|

The Revamped Distribution Sector Scheme (RDSS) has set an ambitious target of installing 250 million prepaid smart consumer meters across India by March 2026, along with mandates for smart metering of all feeders and distribution transformers (DTs). These efforts will help in improving the billing collection efficiency, distribution network infrastructure, better monitoring and help in reducing the AT&C losses in discoms. Although many states have started smart meter implementation, the progress is uneven across regions. As of March 2025, while a significant number of meters have been sanctioned, actual installations remain low particularly for DTs and consumer meters. This article presents a detailed analysis of the current status of smart metering at the feeder, DT and consumer level, highlighting state wise progress, award rates and regulatory preparedness. |

Smart metering has been a key reform in India’s power sector, with a potential for facilitating improved billing, enabling energy monitoring, and effective demand management. It can support distribution companies (discoms) to achieve the objectives of reducing Aggregate Technical and Commercial (AT&C) losses and improving their financial health. The launch of the Revamped Distribution Sector Scheme (RDSS)1 by the Ministry of Power in July 2021 has provided strong momentum to smart meter deployment nationwide, focusing on boosting operational efficiency of state-owned distribution companies2. Smart metering projects are to be executed in TOTEX mode - a combination of capital and operational expenses. Discoms are required to select Advanced Metering Infrastructure Service Providers (AMISPs) through a standard bidding process as mandated by Ministry of Power (MoP)3. AMISPs will be in turn responsible for handling end-to-end metering, with costs covered via debt and equity financing under the TOTEX model for a period of 10 years.

As per the Scheme document, RDSS has a fixed sunset date of 31.03.2026, beyond which the Central Government will not be approving any new sanctions. Therefore, the onus of timely implementation of projects to avail benefits of the Scheme lies with the discoms. The Power Finance Corporation (PFC) and Rural Electrification Corporation (REC) act as designated nodal agencies which play a pivotal role in overseeing all aspects from project sanctioning to closure.

In this article we present our analysis about the progress of smart meter deployment under the RDSS, examine key contractual aspects of the scheme, and review the status of smart metering regulations in different states. The analysis majorly relies on the data from the RDSS dashboard4, which provides comprehensive insights into stage-wise5 deployment of smart meters, supplemented by data from the NSGM Metering Dashboard6 and the CEA's Status of Metering Report ,20247 in India .

1. Targets and status of smart metering

The RDSS has set out an ambitious target of installing 250 million prepaid consumer smart meters until March 2026. In addition, it also includes mandates for smart metering of all feeders and distribution transformers in the country. The following sections provide an analysis of the current status of smart metering at various points within the distribution network.

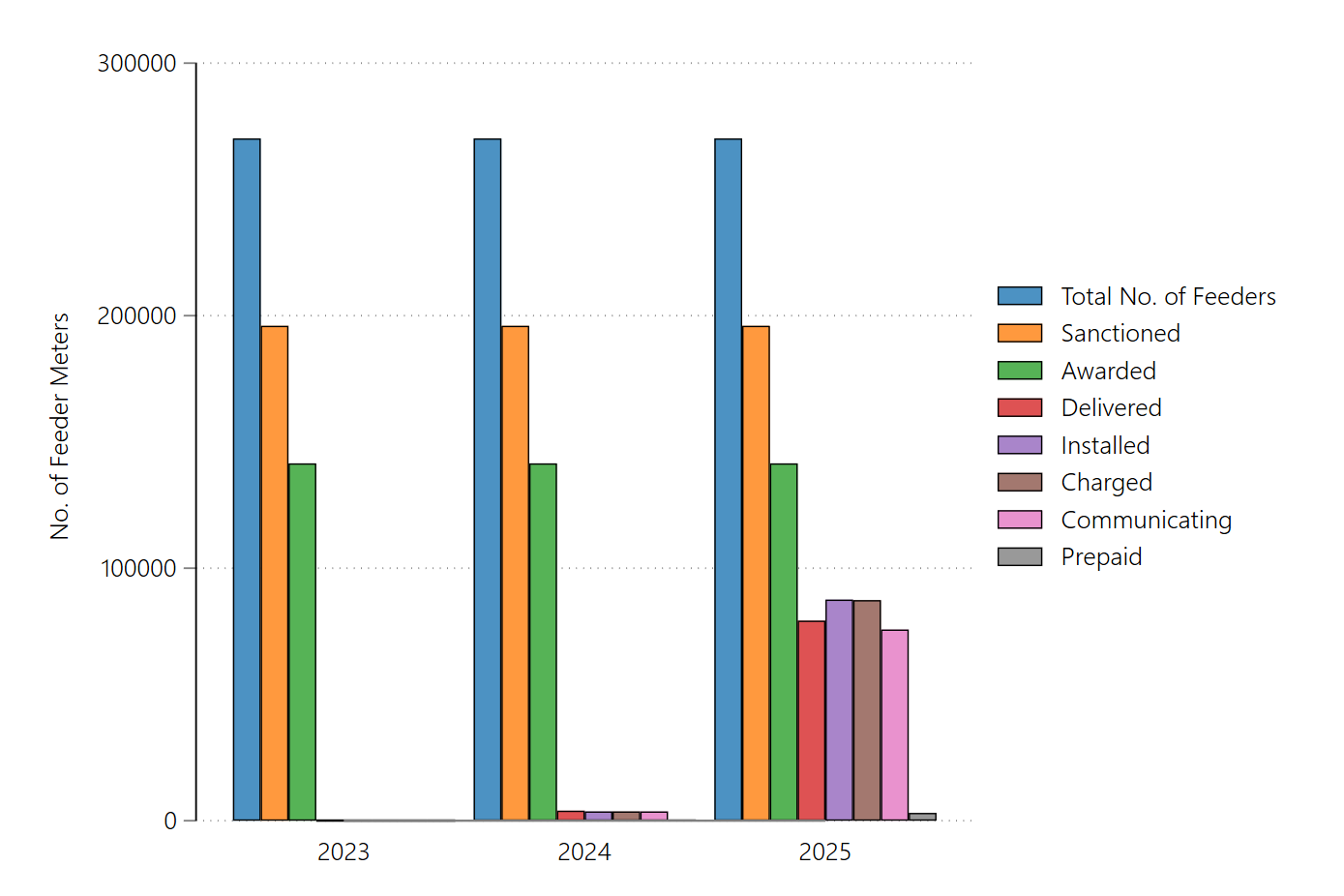

1.1 Feeder Metering

As per the RDSS guidelines, all feeders were to be metered with communicable & AMI/AMR meters by December 2022 and are to be integrated with the National Feeder Monitoring System (NFMS). As per the 2024 CEA report on Status of metering in the country, there are about 2.7 lakh feeders in the country under state utilities (~2.3 lakh 11 kV feeders and 0.35 lakh 66/33/22 kV feeders). The NFMS dashboard mentions that ~81% 11 kV feeder meters are integrated with the NFMS.

