Uttar Pradesh Electricity Regulatory Commission (UPERC), has issued a landmark order in July, 2019, restricting electricity distribution companies (DISCOMs) in Uttar Pradesh from signing any new long-term conventional power purchase agreements with generating companies till December 2022. The order has been in response to a petition filed by Uttar Pradesh Power Corporation Limited (UPPCL) seeking approval of its long-term power procurement plan till FY30.

In the recent past, many states, even though being at the cusp of having significant surplus capacity, have justified further capacity addition with inaccurately high demand growth estimates. Given such a predicament, it is welcoming to note that Uttar Pradesh, a state that has seen 8 million households receiving new electricity connections, and has reeled under power shortages till recently, has recognized that further capacity addition can lead to the burden of financing high fixed costs of stranded contracted capacity. UPERC in this order has mentioned that ‘” Power for All” should not be interpreted as power at all cost.’

The UPERC has observed that enough capacity has been contracted to meet projected demand till 2027 and that further capacity addition should only be considered after reviewing the demand-supply position in December 2022. Till then, the Commission has directed the DISCOMs to procure short-term power from Govt of India’s DEEP portal or through bilateral banking arrangements with other state DISCOMs to address seasonal and occasional short-falls. UPERC has also directed the DISCOMs to ensure that renewable energy procurement takes place only through competitive bidding.

