|

Energy storage is critical towards ensuring grid reliability, security, and cost optimisation given India’s growing share of renewable energy in its power purchase mix. The Central Electricity Authority projects an energy storage requirement of 60.6 GW/341.2 GWh by 2030, which can be met via Battery Energy Storage Systems (BESS) or Pumped Storage Projects (PSP). There has been a policy push to promote the construction of PSPs at the national and state levels to meet this energy storage requirement. This has resulted in a significant increase in the number of projects being proposed, reflected in the magnitude of capacity in the Environmental Clearance (EC) pipeline. As on 22nd may 2025, there are 125 projects with a cumulative capacity of 151.7 GW in EC pipeline, with 13.3% of this capacity having received an EC clearance or initiated construction. This article aims to evaluate the current PSP capacity in the pipeline along with the policy and regulatory framework meant to facilitate their construction. |

1. Introduction

India aims to install 500 GW of non-fossil fuel capacity and meet 50% of its energy requirements from Renewable Energy (RE) sources by 20301. To facilitate the integration of this envisioned RE capacity addition and ensure grid reliability, the Ministry of Power (MoP) introduced Energy Storage Obligation (ESO) targets under the revised Renewable Purchase Obligation (RPO) framework in July 2022. India’s energy storage requirement, which is projected to be 60.6 GW/341.2 GWh by 20302, can either be met by Battery Energy Storage Systems (BESS) or Pumped Storage Projects (PSP).

In the FY 2024-25 union budget speech, the finance minister signalled that an energy storage policy would be issued to promote the construction of PSPs in the country3. This national push is also paralleled by similar policy initiatives to promote the construction of PSPs at the state level.

Given the impetus to rapidly increase the number of PSPs in the country, this article aims to evaluate the current PSP capacity in the pipeline along with the policy and regulatory framework meant to facilitate their construction.

2. Policy Framework

The guidelines issued by MoP on 10th April 2023 outlined existing concessions from the central government, identified PSP sites across states, and highlighted avenues for state government action to promote PSPs in India. It also made note of measures to shorten the approval timelines from the Central Electricity Authority (CEA), and revisions to the Environmental Clearance (EC) framework.

The guidelines identified 56 PSP sites totalling 73.24 GW across 15 states and 1 union territory in the country, and allotted each site to one of seven central Public Sector Undertakings (PSU). Table 1 outlines the number of PSP sites and total capacity allotted to each central PSUs.

Table 1. Number of PSP sites and total capacity allotted to Central PSUs by MoP

| Central PSU | No. of PSP sites | Capacity (GW) | |

| 1. | National Hydroelectric Power Corporation (NHPC) | 10 | 14.7 |

| 2. | Satluj Jal Vidyut Nigam Limited (SJVN) | 11 | 12.8 |

| 3. | Tehri Hydro Development Corporation India Limited (THDC) | 10 | 12.6 |

| 4. | North Eastern Electric Power Corporation Limited (NEEPCO) | 10 | 14.9 |

| 5. | Damodar Valley Corporation (DVC) | 4 | 5.0 |

| 6. | Bhakra Beas Management Board (BBMS) | 1 | 1.8 |

| 7. | National Thermal Power Corporation (NTPC) | 9 | 11.6 |

| Total | 55 | 73.2 |

This approach was meant to facilitate PSP development by state governments, who may award the construction of PSP sites within their state to central or state PSUs to on a nomination basis. It also opened up avenues for Joint Ventures (JV) between state PSUs and the allotted central PSU to develop the identified PSP sites in the state.

The guidelines made note of the budgetary support of 1 – 1.5 Rs. Cr. per MW4 of installed capacity extended to PSPs to establish enabling infrastructure like roads and bridges. The guidelines also state that Power Finance Corporation (PFC), Rural Electrification Corporation (REC), and Indian Renewable Energy Development Agency (IREDA) should treat these projects at par with other RE projects in terms of loan tenor, interest rates etc.

In addition to the budgetary and financing support, the guidelines direct states to consider exempting PSPs from paying taxes (Stamp duty, registration fees, state gross service taxes) and offer government land at concessional rates on an annual lease rent basis. Moreover, it reiterates the 23rd November 2021 notification exempting RE projects (including PSPs) from paying Inter State Transmission (ISTS) charges in line with the 2016 national tariff policy.