According to data from the RDSS portal, approximately 1.95 lakh feeders (72.5%) have been sanctioned for smart metering. Of these, around less than lakh (87,000) have been installed and charged, with about 28% (75,000) in communicating mode. The chart below illustrates the stage-wise progress of feeder smart metering. It shows that there is lag in installation of meters and further ensuring 100% communication in them. These issues need to be investigated and addressed to improve feeder metering and data collection.

Figure 1: Status of feeder smart metering in India as of March 2025

(Source: Prayas (Energy Group) compilation from RDSS dashboard accessed on 09.04.2025)

*Total no. of feeders in the country may include some feeders that are already smart metered; bifurcated data on this is unavailable. The RDSS dashboard mentions Feeder metering in prepaid mode for some entries, which appears to be a glitch in data entry.

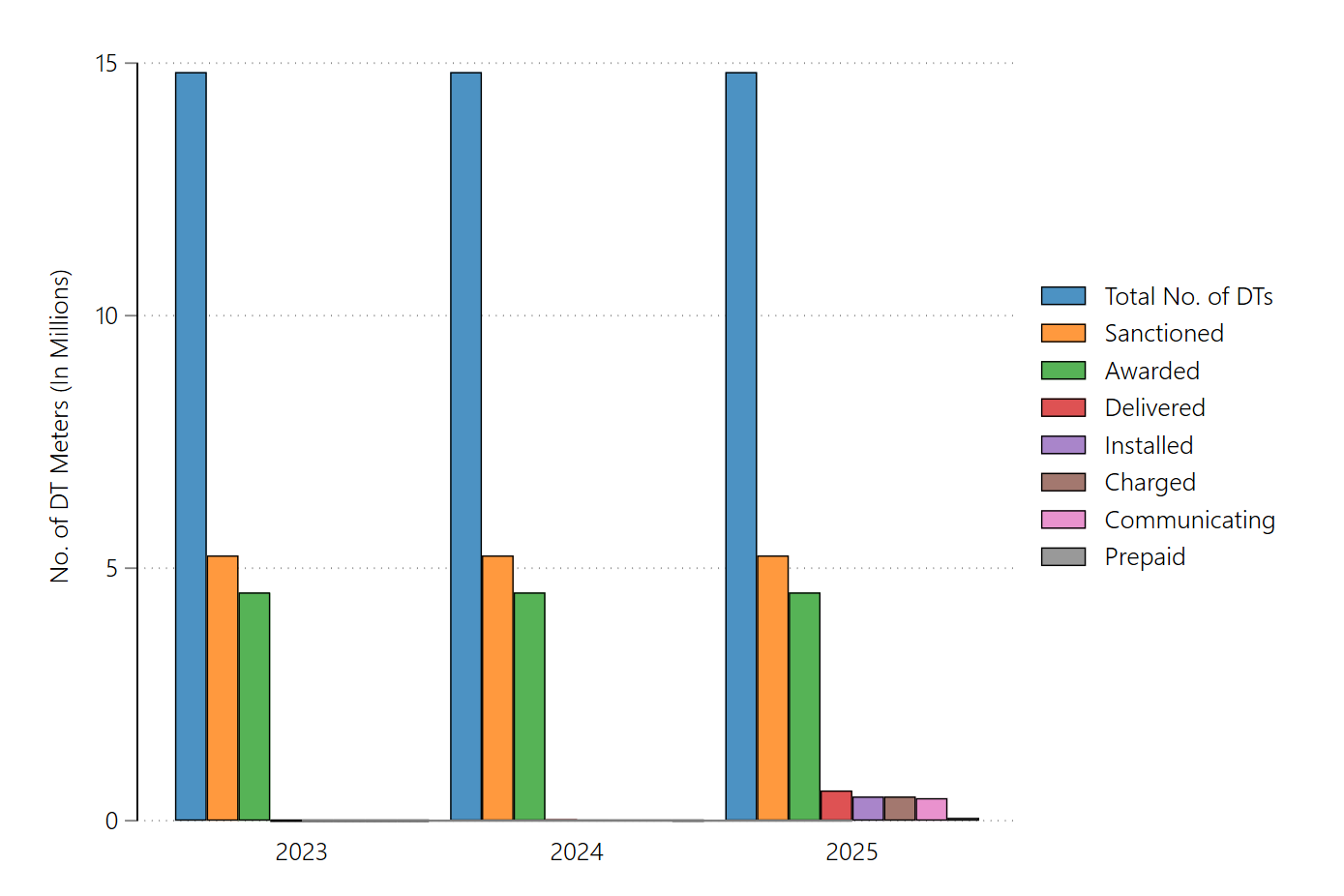

1.2. DT metering

The guidelines also require the installation of communicable distribution transformer (DT) meters integrated with Advanced Metering Infrastructure (AMI) in areas identified for consumer metering under RDSS Phase 1 by December 2023, and for all remaining DT meters by March 2025. Out of the 14.8 million DTs within state discom networks, around 5 million (35%) have been sanctioned for smart metering, while presently about 0.44 million (3% of total no. of DTs) have smart meters in the communicating mode as per data on the RDSS portal. DT metering status shows significant lag in installed meters as against approved numbers.

Figure 2: Status of DT smart metering in India as of March 2025

(Source: Prayas (Energy Group) compilation from RDSS dashboard accessed on 09.04.2025)