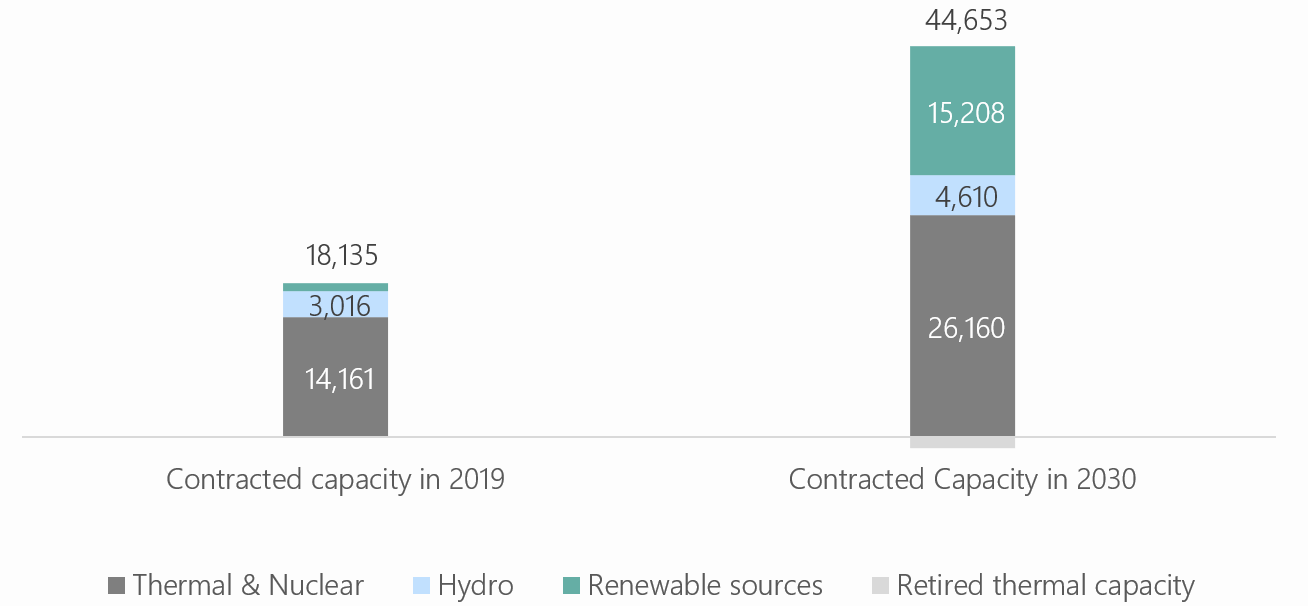

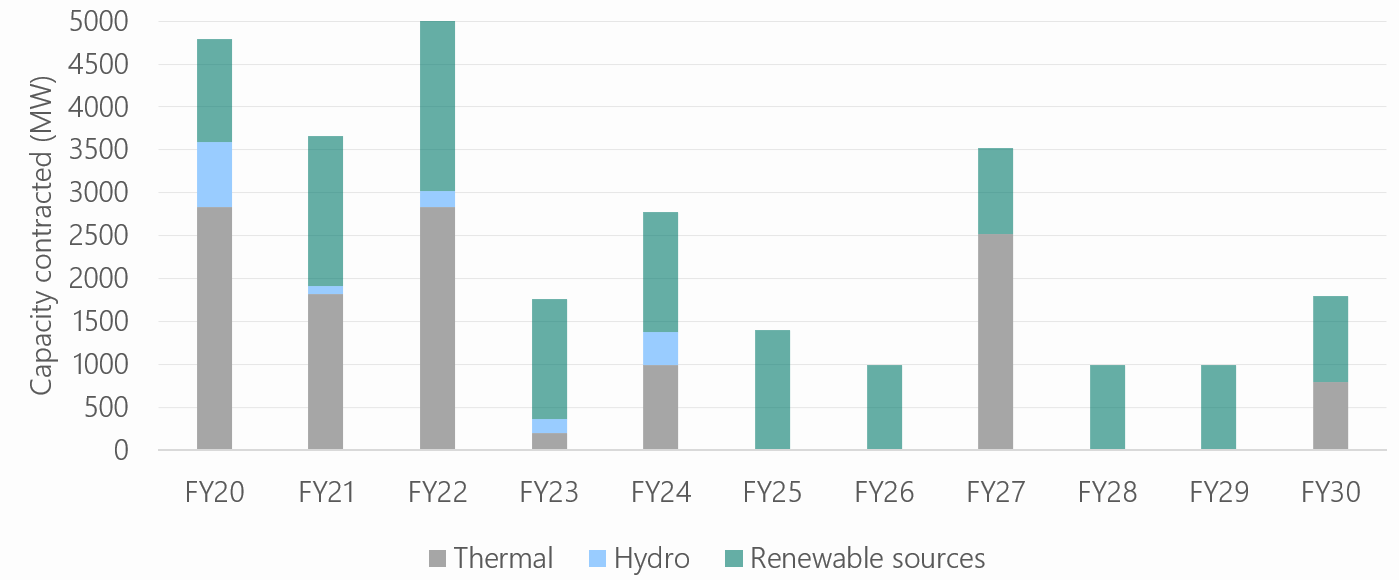

The DISCOMs’ capacity addition plan entails adding 12 GW of baseload thermal capacity, 1.5 GW of hydro, and 14 GW of renewable capacity. This is detailed in Figure 1. Along with this, Figure 2 shows the year-wise capacity addition plan from FY20 to FY30.

Figure 1: Existing contracted capacity in FY19 and capacity addition plan by UP DISCOMs FY30 (MW)

Source: Data cited in UPERC order as per petition no. 1478/2019

Figure 2: Year-wise capacity addition plan from FY20 to FY30

Source: Data cited in UPERC order as per petition no. 1478/2019

While UP’s baseload capacity is projected to increase from 14 GW in 2019 to 26 GW by 2030, thermal capacity of 1,325 MW will be retired. Along with this, renewable capacity will increase from 958 MW to 15 GW. The DISCOMs have claimed that this capacity addition will cater to demand till FY28, but there will be a shortfall in FY29-FY30. On the basis of Central Electricity Authority’s (CEA) 19th Electric Power Survey of India (EPS) report, peak demand forecast for FY30 is 40 GW for UP, whereas 33 GW of coal equivalent capacity will be available for supply. However, the exact quantum of shortage might vary greatly, given that demand has consistently been over-estimated by CEA’s EPS report in the past. In fact, as per the 19th EPS, country-level demand was over-estimated by 11% for FY17.

In response to UPPCL’s petition, UPERC has made several important observations in support of its order. The Commission has focused on demand estimation methodologies, concerns with sales migration, the need for introducing storage capacity, cost of stranded assets, growth of renewables in the generation fleet, and on stringent environmental norms. These observations have been elaborated below:

- Demand growth due to electrification

UPPCL estimated future demand on the basis of CEA’s 19th EPS, by taking into account deviation of actual demand from CEA’s projections in the past three years. The estimates assume a high consumption norm of 144 kWh/kW/month for each new connection obtained by households under SAUBHAGYA. This is the same norm used by UPERC to estimate unmetered domestic demand in the state. Even while considering demand growth rates, ranging from 8%-15% for the new connections, it has been estimated that these new connections would increase demand by only 1-3 GW, to a peak demand of 37-39 GW, in FY 2030. Along with this, the Commission has also taken cognizance of the fact that demand would also be affected by the increasing uptake of energy efficient devices.

- Effects of sales migration

DISCOMs’ demand estimation has accounted for sales migration to open access sources, up to 800 MW by 2030. But migration might be more severe, as it is likely that HT commercial and industrial consumers, whose tariffs are already around Rs. 10/kWh, might also opt for group captive consumption options.

Additionally, the UPERC has cautioned against the tapering of domestic demand growth, stating that roof top solar installations will be picking up in the coming years, given the rapidly falling prices of solar photo-voltaic modules.

- Cost of stranded assets

Capacity utilization of existing PPAs has been noted by UPERC to be sub-optimal. In FY20, fixed cost burden for stranded capacity is Rs. 4797 Crore, which is 9% of total power purchase costs in FY20. It is projected to increase to Rs. 10,750 Crore in FY24. UPERC emphasized the need to optimize DISCOMs’ existing portfolio and weed out non-performing assets and high-cost PPAs.

- Growth of renewable capacity in generation fleet

Citing India’s target of adding 175 GW of renewable capacity by 2022, and UNFCC’s Paris declaration on climate change, UPERC observed that share of renewables will increase in the next few years. Added to this, there has been a Renewable Purchase Obligation (RPO) backlog of 4260 MUs (non-solar) and 3994 MUs (solar) for the DISCOMs, which they would have to catch up on.

- Promotion of battery storage-based power plants

Significant renewable capacity addition has been planned in the coming years. Due to the short duration of peak load, and as Lithium-ion battery prices are coming down, UPERC has recommended the use of this technology in the future. These battery storage systems can be used to supplement ramp up requirements to meet peak load.

- Stringent environmental norms

MoEF&CC has issued stringent emission control norms, which will increase fixed costs of thermal plants due to added capital expenditure on pollution control installations. Cost competitiveness of thermal plants are diminishing and the UPERC has stressed on the need for cautious capacity addition to avoid high costs of stranded assets.

Since the notification of the order in July 2019, no new conventional power purchase agreements have been approved in Uttar Pradesh as of now. Also, quite a few orders have been issued by UPERC regarding tariff adoption for competitively bid power purchase agreements from renewable sources.

The UPERC has observed that UP is a low-income state and the viability of its power sector is directly related to affordability of electricity tariffs. Increased costs would further deteriorate the financial health of state DISCOMs and GENCO. Hence, capacity addition plans will be reviewed by UPERC in 2022.

UPERC’s order has been timely and other states’ electricity regulators could consider adopting a similar approach. Such a process is crucial, given the fast-changing realities of the sector. Additionally, capacity addition review processes could be conducted by UPERC every two years, coupled with energy systems modelling simulation exercises to ease planning processes and avoid stranded assets.