In a similar vein, of the 21 states and union territories with identified PSP sites or projects in the pipeline, 11 have issued policies to promote PSP development as of 29th May 2025. These policies set installed capacity targets within the state for PSPs, as seen in the case of Assam, Rajasthan and Telangana. Additionally, some policies exempt PSPs from paying Intra State Transmission (InSTS) and wheeling charges, and extended additional capital subsidies/viability gap funding.

In addition to the incentives provided by the central guidelines and state policies, changes were instituted by the Ministry of Environment, Forest and Climate Change (MoEFCC) to the EC process. MoEFCC issued an amendment to the Environmental Impact Assessment (EIA) notification 2006 which outlined a separate category for standalone PSPs, differentiating them from conventional Hydro-Electric Projects (HEP). MoEFCC subsequently issued specific Terms of Reference (ToR) for standalone PSPs that details the nature of EIA that has to be carried out in order to acquire an EC. This means that PSPs no longer have to comply with the higher statutory requirements enforced on conventional HEPs, simplifying the nature of the EIA exercise that has to be conducted. Additionally, the amendment made it easier for certain projects to acquire an EC, provided the PSP did not necessitate the creation of new reservoirs, augmentation to increase capacity of existing reservoirs, or require a forest and wildlife clearance.

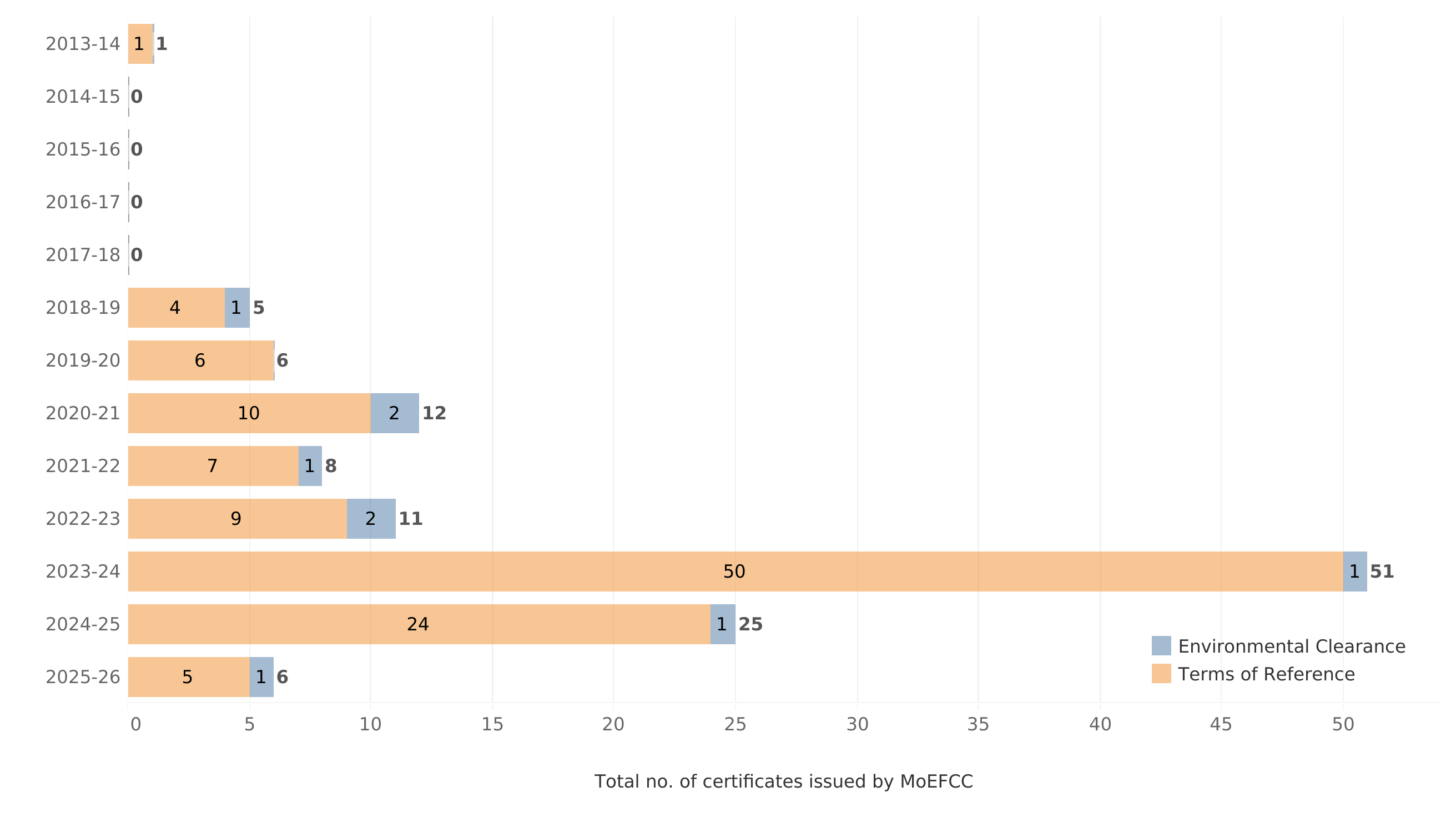

Since the policy push in early 2023, there has been a significant uptick in the number of PSPs under development. An indicator of this uptick is the number of ToRs and ECs issued by MoEFCC to PSPs. Figure 1 shows the number of ToRs and ECs issued by MoEFCC, year-on-year in each financial year since FY 2013-14.