**The RDSS dashboard mentions DT metering in prepaid mode for some entries, which appears to be a glitch in data entry.

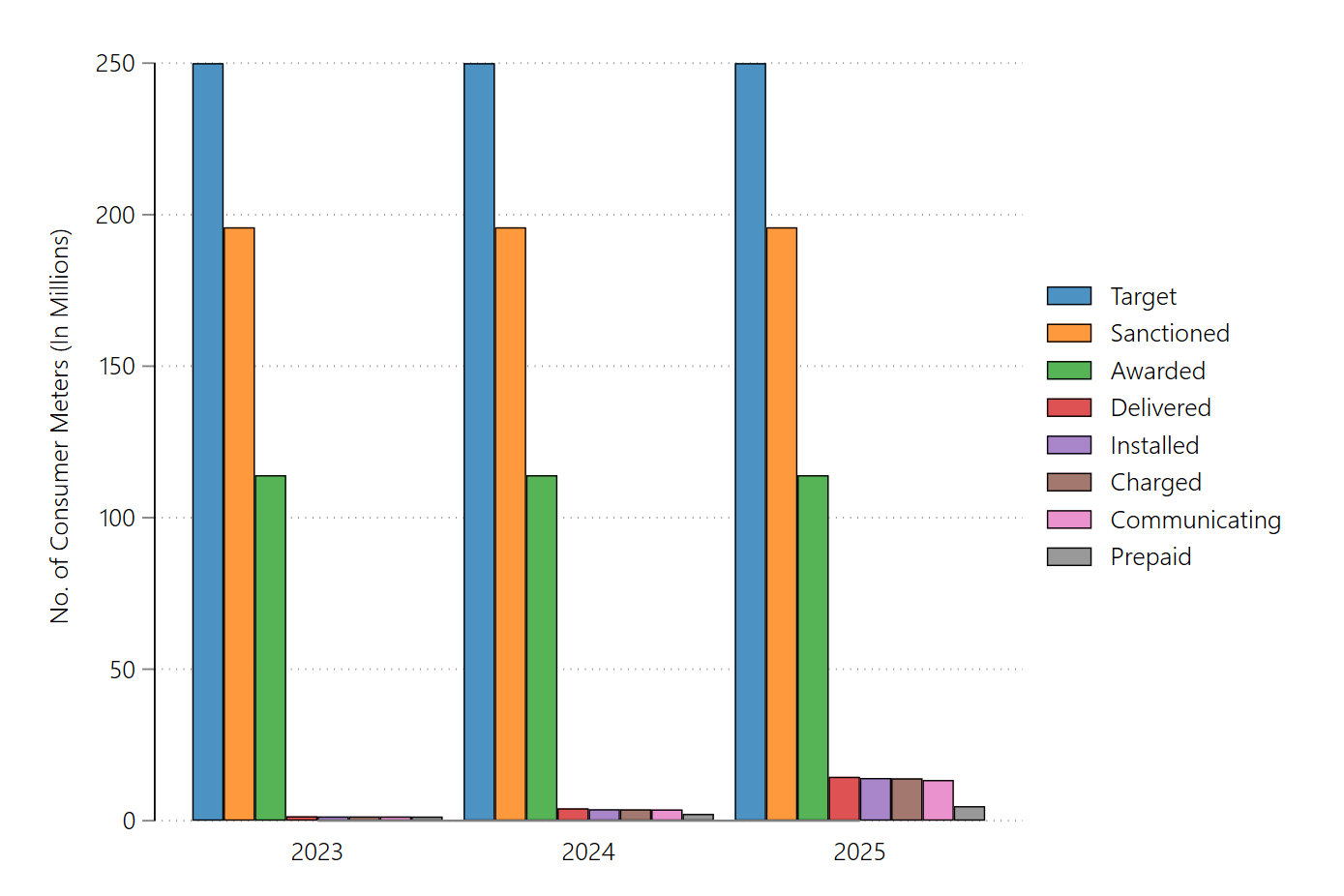

1.3 Consumer Metering

Smart consumer meters are expected to improve billing efficiency and provide better information about energy consumption patterns to discoms and consumers. In order to receive support through RDSS, state utilities are required to implement prepaid smart metering in all categories of consumers except agriculture. The overall number of consumers under the jurisdiction of a discom, therefore, determines its smart metering target. However, the RDSS guidelines state that, to optimize the cost-benefit ratio of smart metering and achieve economies of scale, implementation should be undertaken in a mission-mode, focusing on priority areas identified for the first phase of the Scheme (ex. In UT’s, AMRUT Cities, C&I consumers.), which extended until December 2023. However, information about progress of smart metering in the priority areas or breakup of the total target in phases is not available in the public domain.

The figure 3, shows the progress of consumer metering in India against the target of 250 million smart prepaid meters. It shows that while there is year-on-year progress in meter delivery, installation, charging, and communication, only 13.4 million meters (5% of the target) are currently communicating. Only about 4.8 million meters (1.9% of the target) are in prepaid mode, mainly from Assam, Bihar, Gujarat, Manipur, and West Bengal. Around 11% of sanctioned meters are prepaid smart meters in select states like Andaman & Nicobar Islands, Arunachal Pradesh, Maharashtra and Mizoram, while the rest are whole current smart meters8. Information regarding some states with known pilot rollouts (e.g. Telangana) are not reflected on the RDSS portal.

Figure 3: Status of consumer smart metering in India as of March 2025

(Source: Prayas (Energy Group) compilation from RDSS dashboard accessed on 09.04.2025)

