|

Given the rising cost-competitiveness of RE, its procurement by DISCOMs, third party sale and captive route should be allowed to thrive on the basis of its own economic proposition, rather than being driven by concessions/waivers. This is especially the case as many of the recent concessions being provided (waiver in inter-state transmission charges, concessions on open access and wheeling charges etc.) are cross-subsidised by other users of the grid rather than being subsidised by the union/state government. Moving away from a concessions-based regime for new projects will aid the development of robust RE markets with appropriate market signals for discovery of prices and framework for risk assessment. Obviously, moving away from concessions/waivers should apply only to new projects and should not affect projects which have come up under a specific concessions regime. Such signals are necessary for the RE sector to grow without undue fiscal and economic duress. With many states moving away from the concessions regime, it is also important to ensure that grid services necessary for RE development are provided by appropriate stakeholders such as distribution companies, LDCs and transmission utilities, as long as they are valued and priced appropriately. This is especially the case for banking services. Till specific market instruments for green power have adequate liquidity and offer flexibility, banking services would be required. Instead of denying this service, it can be valued on a block-wise basis based on costs incurred by the DISCOMs. Similarly, the entire cost of deviation caused due to wind and solar generators should be borne by the generators rather than allowing a 10-15% error without penalties as is currently the case. The article covers the trends in concessions and proposes a methodology for valuing vital grid services provided by utilities. |

1. Introduction

Renewable Energy (RE) is playing an increasingly important role in India’s electricity sector and will be the central pillar of electricity generation in the future. The robust growth in RE (90 GW by Dec, 2020) was possible due to a strong policy and regulatory push and due to its benefits such as ever reducing prices, vast resource potential, local environmental benefits, climate mitigation, energy security and low gestation periods. To encourage the adoption of RE, various policy incentives were initiated. These included 100% Foreign Direct Investment (FDI) in 1992, Accelerated Depreciation (AD), energy banking and preferential feed-in-tariffs. While some of these early incentives were modified with time or completely withdrawn, a few continue to remain in place with newer incentives coming into play. As an example, the accelerated depreciation benefit saw many changes over the years and was finally withdrawn. It was replaced with a Generation Based Incentive to overcome some of the limitations of AD.

While the solar PV sector adopted competitive bidding based pricing framework very early in its development, the wind sector became overdependent on the incentives, and has yet to fully adjust to competitive bidding even after many years, unlike solar. To prevent such over-dependence, as needs and contexts evolve, policies also must evolve. Over the years, with RE generation prices having fallen considerably (with the latest solar PV bid at Rs 2/kWh), RE has become competitive with new thermal plants as well as some existing high marginal cost thermal plants in terms of energy cost. Thus, it becomes imperative that RE now grows on its own fundamental value proposition and reduce its dependence on policy and regulatory incentives.

To promote non-DISCOM based large scale RE procurement, many states started offering concessions/waivers to RE based open access and captive projects as well. Through open access (OA), large consumers, typically with a contract demand of more than 1 MW, can avail electricity supply from sources other than the Distribution Company (DISCOM) in whose area of supply the consumer is situated. The OA consumer has to pay a number of charges namely – the cross subsidy surcharge (CSS), additional surcharge (AS), transmission and distribution network charges and losses.

These concessions/waivers could be in the form of reduced wheeling/transmission charges, exemption from payment of CSS and AS, nominal energy banking charges etc. The nature, scale and applicability of these concessions and waivers vary across states. While such waivers/concessions may have been necessary policy incentives some years ago, falling RE generation prices have rendered them largely unnecessary at present. One should certainly not expect such concessions to be in place forever and plan for an alternate regulatory framework. This is especially true since many of these concessions are not budgetary subsidies, but are cross-subsidised by other users of the grid.

Currently, many states are already moving away from these concessions/waivers and some are also changing their energy banking framework for RE based OA and Captive use. This article aims to take stock of some of these recent changes and start a discussion on the growth of RE without policy incentives. The scope of the article is limited to large scale RE based open access and captive projects and does not cover policy/regulatory issues around small scale RE like rooftop solar.