Figure 1. Number of ToRs and ECs issued by MoEFCC for pumped storage projects since FY 2013-14

Source: Prayas (Energy Group) compilation from Expert Appraisal Committee minutes of the meeting, ToRs/ECs issued by MoEFCCC on PARIVESH portal, and CEA development of pumped storage in India report.

Note: 1) Data for FY26 represents the ToRs and ECs issued in April and May 2025. 2) MoEFCC has approved the issuance of 2 ToRs and 5 ECs post FY 2022-23 which are still under processing with the authority.

MoEFCC has issued 116 ToRs and 9 ECs in total between March 2013 and June 20255. 66% of these ToRs and ECs have been issued post FY 2022-23, with a significant spike in FY 2023-24. Since project proponents must acquire an EC prior to initiating construction, the number of PSPs at various stages of the EC pipeline indicates the total PSP capacity in the pipeline in India.

3. PSPs in the EC pipeline

As of 22nd May 2025, there are 8 commissioned PSPs with a total capacity of 4.8 GW, and an additional 125 projects in the EC pipeline6 with a cumulative capacity of 151.7 GW. Table 2 shows the breakdown of PSP capacity in various stages of the pipeline.

Table 2. PSPs at various stages of the EC pipeline in India

| Particular | No. of PSPs | Capacity (GW) | |

| 1. | Applied for Terms of Reference | 13 | 14.8 |

| 2. | Received Terms of Reference | 96 | 115.1 |

| 3. | Applied for Environmental Clearance | 1 | 1.5 |

| 4. | Received Environmental Clearance | 7 | 10.3 |

| 5. | Under Construction | 8 | 9.9 |

| Total | 125 | 151.7 |

Source: Prayas (Energy Group) compilation from Expert Appraisal Committee minutes of the meeting, ToRs/ECs issued by MoEFCCC on PARIVESH portal, and CEA development of pumped storage in India report.