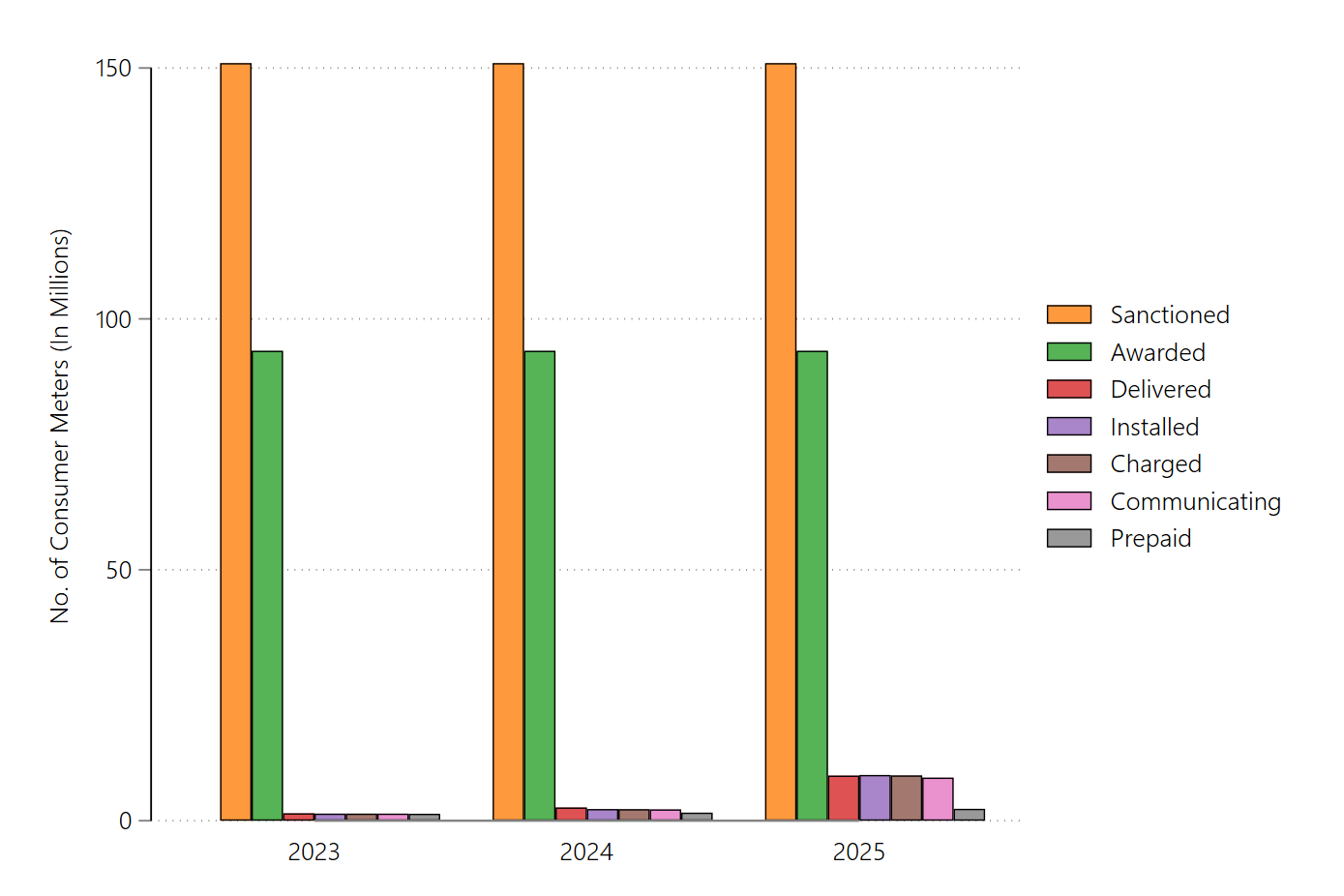

2. Status of consumer metering in selected states

We analysed smart metering progress in 10 RDSS-participating states which together account for 68% of India’s total consumers as per CEA Annual General Review 2023. These "selected states" include Maharashtra, Tamil Nadu, Uttar Pradesh, West Bengal, Andhra Pradesh, Gujarat, Bihar, Telangana, Madhya Pradesh and Rajasthan. Karnataka, ranks fourth in number of consumers, was excluded due to non-participation in RDSS and no data availability in terms of progress of smart metering.

Figure 4 shows the year-on-year status of consumer metering in the selected states. It can be seen from the RDSS portal data and a Lok Sabha response9 that no fresh sanctions have been made in the years 2024 and 2025; and the total awarded items have also remained at 62% of the sanctioned over the three years. Implementation has improved, but as of March 2025, only 5.7% of installed meters are communicating and 1.6% are in prepaid mode.

Figure 4: Year-on-year status of consumer smart metering in selected states as of March 2025

(Source: Prayas (Energy Group) compilation from RDSS dashboard accessed on 09.04.2025)

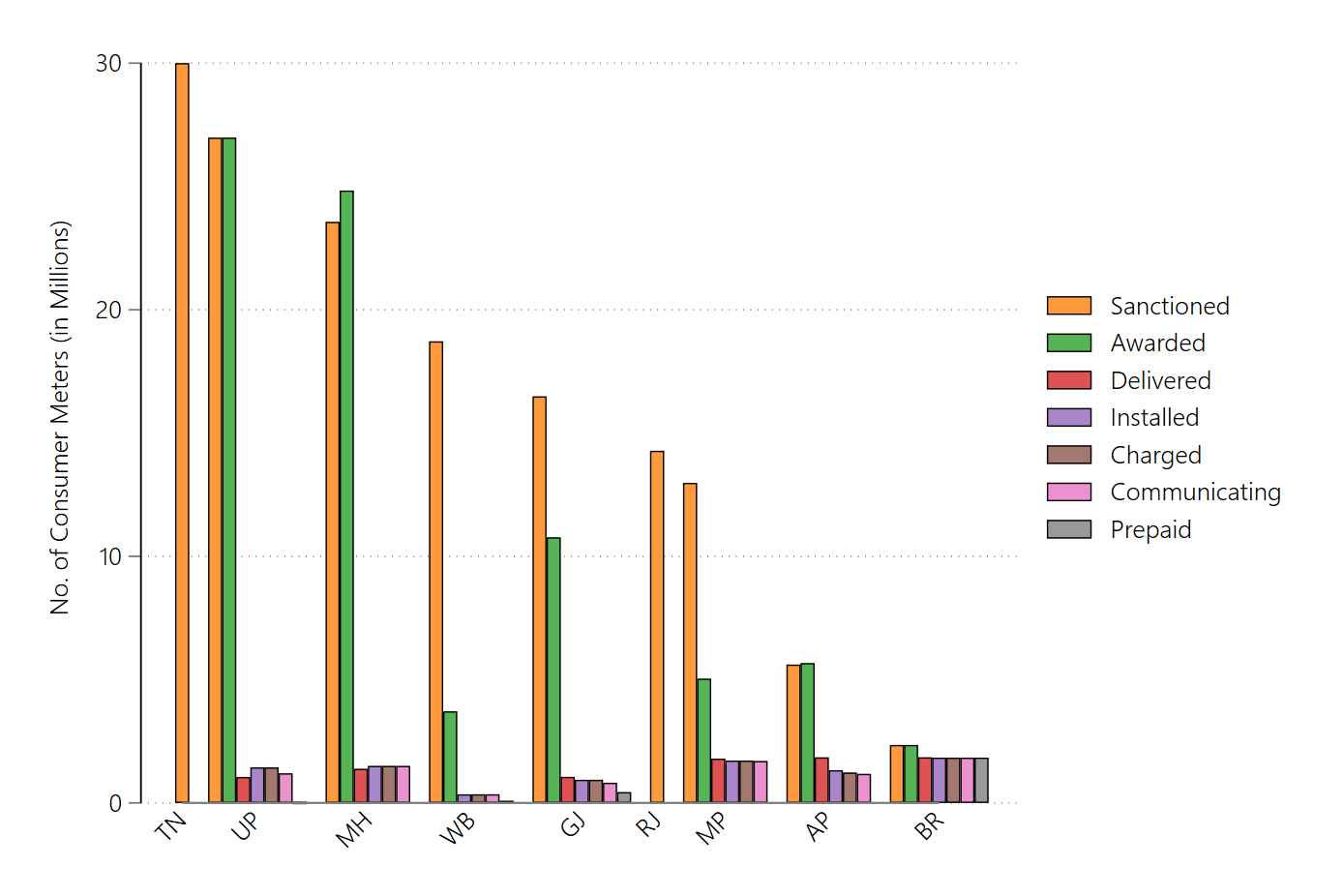

Figure 5 presents a state-wise analysis of implementation status as presented on the RDSS monitoring portal as of March 2025. It is seen that although Tamil Nadu has the highest number of sanctioned meters, the actual process of implementation is yet to start. Uttar Pradesh shows a close match between sanctioned and awarded meters. Bihar leads in execution, with all sanctioned meters awarded and 78% of installed ones communicating; all are prepaid. In Gujarat and West Bengal, 46% and 27% of installed meters are prepaid. In other selected states, the number of prepaid meters as indicated on the RDSS dashboard, is zero. Telangana has no data on the RDSS dashboard and hence is excluded from the chart.