2. Wires Charges and Losses

These are the transmission (at ISTS/InSTS level) and wheeling (distribution) charges and losses for using the wires network to transmit and distribute the RE power to the consumer. The concessions and waivers in these charges vary a lot across states. Maharashtra offers no concession both for OA and Captive transactions. Gujarat offers 50% wheeling concession only for solar captive projects which do not avail Renewable Energy Certificates (RECs) as well as for wind captive projects wheeling power to a consumption site below 66 kV voltage level. Tamil Nadu gives a 50% concession to transmission and wheeling for both wind and solar, except for plants availing RECs. Recently, Rajasthan provided for an exemption of 75% in intra-state transmission and wheeling charges for the Renewable Energy with Storage projects and an exemption of 100% for supplying power to Electric Vehicle charging stations either under the Captive route or via open access. These include clear sunset clauses of seven years and ten years respectively

Apart from state transmission and wheeling charges, a very important waiver is that of ISTS charges and losses. Para 6.4(6) of the National Tariff Policy (NTP), 2016 provides that ‘In order to further encourage renewable sources of energy, no inter-state transmission charges and losses may be levied till such period as may be notified by the Central Government on transmission of the electricity generated from solar and wind sources of energy through the interstate transmission system for sale’. Via orders issued by the Ministry of Power in 2016 and 2017, this waiver was made applicable only to those solar and wind projects that are awarded through competitive bidding process and commissioned up to 31st December, 2019 (solar) and up to 31st March, 2019 (wind). The waiver is available for a period of 25 years from the date of commissioning of such projects and was limited only for those projects entering into Power Purchase Agreements (PPAs) for sale of electricity to the Distribution Companies for compliance of their renewable purchase obligation. Subsequently, in 2018, Ministry of Power (MoP) extended this deadline for all such projects commissioned till 31st March, 2022, providing further that it will be available for solar and wind projects entering into PPAs with all entities, including Distribution Companies. In 2019, this deadline was further extended to 31st December, 2022. Taking into account the disruptions caused by the Covid-19 pandemic, the waiver was recently extended further till 30th June, 2023. This waiver would be additionally applicable to solar-wind hybrid power plants, as well as solar photovoltaic projects commissioned under the second phase of the Ministry of New and Renewable Energy’s Central Public Sector Undertaking Scheme and those commissioned under the Solar Energy Corporation on India’s Tender for manufacturing linked capacity scheme.

It is imperative to quickly move away from such concessions on wires charges and losses since they end up sending wrong market signals. The ISTS waiver is leading to even smaller projects being connected to the ISTS network, with all projects queuing up for inter-connection only in few States, irrespective of the consumer location and voltage.

3. Cross-subsidy surcharge (CSS) and Additional Surcharge (AS)

CSS is the largest component of the open access charges. Until recently, many states either completely waived off this charge or gave a high level of concession. In 2017, for example, CSS attracted a wide level of concessions, which ranged from a full waiver in Madhya Pradesh and Rajasthan, a 75% waiver in Maharashtra, to a 50% waiver in Tamil Nadu.1

Presently, with increasing cost-competitiveness of RE, many states have either removed these concessions or are proposing to do so. Maharashtra was the first state to completely remove the concessions for CSS since 2017. Gujarat gives a 50% concession only to Wind OA and Solar non-REC projects, however the new Gujarat Solar Policy of 2021 proposes to remove all CSS/AS concessions to third party sale projects. Rajasthan, recently, has acknowledged that the technology has indeed matured over time and henceforth will levy full CSS on Solar OA with no exemption. On the other hand, Chhattisgarh has chosen not to levy any CSS on open access solar and give a 50% concession to other OA RE. Odisha has continued to give a 100% concession to CSS for consumers availing OA RE.

AS is another component of the OA charges which the SERC levies to recover backing down costs due to sales migration from OA. Even in the case of AS, there is no homogeneity across states. Many states such as Maharashtra and Haryana offer no concession specifically for RE. Some choose to waive it either fully or partially for RE. For example, recently, Odisha exempted RE OA from the surcharge, while Gujarat increased its AS to all open access consumers while retaining the 50% concession to Wind OA.

