|

In an attempt to grapple with changing realities of the Indian power sector, many states are now attempting to levy Additional Surcharge (AS) not only on Open Access (OA), but also on Captive. This is significant as the AS currently ranges from Rs. 1 to 1.5 per unit across various states. While the E-Act gives categorical exemption of CSS (Cross-Subsidy Surcharge) for Captive, it does not do so for AS. The states are leveraging this ambiguity to bring Captive under the ambit of AS, in a bid to attain a reliable revenue stream for the financially distressed DISCOMs. While this is indeed a notable move by the states, the issue remains highly litigious and uncertain. This article focuses on recent evidence from regulatory orders, Appellate Tribunal for Electricity (APTEL) and Supreme Court (SC) judgements on the tenability of such a levy of AS. |

Background

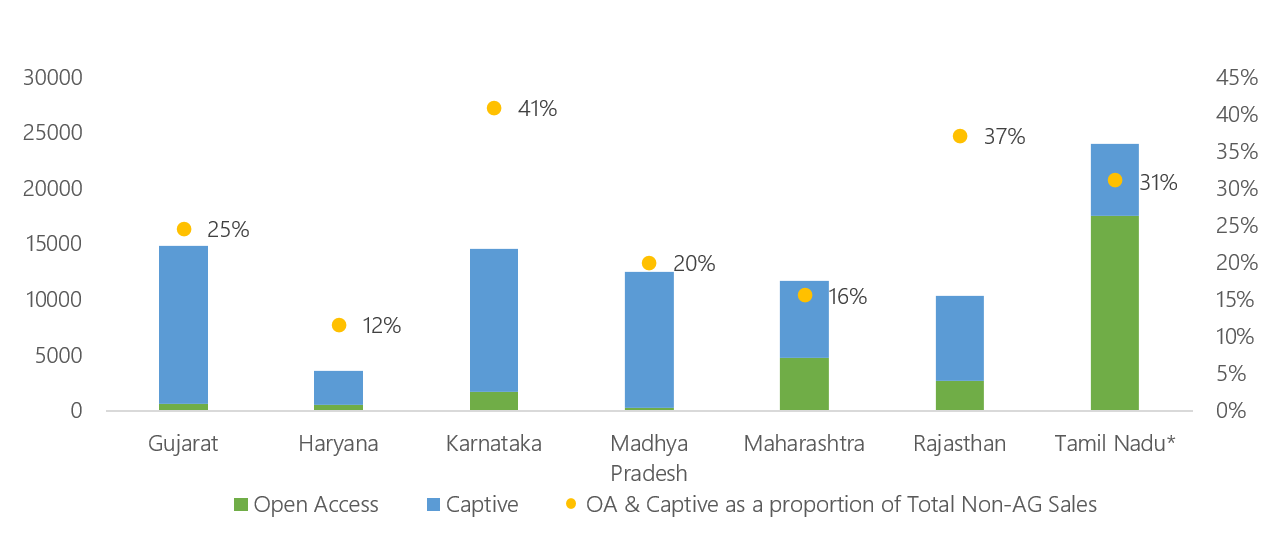

With cost competitiveness of Renewable Energy (RE) and increasing DISCOM tariffs, more and more consumers find it lucrative to migrate away from DISCOMs towards Open Access (OA) and Captive generation. As seen in Figure 1, sales migration in FY19 was as high as a fourth of DISCOMs total non-agricultural sales. Given falling RE prices, this trend will likely intensify in the near future. Such migration results in significant revenue loss for the DISCOMs, for which compensation is crucial. These accumulated losses of DISCOMs in the country currently amount up to Rs. 5 lakh crores3. Consumers who opt to reduce their dependency on the DISCOM via OA and captive routes, have to pay transmission and wheeling charges for the use of the requisite network. In most states, this migration is dominated by captive generation. While OA consumers pay Cross-Subsidy Surcharge (CSS) and Additional Surcharge (AS), captive consumers have been exempted from both those charges. Our indicative analysis shows that while per-unit savings of OA are negligible, per-unit savings of captive are considerable (~30%) vis-à-vis an HT Industrial DISCOM consumer.

Figure 1: OA and Captive Sales in 2018-19

Source: PEG compilation from various tariff orders and additional surcharge petitions. Note: The open access sales for Tamil Nadu are for the year 2019-20, as 2018-19 numbers are unavailable.

The power sector has progressively transformed in the past two decades due to techno-economic developments. Therefore, legal and policy provisions also need to keep pace. At a time when most DISCOMs have surplus capacity and new captive units are increasingly renewable energy based, with low gestation periods, high modulatory and lower investment requirement, it is prudent to reassess the exemptions afforded to Captive units by the Electricity Act, 2003. This reassessment should be such that it compensates the DISCOMs in the medium term while also providing them with signals for cost-efficiency and competitive decision making in the near future. However, such compensation frameworks should not arrive at charges that are so high that they will deter market competition and consumer choice. States are now trying to grapple with these changing developments, and a few are finding innovative avenues to compensate the DISCOMs. One of these avenues they are trying to push for is to extend the ambit of Additional Surcharge to cover Captive consumers. This article focuses on recent litigation cases that have attempted to do the same.