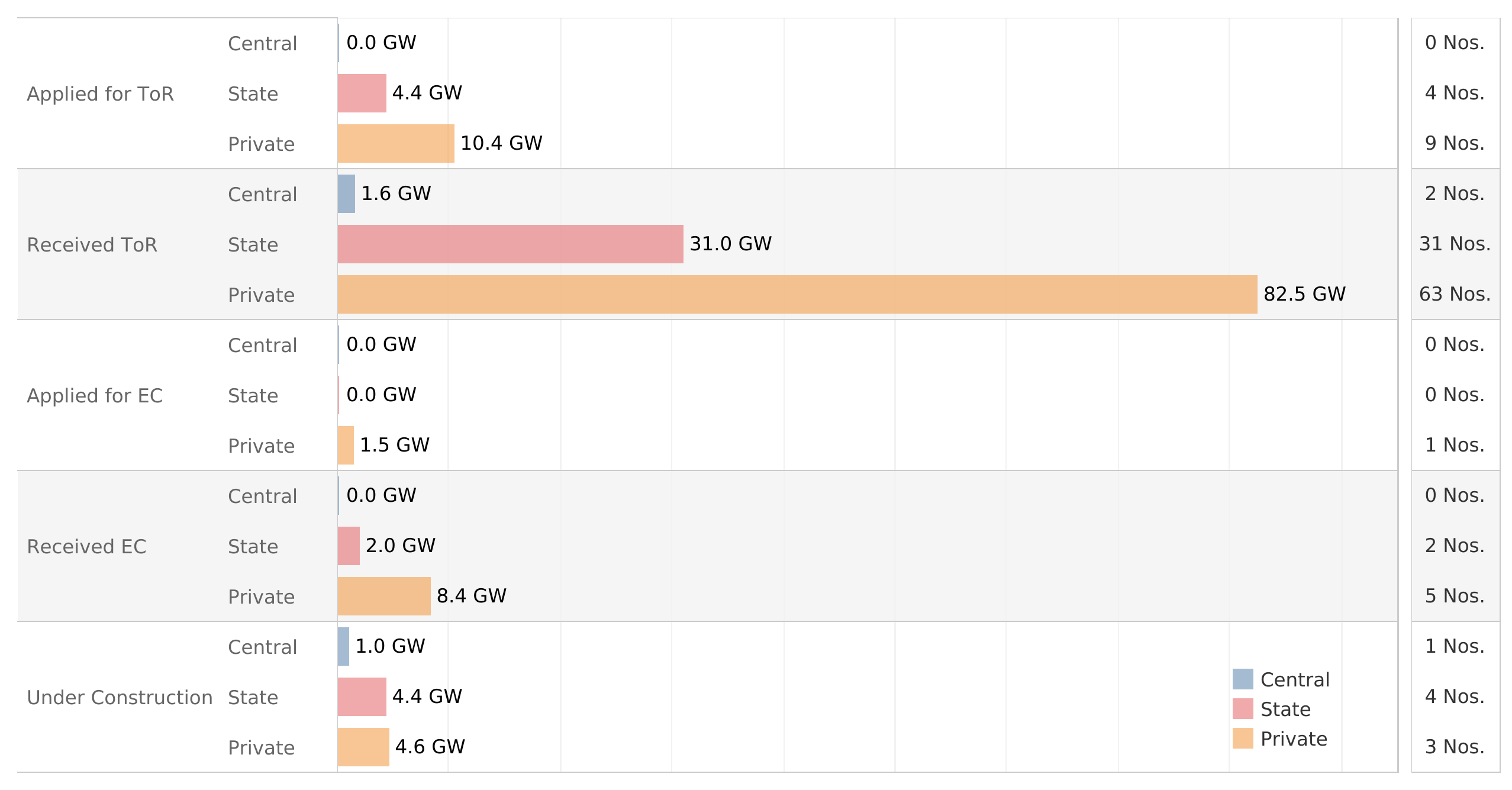

Prior to starting construction, the CEA accords approval to the Detailed Project Report (DPR) of the PSP7. The EC accorded by the MoEFCC forms a critical part of each DPR. MoEFCC first issues each project a ToR which outlines the nature of the EIA that has to be carried out. An EC is then issued provided the MoEFCC is satisfied with the EIA exercise, and the requisite mitigatory measures are outlined in the EC. As can be seen in table 2, 96 of 125 projects have been issued ToRs, with cumulative capacity accounting for 75.9% of the total capacity in the EC pipeline. A majority of the PSPs in the pipeline have been proposed by private project proponents. Figure 2 shows the ownership breakdown of the PSPs at various stages of the EC pipeline.

Figure 2. Ownership-wise breakdown of PSPs at various stages of the EC pipeine

Source: Prayas (Energy Group) compilation from the Expert Appraisal Committee minutes of the meeting, ToRs/ECs issued by MoEFCCC on PARIVESH portal, and CEA development of pumped storage in India report.

Private project proponents have proposed 81 of the 125 projects making up ~71% of the total capacity in the EC pipeline. Similarly, State and Central PSUs/State Nodal Agencies (SNA) have 40.7 GW and 2.6 GW respectively at various stages, accounting for a combined ~29% of the total pipeline capacity in the country.

Forty-five project proponents, private or government owned in nature, are responsible for all the projects at various stages of the EC pipeline. However, only 7 companies either directly or indirectly via subsidiaries, are responsible for an outsized majority of pipeline capacity. Table 3 contains details regarding these 7 companies.