Considering the cost competitiveness of RE and the worsening financial health of the DISCOMs (in part due to growing sales migration to OA/CPP), states should gradually move away from these CSS and AS concessions/waivers with clear sunset clauses to ensure a smoother transition. Experience of recent years shows that the growth of RE has mainly been driven by reducing power purchase costs. Therefore, RE OA should be allowed to thrive on the basis of its own economic proposition, rather than being driven by concessions. Having said that, apart from removing these concessions, CSS/AS, which would be equally applicable for all sources of generation, should also be set at a level so as to not deter competition through OA. Moreover, volatility in CSS/AS charges causes uncertainty among the consumers, dissuading them from moving towards medium or long-term open access. Thus, there should be a medium-term certainty of the CSS/AS charge.

4. Energy banking

RE has seasonal and diurnal variations (especially wind and solar), due to which the demand pattern of the RE-OA consumer may not match the RE generation in real time.2 An energy banking mechanism allows the RE-OA consumer to bank ‘excess generation’ with the DISCOM, usually over a year. Banking is presently allowed by SERCs upon levy of a banking charge which differs in magnitude across states. Additionally, various attributes of the energy banking framework such as seasonality constraints, buy back rates, accounting for RPO etc. also differ by states.

In the past one year, many states have changed their energy banking norms. Renewable energy-rich states such as Maharashtra and Gujarat have moved from an annual banking facility to a monthly banking facility. Andhra Pradesh has completely withdrawn its banking facility and Karnataka is proposing to do the same. However, presently RE based OA/CPP transactions would not be able to thrive without some form of energy banking arrangement. Discontinuing the energy banking framework in its totality is not an appropriate strategy in the near term.

The core issue with energy banking is that it is essentially a service by the DISCOMs to OA or captive power consumers. Yet, in most cases this service is paid for only at a nominal and ad-hoc rate of 2-5% (e.g Maharashtra, Haryana, Andhra Pradesh, Goa and UTs) of the energy in kind. The counterfactual to the energy banking service is the alternative of installing energy storage, which attracts significant costs. Further, the time of injection and withdrawal and the value of such injection/withdrawal changes by time of the day and by seasons, depending on the load and generation mix available with the DISCOM. This is not captured by the 2-5% adhoc rate for energy banking. Thus, there is certainly a hardship caused to the DISCOMs due to this arrangement, cost of which is falls on non-OA / non-captive consumers.

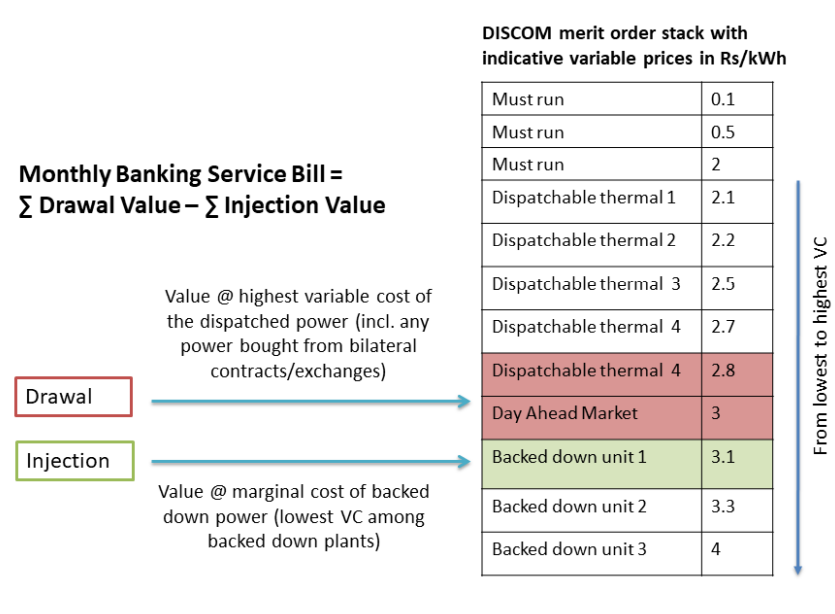

An alternative banking framework, therefore, could be a banking charge on a per unit basis (Rs/kWh), instead of the present energy in-kind practice. This charge is to be determined based on the difference between power purchase cost at the time of banking of energy and its drawl, which is revenue neutral to both the DISCOM and the consumers eligible for banking. This can be done by linking energy banking with the actual Merit Order Dispatch of the distribution utility. The energy banking framework could be as follows:

- For each 15-minute block, energy banked would be valued by the DISCOM at the lowest variable cost of the backed down power or the cost of power on the Day Ahead Market (or possibly a Green-TAM or Green-DAM in the future when liquidity increases, as this includes the value of the RPO) at that time, whichever is lower. If there is no backing down, then the energy banked for each 15-minute block would be valued at the cost of power on the Day Ahead Market (or possibly a Green-TAM or Green-DAM in the future when liquidity incrases, as this includes the value of the RPO).

