power purchase related public hearings in Telangana after 2016 makes matters worse. Only a pro-active regulatory commission, which ensures long term power purchase planning, and a vibrant civil society, which is enabled to participate in regulatory process, can improve the situation.

4. Lessons – for Telangana and other states

There are many lessons from this case, useful for Telangana as well as other states. Firstly, there is a need to introduce more transparency in bi-lateral trading transactions, in this case between distribution companies from two states. In addition to regulatory approval of the trade margin and contract terms, there should be a mandate for the DISCOMs to report the details of the transactions on a regular basis on their websites, similar to the reports put out by inter-state traders or power exchanges. In the absence of any such reports, one has to depend on annual tariff filings and regulatory orders to gather such information, much after the actual transaction.

Secondly, competitive bidding with proper guidelines and regulatory oversight is a much better power purchase option, compared to MoU based cost plus options, even if it is between government owned organisations. Thirdly, in situations like this, where generation is in one state and consumption is in another, there is a need to re-examine which agency should regulate the power purchase. In many ways, CERC may be in a better position to do this, after taking inputs from the concerned states.

Finally, there is an essential need of rigorous load forecast and power purchase planning before signing long term PPAs. Surplus power and costly thermal capacity addition are the result of not taking this up. Under the current situation of fast changes in renewable energy and storage, as well as market operations, it is also essential to periodically revise such plans. Lack of such planning can lead to resource lock-ins, as is already happening in many other states.

Endnotes

1. As mentioned in the Energy task force report and Power for all agreement, the state thermal power capacity was 2282 MW at the time of state formation, and the plan was to add 6840 MW of state thermal capacity in 5 years

2. Power surplus projected for 2014-15 in the CSERC’s 2014-15 retail supply tariff order was about 6,500 MU, whereas the shortage projected by the Telangana Energy task force report was over 9,000 MU

3. This project was renamed as Atal Bihari Vajpayee Thermal Power station – ABVTPS in 2018. Hence it is referred to as Marwa, MTPS, or ABVTPS in different reports

4. Approved variable charges as per TSERC FY 18 tariff order for some plants: KTPS V (1.92/kWh), NTPC Ramagundem 1 & 2 (2.18), NTPC Talcher (1.7), Singareni (1.69), TTPL 2 (1.82)

5. FAC reported by CSPGCL for MTPS is about Rs 0.3/kWh and transmission charges would be about Rs 0.3/kWh. It is not easy to assess other charges like environment – the new emission norms may increase the tariff by 0.35 to 0.75/kWh

6. As reported in the TSSPDCL Annual Report for FY19

7. A load forecast and resource plan for the 4th control period (2020-24) was apparently submitted to the TSERC in October 2018, but the process of finalising it was not taken forward, due to many reasons including a long period of non-functioning of TSERC in 2019, as discussed in the Power Perspective update, “A commentary on limited regulatory oversight in Telangana”. As per the TSERC Distribution wheeling tariff order for the 4th control period (2019-24), issued in April 2020, Telangana DISCOMs submitted that they “have adopted the Distribution Plans submitted in the Resource Plans for projection of ARR for 4th Control Period. The Regulations does not mandate Public Hearing process to approve the Resource Plans.”

8. In CSPGCL’s response to CSERC in December 2018, it stated that as per CSERC MYT Regulations 2015, stake holders in Chhattisgarh could participate. It also stated that CSPGCL has no agreement with Telangana DISCOMs. Since the two PPAs – earlier one between CSPGCL and CSSPDCL and the subsequent one between CSSPCL and Telangana DISCOMs are separate agreement, it stated that PPA between CSPGCL and CSPDCL is not a back-to-back agreement. CSPGCL was not at all privy to the PPA entered by TSSPDCL with CSPDCL. It also stated that the contract between CSPDCL and TSSPDCL was not a contract for resale (trade), rather was standalone sale and purchase contract. These are all surprisingly totally opposed to the stand taken by CSSPDCL in its PPA with Telangana DISCOMs and its tariff petitions to CSERC

9. The case does not appear exactly similar, since only a portion of the power is sold and there is no intermediate distribution company