Figure 5: State-wise status of consumer smart metering in selected states as of March 2025

(Source: Prayas (Energy Group) compilation from RDSS dashboard accessed on 09.04.2025)

3. Award rates for smart metering

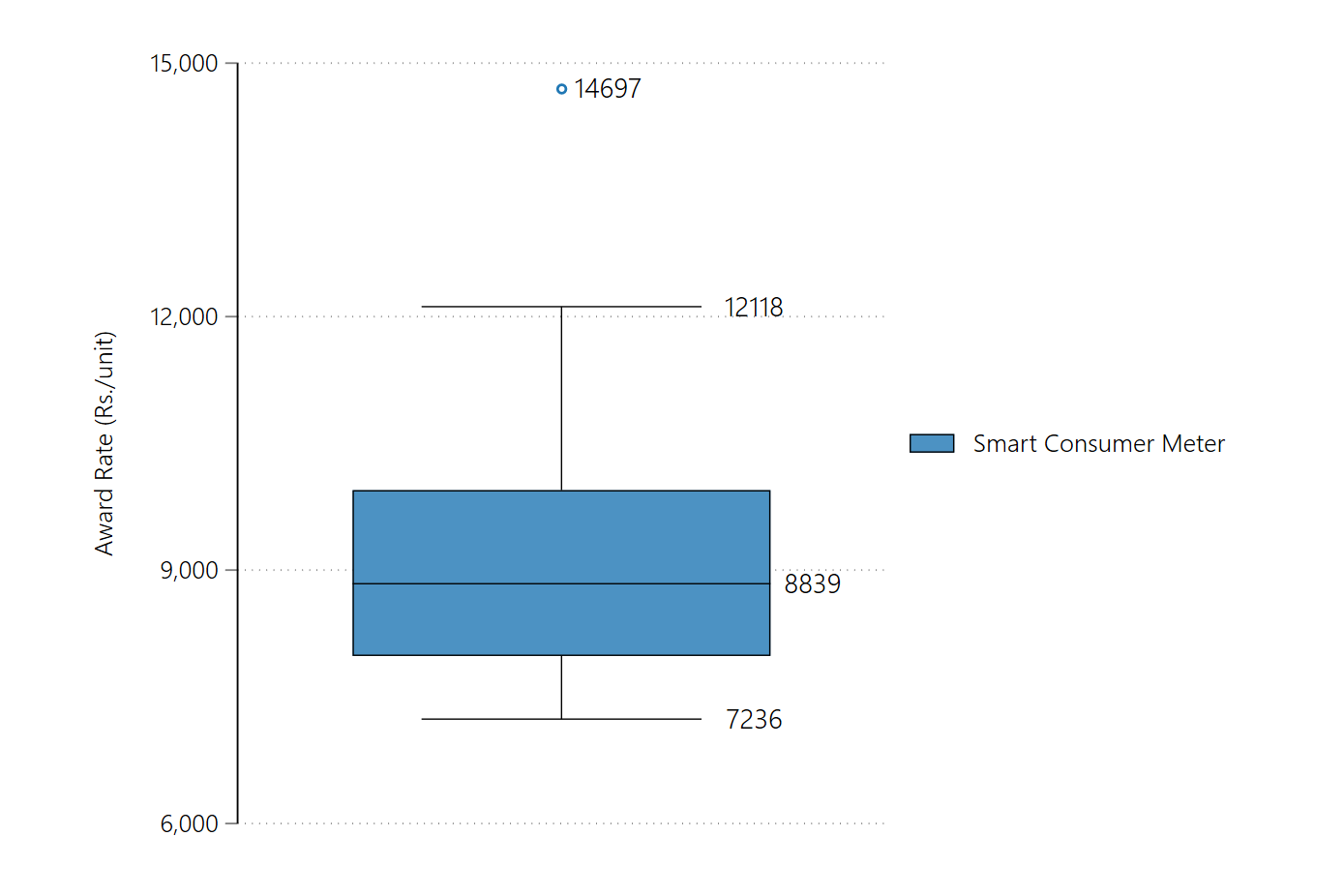

The RDSS dashboard also provides data about the quantities and award rates for different types of meters in various states. Award rate is a comprehensive per unit cost where unit comprises of meter manufacturing cost as well as expenses from its installation to operation and maintenance and associated services for the period of the contract typically lasting 10 years10. Figure 6 captures the award rates for single phase whole current smart consumer meters across discoms at the national level. Half of the award rates are below Rs.8839, the lowest and the highest being Rs.7236 and Rs. 12118 respectively. Importantly, the distribution is right-skewed, indicated by a higher mean of Rs.9093. The highest recorded award rate for AMI works is Rs.14697 by Sikkim Power Department, which incidentally has also awarded the lowest no. of meters among all discoms. A brief assessment of impact of number of meters on cost of AMI is discussed in following paras.

Figure 6: Distribution of Award Rates for Smart Consumer Meter for 33 Discoms

(Source: Prayas (Energy Group) compilation from RDSS dashboard accessed on 09.04.2025)