- Energy drawl for each 15-minute block would be charged by the DISCOM at the highest variable cost of the dispatched power (incl. any power bought from bilateral contracts/exchanges).

- Credit for energy banking and charges for drawl would be calculated for each 15-minute block and would be settled at the end of the month. Such monthly settlement will also avoid the need for specifying any buy-back rate for excess power banked with the DISCOM at the end of the year as was needed in the erstwhile banking framework.

- The green attribute for any un-utilised banked energy at the end of the year would be credited to the DISCOMs RPO.

- Since the banked energy is objectively valued both at the time of banking and drawl (thereby making the DISCOM revenue neutral for such transactions), there should not be any seasonal or Time of Day (ToD) based constraints on the banking and drawl of the banked energy subject to technical network constraints.

- Till the time appropriate metering and accounting systems are put in place for such 15-minute block wise valuation, a simpler temporary approach of charging difference in ToD tariff for injection slot and withdrawal slot could be considered.

A schematic of the banking proposal is shown in the Figure 1.

Figure 1: An alternative Energy Banking Service Valuation Framework

Source: Prayas (Energy Group) analysis

The Gujarat Solar Policy of 2021 has adopted a banking charge designated in Rs/kWh which varies from Rs 1.1-1.5/kWh and applicable not just on banked energy but on energy consumed. Further the policy has effectively stopped banking for HT consumers (both captive and OA) by restricting energy accounting to one day. However, this is yet to be incorporated by the GERC in its regulations.

Additionally, wind and solar power have relatively low Capacity Utilisation Factors (CUFs) (20-35%). Thus, it is possible that OA consumers may seek open access permission for capacity greater than their stated drawl requirement and potentially misuse the energy banking service. To ensure that this is avoided, there is a need to cap the maximum RE generation that can be procured in relation to the energy demand. Therefore, RE capacity contracted should be such that there is no significant excess generation, say up to 10%, over the yearly demand of the consumer. MERC presently limits the maximum unutilized monthly banked energy to 10% of total monthly generation.

5. Forecasting and Scheduling mechanism, Deviation Settlement charges

While CERC has put in place Forecasting and Scheduling regulations for projects connected to ISTS since 2015 with the implementation procedure being finalised in 2017, most states have notified their state regulations in this regard in the last few years. Given the variability and intermittency of wind and solar power coupled with the existing (limited) accuracy of forecasting (not 100%), all regulations have allowed for deviation error up to a certain level (10/15%) without any penal DSM charges. This is an implicit incentive for RE, since all other generators pay for all their deviation under the DSM penalty mechanism linked to frequency. This begs the question, who pays for the deviation up to 15% or 10% allowable error?

In most states, the DISCOMs bears the cost of deviation penalties by wind and solar up to 10/15% absolute error. A better and more equitable approach would be such that the deviation penalty caused due to wind and solar should be borne by these generators. To operationalise this, a suggested approach (as operationalised in Maharashtra) is outlined below.

- First, the SLDC calculates the contribution of solar and wind deviation to the total deviation charge for the state at its periphery.

- Secondly, they collect deviation charges for wind and solar deviation in accordance to absolute error at each pooling station.

- Thirdly, if the total deviation penalties collected from the wind and solar projects are lower than what wind and solar power deviation contributed to the state deviation penalty, then the balance is additionally recovered from the generators (through their QCAs) in proportion to their deviation.