Table 3. Details on PSPs being developed by 7 companies with majority share of the EC pipeline in India

| Project Proponent | Ownership | No. of PSPs | Capacity (GW) | PSPs issued EC/Under construction (% capacity) | |

| 1. | Greenko Energies Private Ltd. | Private | 16 | 27.67 | 37.3% |

| 2. | New and Renewable Energy Development Corporation of Andhra Pradesh Ltd. | State | 18 | 19.25 | 7.8% |

| 3. | Adani Green Energy Ltd. | Private | 10 | 16.50 | 9.1% |

| 4. | Torrent Power Ltd. | Private | 8 | 13.86 | 0% |

| 5. | Chhattisgarh State Power Generating Company Ltd. | State | 5 | 7.70 | 0% |

| 6. | JSW Energy | Private | 6 | 6.31 | 2.1% |

| 7. | Gujarat State Electricity Corporation Ltd. | State | 7 | 3.34 | 0% |

| Total | 71 | 94.63 |

Source: Prayas (Energy Group) compilation from the Expert Appraisal Committee minutes of the meeting, ToRs/ECs issued by MoEFCCC on PARIVESH portal, and CEA development of pumped storage in India report.

The 7 companies mentioned in table 3, each individually developing at least 5 PSPs, have proposed 71 of the 125 projects, making up 62.4% of the total capacity in the EC pipeline.

The PSPs in the pipeline have been sited across 15 states in the country. However, like with project proponents, a majority of the PSPs have been proposed in 6 states. Table 4 contains the breakup of the pipeline capacity across the 6 states.

Table 4. Details on PSPs being developed in 6 states with majority share of the EC pipeline in India

| State | No. of PSPs | Capacity (GW) | PSPs issued EC/Under construction (% Capacity) | |

| 1. | Maharashtra | 18 | 29.55 | 8.5% |

| 2. | Andhra Pradesh | 23 | 26.73 | 17.0% |

| 3. | Uttar Pradesh | 12 | 18.22 | 20.1% |

| 4. | Rajasthan | 10 | 14.20 | 12.7% |

| 5. | Chhattisgarh | 12 | 13.68 | 0.0% |

| 6. | Tamil Nadu | 9 | 10.30 | 4.85% |

| Total | 84 | 112.68 |

Source: Prayas (Energy Group) compilation from the Expert Appraisal Committee minutes of the meeting, ToRs/ECs issued by MoEFCCC on PARIVESH portal, and CEA development of pumped storage in India report.

The 6 states mentioned in table 4 account for 74.3% of the total PSP capacity in the pipeline.