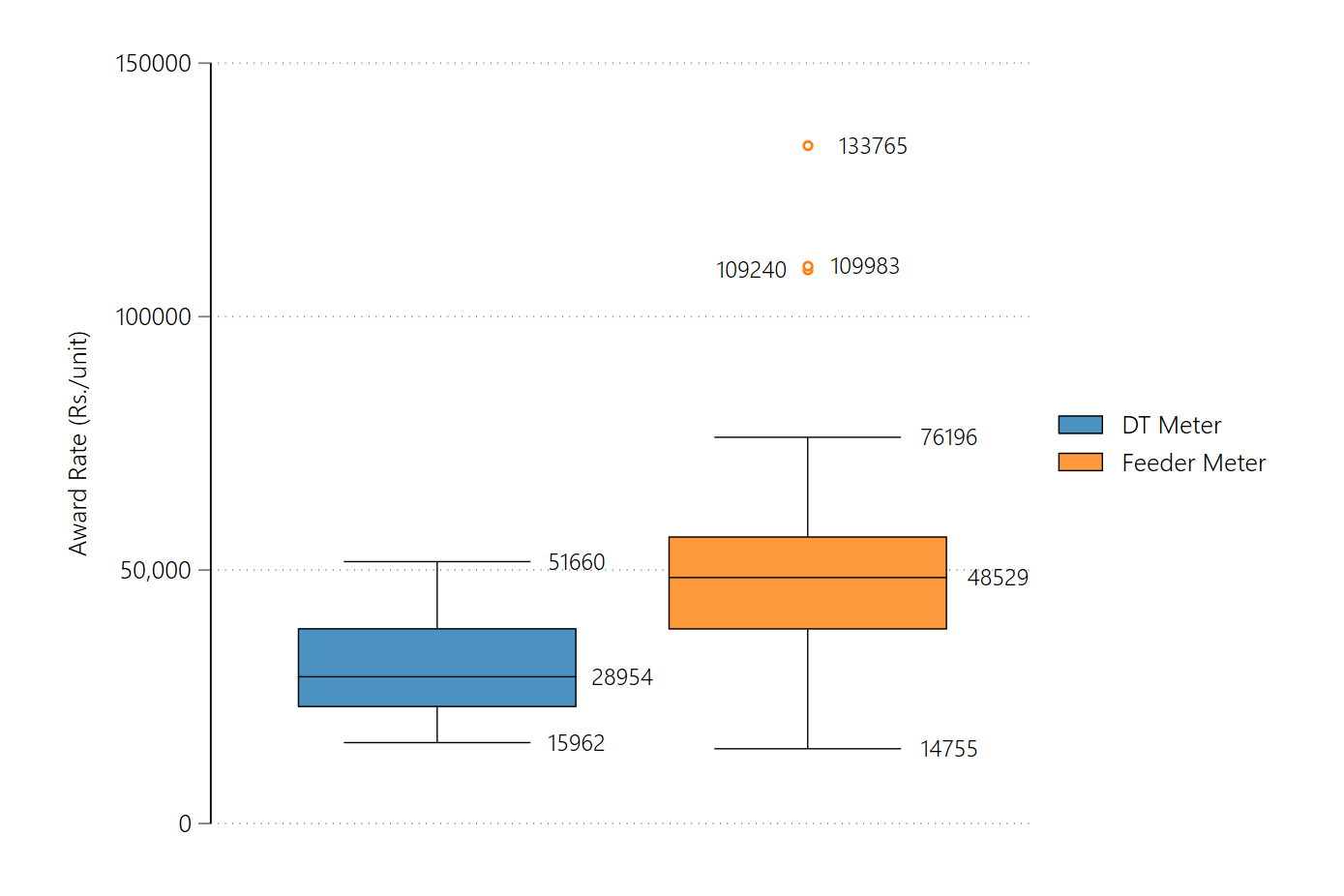

Figure 7 delineates the distribution of the cost of DT and Feeder meters for all discoms across states. Median award rate for DT meters is Rs.28,954/unit, the lowest and the highest award rate being Rs.15,962/unit and Rs.51,660/unit respectively11. The range of award rates for feeder meters is large, with the most economical meter award rate costing as low as Rs.14,755/unit. Tripura’s award rate per unit is the highest at Rs.1,33,765, followed by Mizoram and Himachal Pradesh at Rs. 1,09,983 and Rs. 1,09,240 respectively. The median award rate for feeder meters is Rs. 48,529, while the mean is higher at Rs. 51,042 due to the presence of outliers.

Figure 7: Distribution of Award Rates for DT and Feeder Meters for 37 and 30 Discoms respectively

(Source: Prayas (Energy Group) compilation from RDSS dashboard accessed on 09.04.2025)