In essence, the entire cost of deviation caused due to wind and solar is finally passed back to the generators, thereby allaying the fears of the DISCOM which would have had to bear the brunt in the absence of this provision. This additional settlement is required due to difference in existing penalties for wind and solar generators connected to InSTS/ISTS and existing frequency linked deviation settlement mechanism at the state periphery. We feel that this is the right approach and will further push the growth of renewables in the long run. In fact,MERC3 has adopted this approach and other states should amend their regulations in this direction. This is an important step going ahead, especially when the share of wind and solar energy is expected to rise sharply.

5.1. Virtual Pools, Aggregation of schedules and level of allowable absolute error

The ‘Model Regulations on Forecasting, Scheduling and Deviation Settlement of Wind and Solar Generating Stations at the State level’ issued by the FoR in 2015 stipulated a recommended level (10/15%) of allowable absolute error at each pooling station based on studies4 done at few sample pooling stations.

Given that the estimation of the stipulated level is based on studies at the pooling station level, the recommended level of error (10% for new projects / 15% for old projects) for which there are no penalties, holds true only when errors are calculated at the level of each pooling station and not aggregated at the level of the state. Errors estimated at the system level would most likely be lower than those estimated for individual pooling stations due to geographical diversity. What matters in terms of system balancing is the aggregate deviation from wind and solar generation. Hence aggregation5 of wind/solar schedules across pooling stations and QCAs could be allowed but only if the entire deviation penalty is passed on the wind/solar generators as suggested in section 5.

6. Conclusions / Closing remarks

- New RE (esp. wind and solar at a 25-year fixed tariff of Rs 2.5-2.75/kWh) is cost competitive in terms of energy cost, with new thermal power and even some existing high marginal cost plants. Thus, there is no need for further concessions/waivers for RE based open access and captive power plants. Hence it is time that SERCs levy the full charges and losses for RE based OA for these two categories, namely,

- Transmission (ISTS and InSTS) & Wheeling charges and losses

- Cross subsidy surcharge and Additional Surcharge

Similarly, it would be prudent to not further extend the ISTS waiver for RE projects. In any case levying the full charges for RE projects, both for DISCOM projects and OA/CPP transactions would be appropriate as it would not hamper RE investments given their cost effectiveness and high RPO targets. It should be stressed that moving away from concessions/waivers should apply only to new projects and should not affect projects which have come up under a specific concessions regime

- Presently RE based OA/CPP transactions would not be able to thrive without some form of energy banking arrangement in the short-medium term. Discontinuing or severely restricting the energy banking framework in its totality is not an appropriate strategy in the near term. Rather, energy banking should be recognised as a grid service and should be appropriately priced by SERCs to compensate DISCOMs and move away from the nominal and ad-hoc rate of ~2-5% of the energy in kind to 15-minute block-wise valuation of banking service provided. Till the time appropriate metering and accounting systems are put in place for such 15-minute block wise valuation, a simpler approach of charging difference in ToD tariff for injection slot and withdrawal slot could be considered.

- With regard to F&S, all ERCs should do a comprehensive review of the operational experience thus far and appropriately revise and tighten error bands for over/under injection while amending their regulations. However, more importantly ERCs should pass on the entire cost of deviation caused due to wind and solar (calculated as an aggregate at the state level) back to the generators, thereby allaying the fears of the DISCOM which would have had to bear the brunt in the absence of this provision.

Endnotes

1. Choosing Green: the status and challenges of renewable energy based open access, (Prayas (Energy Group), 2017), 19.

2. Net-metering based rooftop solar is essentially a liberal energy banking service for consumers with no charges (thus saving on counterfactual battery costs). The consumer uses the grid as a virtual battery, by banking excess generation and un-banking as and when needed, all throughout the year. Energy banking is a service and must be appropriately priced with a more balanced framework with at least large consumers (say >10/100 kW) bearing some cost of reliability and future uncertainty.

3. See MERC F&S regulations (Regulation 12(d)) and procedure (Regulation 10-12). Specifically, Regulation 12(d)

Deviation Accounting

(d) Any shortfall in the aggregate amount of Deviation Charge payable by Solar and Wind Energy Generators at the State periphery and the amount receivable from them by the Pool Account shall be paid by the respective QCAs in proportion to their deviation reflected at the State periphery.

4.For details on this, please see pp.22-23 of the report.

5. Aggregation is allowed by Karnataka.