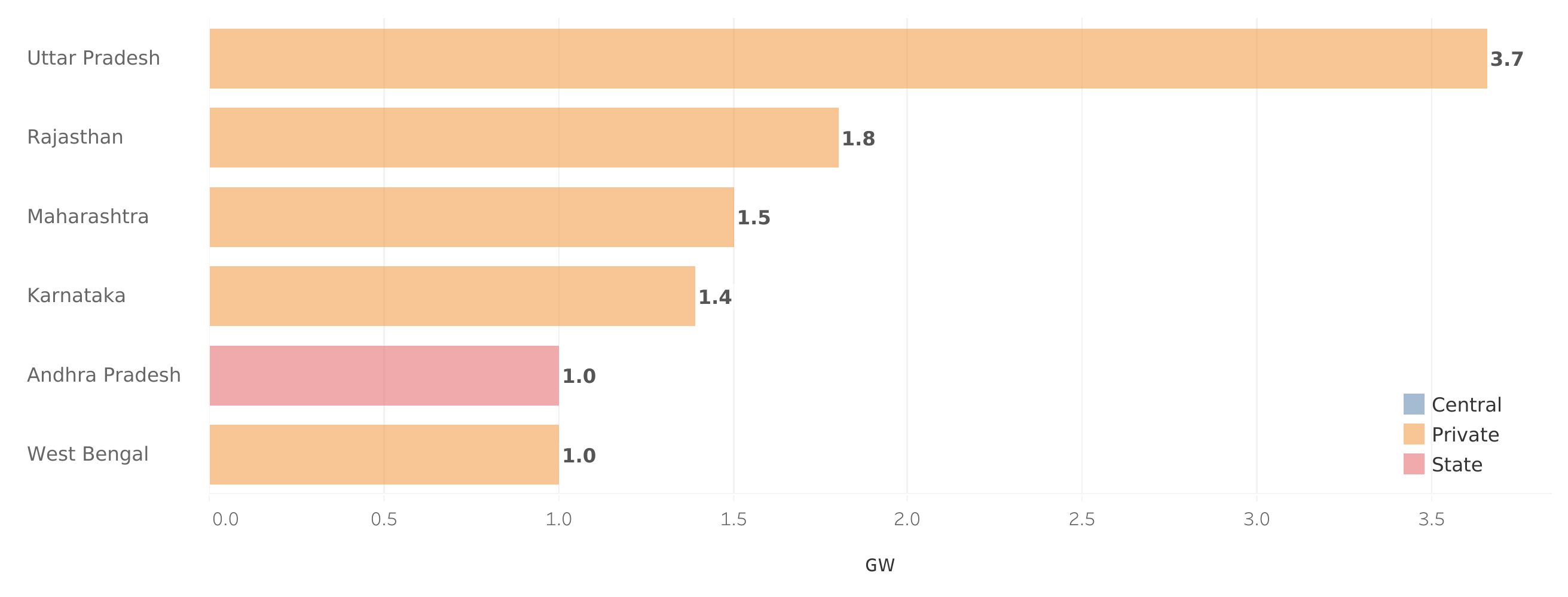

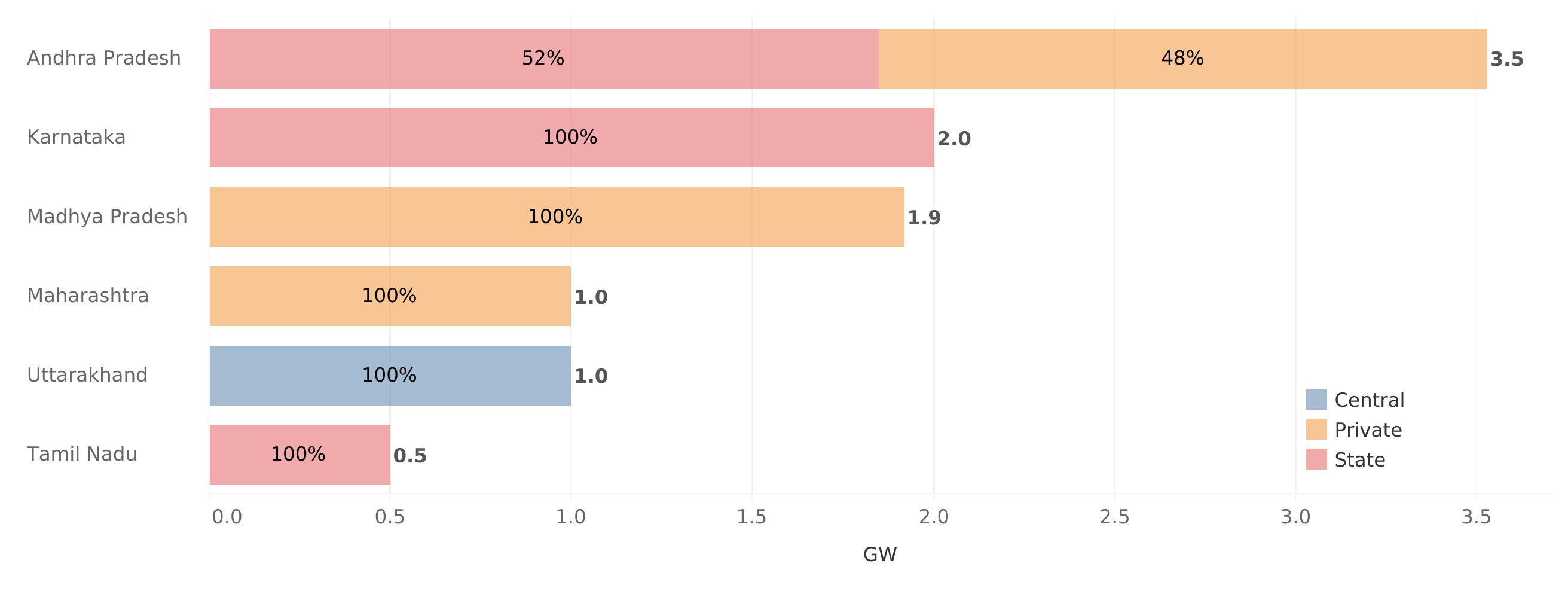

As mentioned earlier, majority of PSPs have only been issued ToRs and are in the process of carrying out the EIA. Project proponents have 5 years from the date of issuance to submit the EIA report to MoEFCC for consideration of EC approval, after which the ToR stands expired. It is important to note that not all projects that have been issued ToRs will be commissioned. Projects that have been issued ECs and have begun construction have a higher likelihood of being commissioned than those that have only been issued ToRs. Figure 3 shows the state-wise breakdown of the PSP capacity which has been issued ECs and figure 4 shows the state wise breakdown of the PSP projects which are under construction.

Figure 3. State-wise break of PSP capacity that has been issued ECs

Source: Prayas (Energy Group) compilation from the Expert Appraisal Committee minutes of the meeting, ToRs/ECs issued by MoEFCCC on PARIVESH portal, and CEA development of pumped storage in India report.

Figure 4. State-wise break of under construction PSP capacity

Source: Prayas (Energy Group) compilation from the Expert Appraisal Committee minutes of the meeting, ToRs/ECs issued by MoEFCCC on PARIVESH portal, and CEA development of pumped storage in India report.

Of the PSP capacity in the pipeline, 6.8% and 6.6% have been issued ECs and are under construction, respectively. Private players currently account for ~50% of the under-construction PSPs in the country. However, this proportion is only likely to rise as 80.7% of those projects that have been issued ECs are owned by private project proponents.

PSP policies and the EC framework prioritise the construction of PSPs on pre-existing reservoirs to minimise their environmental impact. Currently, 5 of the 7 projects that have been issued ECs have 1 pre-existing reservoir each. These projects account for ~47% of the capacity that has been issued ECs. Similarly, 3 of 8 under construction PSPs have 1 pre-existing reservoir, and an additional 4 under construction PSPs do not require any new reservoirs. These 7 projects account for 83.1% of the currently under construction capacity in the country.