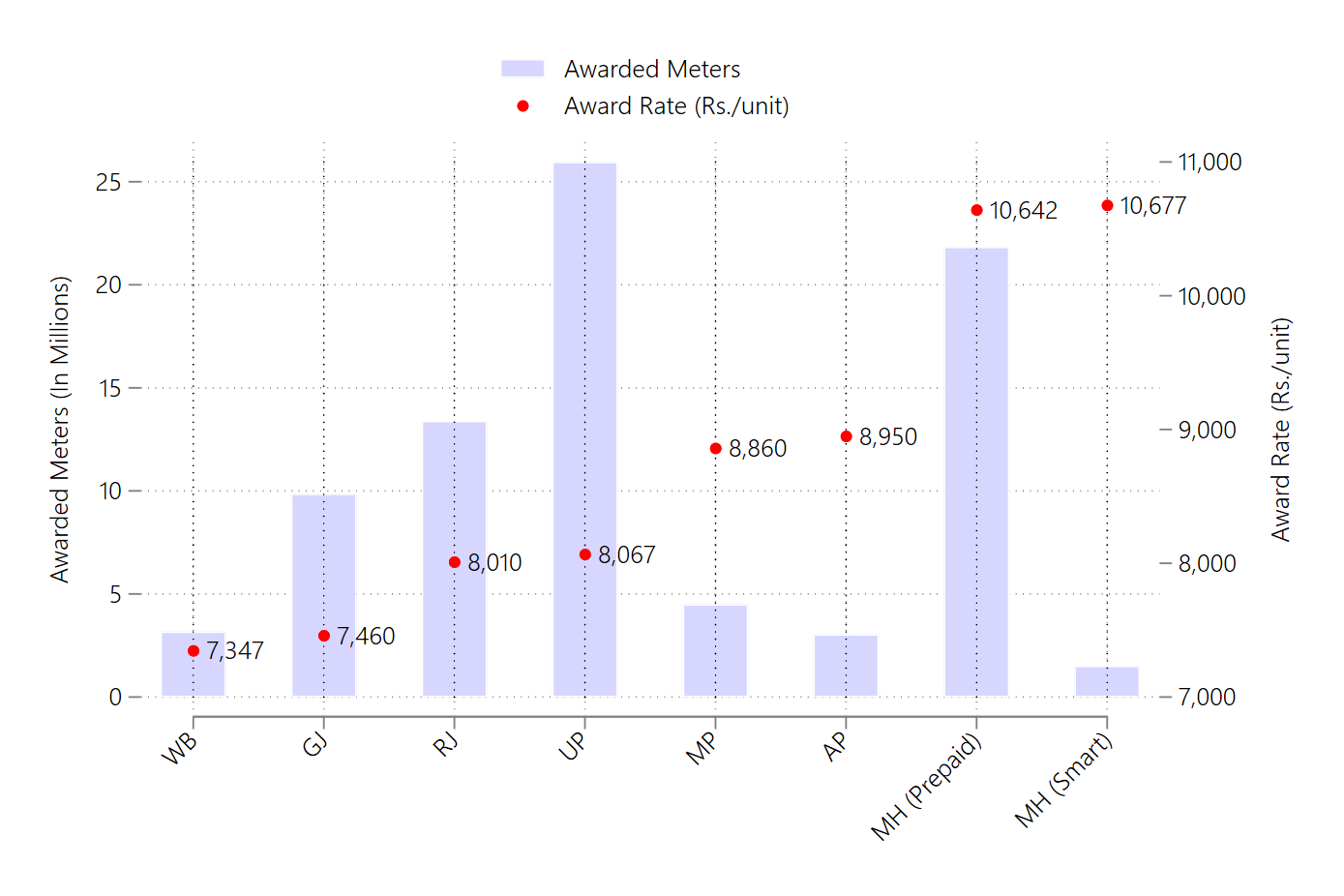

Figure 8 shows the awarded quantities and award rates for single phase smart consumer meters in the selected states. The highest award rate exceeds the lowest by 45%, with no clear correlation between award rates and quantities.

Figure 8: Select states: Award rates for single phase smart consumer meters

(Source: Prayas (Energy Group) compilation from RDSS dashboard accessed on 09.04.2025)

4. Contracts and Bidding Process

Following the standard bidding document, discoms are required to issue a Request for Proposal (RFP) to select Advanced Metering Infrastructure Service Providers (AMISPs). After pre-bid meetings and thorough evaluation of technical and financial bids, final bidders are required to compete on price, and the AMISP (either a sole firm or consortium) is selected. It is expected that the AMISP executes end-to-end metering, from planning to maintenance. After the contract period, infrastructure is to be handed over to the utility.

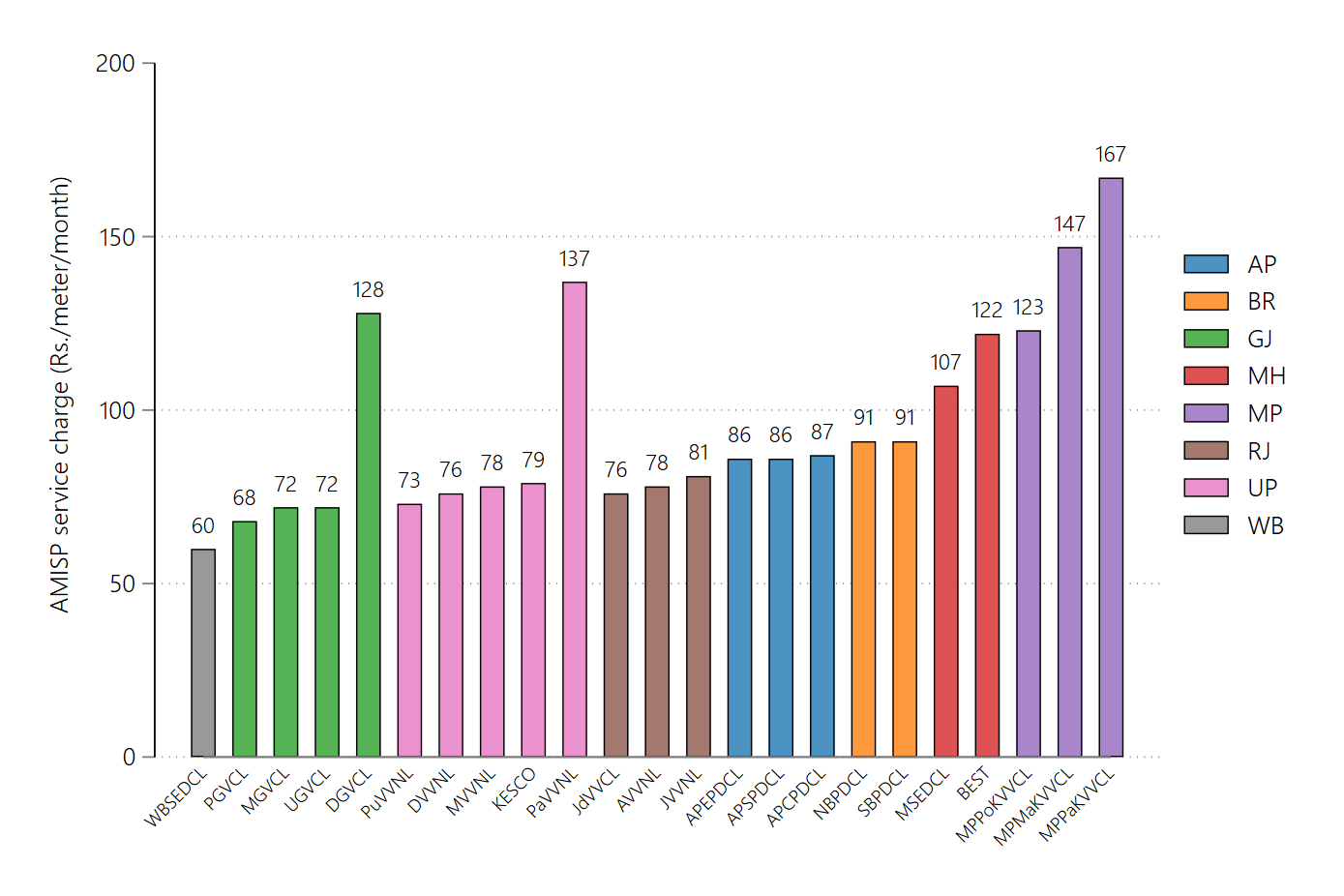

Since the smart metering projects are implemented in TOTEX mode, monthly payments to AMISPs are a function of the number of meters awarded, award rate and the operating and maintenance period of 93 months. Figure 9 shows the per meter per month (PMPM) charge to be paid by discoms across selected states.

Figure 9: AMISP Service Charge for Discoms for Selected States

(Source: Prayas (Energy Group) compilation from RDSS dashboard accessed on 09.04.2025)

The vertical axis shows the PMPM fee that a discom is required to pay upon successful installation of meters to AMI service providers. The PMPM fee is derived from discom’s respective award rates using the following formula:

PMPM= (Award Rate - subsidy/meter)/93

Here, 93 months12 is the contractual timeline of O&M of smart metering works for AMISPs. Central government also provides a per meter subsidy of 15% or Rs.900 (whichever is lower) for ‘other than special category’ states and 22.5% or Rs.1350 (whichever is lower) for ‘special category’ states.