However, only 13 of the 96 projects that have been issued ToRs are sited with at least one existing reservoir. Hence majority of the projects with ToRs will require the creation of two new reservoirs if they proceed to construction.

4. Regulatory framework to contract PSPs

As can be seen from the previous section, there is a significant amount of PSP capacity in the EC pipeline. If commissioned, these projects will be contracted by private enterprises to meet their supply requirements through captive means or direct open access, or by Distribution Companies (DISCOMs) to meet their energy storage needs and fulfil the applicable ESO. DISCOMs can contract PSPs in 2 modes:

- From central/state PSUs or JVs who are awarded PSPs on a nomination basis

- Tariff Based Competitive Bidding (TBCB)

As mentioned in section 1, 55 sites totalling 73.2 GW have been allocated to central PSUs across 15 states and 1 union territory. Currently, state and central PSUs have 43 projects totalling 43.4 GW in various stages of the EC pipeline. If contracted, it is likely that the tariff determination will be on cost-plus basis under section 62 of the Electricity Act 2003.

A PSP contracted by DISCOMs from multiple states would have its tariff determined by the mechanism in the tariff regulations notified by the Central Electricity Regulatory Commission (ERC). However, if the PSP was wholly contracted by DISCOMs within the state, the tariff would be determined by the mechanism notified by the state ERC. Currently, of the 19 states with PSPs under central or state PSUs in the pipeline, only 9 states have such explicit mechanisms for tariff determination of PSPs outlined in their state tariff regulations. The remaining state ERCs have to issue regulations for PSP tariff determination in the coming years to account for the commissioning of PSPs in their respective state.

MoP issued draft TBCB guidelines for PSPs in August 2024, with the final guidelines being notified on 6 February 2025. As on May 2025, 12 tenders8 have been issued by central and state PSUs for standalone PSPs whose tariffs were to be discovered via competitive bidding. Of these, 4 tenders totalling 6.25 GW/51 GWh have been awarded, with 3 tender totalling 19.5 GWh still in the tendering process. Table 5 contains the details on the 4 awarded tenders whose prices have been realised.

Table 5. Details of the 4 tenders for PSPs awarded via competitive bidding

| Procurer | Capacity (MW) | Storage (Hours) | Contract Duration | Price (Rs. Cr./MW/Year) |

Winner | |

| 1. | NTPC | 500 | 6 | 40 years | 1.67 | Greenko |

| 2. | MSEDCL | 3000 | 8 | 40 years | 0.84 – 0.85 | JSW & Torrent |

| 3. | UPPCL | 2000 | 8 | 40 years | 0.76 – 0.96 | JSW & Adani |

| 4. | UPPCL | 1500 | 8 | 40 years | 0.77 | JSW |

Source: Based on dataset compiled by Debmalya Sen

5. Conclusion

In light of India’s larger ambitions to meet a growing portion of its energy requirements from RE sources, storage investments become critical to ensure reliability and cost-optimisation. The national and state policy push, coupled with state electricity regulations, has facilitated a framework for PSP development to meet this storage requirement. This is clearly reflected in the significant increase of the PSP capacity in the EC pipeline post FY 2022-23. The conducive policy and regulatory environment has drawn particular interest from private enterprises, who account for over 70% of the pipeline capacity. But it is yet unclear how much capacity will be commissioned, considering that majority of the projects are still in nascent stages of development.

The longer gestation periods and risks of cost and time overruns involved in the commissioning of PSPs creates additional uncertainties in power procurement planning for DISCOMs. On average, it took 29 months for PSPs to be issued an EC from when the project received its ToR from MoEFCC. Additionally, it takes 48 – 66 months9 for a PSP to be commissioned from when it initiates construction, depending on the nature of the PSP. Therefore, it could take 5 – 8 years for a PSP to be commissioned not accounting for the time involved in acquiring a ToR, or any additional delays. This makes PSPs a suitable option to only meet the DISCOMs energy storage requirements on a long-term horizon and not to address its near-term storage needs.

The CEA optimal generation mix report projects a PSP requirement of 18,896 MW by 2030. Considering projects which have been issued ECs and are currently under construction, the average CapEx requirement amounts to Rs. 5.26 Crore/MW. This implies a total CapEx requirement of approximately Rs. 1 lakh Crore by 2030. Given the magnitude of capital outlay, it is critical to ensure that the PSP requirement is determined via an analytically rigorous modelling-based approach to minimise the impact on consumer tariffs. Additionally, PSPs should be contracted on a least-cost basis via competitive bidding processes to ensure cost prudence.

Measures like Time of Day (ToD) tariffs and agriculture feeder solarisation shift demand for electricity to coincide with solar generation, reducing the magnitude the storage required to ensure grid reliability and security. This, coupled with the consistent and ongoing reduction in BESS prices, highlights the need to critically evaluate the magnitude of PSP requirement going forward. This is also reflected in CEA’s projections for energy storage, which recommends meeting ~60% of India’s storage requirement from BESS (on GWh basis).

Given the magnitude of capacity in the pipeline and the fast-paced changing nature of the sector, there is a need to analytically assess the suitability, demand for, and impact of pumped storage projects in India.

|

The authors thank Ann Josey, and Shantanu Dixit for their valuable inputs and review of this document.

Comments and suggestions on the series are welcome and can be addressed to |

Endnotes

[1] Press Information Bureau - India’s stand at CoP 26, dated 3rd February 2022.

[2] CEA Report on Optimal Generation Mix 2030 Version 2.0, April 2023.

[3] Press Information Bureau – Policy for Promoting Pumped Storage Projects to be brought out for electricity storage, dated 23rd July 2023.

[4] Rs. 1.5 Crore/MW for PSPs with installed capacity upto 200 MW and Rs. 1 Crore/MW for PSPs with installed capacity above 200 MW.

[5] This does not include issue of transfers/amendments to ToRs/ECs by MoEFCC.

[6] The EC pipeline also includes projects that are under construction after having been issued an EC.

[7] As per the EIA Notification 2006 (and amendments), CEA has to accord approval to the DPR of PSPs with a CapEx exceeding Rs. 1000 Crore. The threshold is Rs. 2500 Crore if the PSP was allocated via competitive bidding in line with central bidding guidelines, or if the PSP was part of the CEA national electricity plan.

[8] The tender issued by NTPC for 500 MW/3000 MWh of energy storage in 2022 was technology agnostic.

[9] MoP Model bidding guidelines for pumped storage projects.