Madhya Pradesh (MP) has the highest average AMISP fee of Rs.146 among the states, with MP Paschim Discom leading at Rs. 167, which is not only the highest among MP Discoms but across all discoms in the selected states. On the contrary, West Bengal has the lowest AMISP service charge among all states i.e. ₹60, followed by Rajasthan, which pays an average service charge of ₹79.

The AMISP service fee forms a part of the AMISP’s financial bid. In general, the bidding proposal comprises of a list of documents and forms like: Tender fee, list of consortium and subcontractors, Bidder information, Project implementation plan, experience and eligibility proof of members of consortium etc. which due to the respective confidentiality clause in RFP and AMISP contract are not available in the public domain. The process of examination, evaluation and comparison of bids is held confidential by utilities along with the information relating to the contract award. AMISP are also expected to maintain confidentiality of their bids to avoid compromising their competitive positions. Without access to this information, it is difficult to compare the PMPM cost against the plan of implementation, timeline of the project, prices quoted in various stages of bidding and other service level agreements.

5. Status of Regulations with respect to smart metering

As the country envisages large-scale deployment of smart prepaid meters, utmost scrutiny at the regulatory level is required to ensure not just successful implementation of the projects but to also allow for mid-term evaluations to prevent cost overruns and pass through to consumers. In addition to the technical aspects, building consumer awareness and confidence in these systems is also critical. An effective regulatory mechanism is required to help streamline smart prepaid meter installation and operation. We reviewed national and state level regulations related to smart metering to assess provisions included and their robustness.

At the National Level, Central Electricity Authority (Installation and Operation of Meters) regulations and the CEA Cyber security in Power Guidelines 2021 define the standards and functionality of smart/prepaid smart meters and provide guidelines on data storage, sharing and security respectively. Most states refer to the CEA Metering Regulations, however Cyber security guidelines have hardly been referred to/mentioned. The state electricity regulations have adopted different approaches; some states like Karnataka, Telangana, Madhya Pradesh, Tripura, Haryana, and Assam have created separate smart prepaid metering regulations or practice directions, while others have issued amendments to their existing supply codes.

We present a brief analysis of the review of regulations of regulations in the 10 selected states and Karnataka:

- All state regulations require that consumers have access to their usage data and prepaid balance.

- Data privacy and security are briefly mentioned, with no link to detailed cyber security guidelines.

- Most states allow automatic disconnection when credit runs out; only a few mention the time within which auto-reconnection shall happen after recharge.

- Various payment options—both online and offline—are available in all states.

- Few states address consumer awareness or training; only Telangana has allocated a specific budget for this.

- Clarity regarding purchase and meter rent is not provided in most state regulations as clauses relevant to the same were introduced for electronic meters.

- Only Uttar Pradesh and Telangana mention monitoring or evaluating smart metering progress.

- Bihar is the only state to set clear timelines for meter testing and recalibration, which is key for accurate billing.

A detailed analysis of the regulatory provisions in different states will be presented in an article to follow.

6. Conclusion

The RDSS has set ambitious goals for lowering AT&C losses and closing the ACoS-ARR gap by 2024-2025 with a dual approach of infrastructure and capacity building. With the fixed timeline of the scheme, it becomes imperative on the part of discoms to implement projects in time to reap its advantages. The nodal agencies such as PFC and REC are central to the entire process, right from project sanction to closure.

Even with these initiatives, deployment of smart meters is slow, especially in consumer metering. As of March 2025, only 5% of the consumer metering target of 250 million meters was met, and only 1.9% of meters were installed in prepaid mode. Although some states such as Bihar and Uttar Pradesh have made notable progress, several other states report delays in installation and enabling 100% communication.

The wide variation in award rates for AMI service provides across states points to the need for through evaluation of costs of the projects which can be brought in by introducing transparency in the bidding process.

The study also underlines the need for strong regulatory mechanisms at the national and state levels to facilitate the effective roll-out of smart meters. National regulations, like those issued by the Central Electricity Authority (CEA), outline guidelines for the installation, operation, and cybersecurity of meters. Still, most states have not been completely adopted, these standards, particularly in data privacy and meter testing and recalibration. Furthermore, increasing consumer awareness and capacity building of all stakeholders involved is necessary. States can adopt the Frequently Asked Questions ( FAQ’s) as provided by NSGM.

In all, although the RDSS has established momentum for smart meter rollouts, considerable work still needs to be done. These include addressing regulatory gaps, ensuring timely implementation, increasing consumer awareness, and introducing transparency in the procurement processes.

|

The authors thank Aditya Chunekar, Shantanu Dixit for their valuable inputs and review of this document.

Comments and suggestions on the series are welcome and can be addressed to |

Endnotes

[1] The Scheme subsumes the erstwhile Integrated Power Development Scheme (IPDS), the Deen Dayal Upadhyaya Gram Jyoti Yojana (DDUGJY) and the Prime Minister's Development Package (PMDP)-2015 under which around 16.5 lakh smart meters had been installed in the country. The cumulative achievement for consumer smart metering as of March 2025 under RDSS is around 1.2 crore meters (Source: NSGM dashboard).

[2] https://www.pfcindia.com/Default/ViewFile/?id=1637941535571_Final_Revamped_Scheme_Guidelines_Revised.pdf&path=Page

[3] https://recindia.nic.in/amisp

[4] https://rdss.powermin.gov.in/mis-report

[5] Descriptions about different stages of metering are not provided. As per our understanding, DPRs for total number of smart meters sanctioned are represented as sanctioned meters, number of meters awarded through contracts to AMISPs are represented by awarded meters, meters delivered to discoms are represented by delivered number of meters, meters actually installed on consumer premises are installed meters, number of meters connected to supply are charged meters, number of meters for which data is communicated are communicating meters, number of meters operating in prepaid mode are counted as prepaid meters.

[6] https://www.nsgm.gov.in/en/sm-stats-all

[7] https://cea.nic.in/wp-content/uploads/notification/2024/09/Report_on_Metering_status_of_Feeders_DTs_and_Consumers__as_on_31st_March_2024-1.pdf

[8] RDSS provides information on type of meters, where in 1 ph meters are distinctly reported as being whole current prepaid or whole current smart meters.

[9] https://sansad.in/getFile/loksabhaquestions/annex/184/AU5474_wR4CZE.pdf?source=pqals

[10] https://www.nsgm.gov.in/sites/default/files/AMISP-Contract-January-2021.pdf

[11] Details regarding discom wise costs and number of meters will be discussed in a following article.

[12] As per data published on RDSS portal for O&M period (no. of months)