Experience from states

Here, we will look at recent cases in the states of Tamil Nadu, Maharashtra and Madhya Pradesh where levy of AS on captive was pushed for, either by the DISCOMs or the ERCs.

In a recent order4 Tamil Nadu Generation and Distribution Corporation Limited (TANGEDCO) pushed for the application of AS on captive consumers. They cited the Himachal Pradesh Electricity Regulatory Commission (HPERC) (Cross Subsidy Surcharge, Additional Surcharge and Phasing of Cross Subsidy) Regulations, 20065. Over 15 years ago, HPERC stipulated that AS will be payable by any migrating consumer including any consumer who puts up a captive plant for his own use. TANGEDCO further cited the Maharashtra Electricity Regulation Commission (MERC) Order No. 195 0f 2017 (elaborated below), differentiating between original versus converted captive consumers. In TANGEDCO’s case, the ERC outrightly declined to consider the possibility of application of AS on captive consumers.

In Maharashtra’s case, the ERC took a different position. MSEDCL, in MERC Order No. 195 of 2017, underlined that most distribution utilities, including MSEDCL, are power surplus at present. Further, it differentiated between original captive users (who were never the consumers of DISCOM and whose demand had not been included in the power procurement of the DISCOMs) and converted captive users (who were prior consumers the DISCOM but then switched to captive, particularly, Group Captive Power Plant (GCPP) arrangement). The Commission emphasised that group captive consumers are mostly those consumers who procure preferential shares at nominal cost to collectively meet the 26% equity criteria as per the Electricity Rules, 2005. However, these consumers frequently switch between procuring power form the DISCOM and the GCPP, similar to OA consumers, whilst availing the benefits of exemption from OA charges (CSS and AS), without investing in actual equity. Therefore, the GCPP model adds to the challenge of power procurement by DISCOMs and contributes to the build-up of stranded capacity. Thus, on account of such stranded capacity, MERC held that AS is applicable on such Group captive consumers, in addition to OA consumers. This was then challenged at APTEL6 by two existing group captive generators (JSW and Sai Wardha) in 2018. APTEL held that “there cannot be any distinction between an individual captive consumer and converted captive consumers” in March, 2019. MSEDCL challenged APTEL’s order in the Supreme Court, which has stayed the verdict till final adjudication (C.A. No. 005074–005075/2019).

In another recent order of Madhya Pradesh ERC7 on Petition No. 12 of 2020, dated 14th May 2021, the Commission dealt with another such case of levy of AS on an on-site captive consumer. The DISCOM, M.P Paschim Kshetra Vidyut Vitaran Co. Ltd (MPPKVVCL), relied on an 2007 order of MPERC8, wherein the ERC held that captive users are liable to AS, subject to MPPKVVCL demonstrating stranded fixed costs as a result of their Universal Supply Obligation. In the recent order, the main contentions were on the subjects of – definition of ‘supply’ of electricity under the E-Act, applicability of AS without the levy of wheeling charges, demonstration of stranded capacity by DISCOM and the lack of explicit additional surcharge exemptions provided within the E-Act9. While MPERC proceeded to levy AS on the captive consumer, this matter also now remains sub-judice, as the consumer filed an appeal at APTEL10.

Meanwhile, in an approach similar to Himachal Pradesh ERC, the Madhya Pradesh ERC pushed for AS on all Captive consumers in its Draft Madhya Pradesh Electricity Regulatory Commission (Cogeneration and Generation of Electricity from Renewable Sources of Energy) Regulations, 2021 (Revision-II), in the following provision:

11.2(d) The RE captive consumer of Renewable Energy based Captive Generating Plant shall not be liable to pay cross subsidy surcharge, but it shall be liable to pay wheeling charges, additional surcharge, as applicable under Section 42 of the Electricity Act, 2003 and shall also be liable to bear the losses for carrying the generated electricity from its plant to the destination for its own use or for the use of its captive user as defined by the Act or the rules made thereunder.

DISCOMs and SERCs are certainly pushing hard for AS on Captive, as is witnessed above. More recently, we have also had cases of the state government attempting to push for the same. For example, the government of Gujarat came out with their Draft Solar Power Policy of 2021, where they specifically defined ‘captive use’ as use of electricity for self-consumption by a consumer having 100% ownership of the Solar Power Plant. This effectively was an effort to remove group captive consumers from the ambit of ‘captive use’, such that open access charges such as AS and CSS could be leviable on such consumers. This was ultimately not accommodated by the Gujarat ERC in the final regulations.

Therefore, charging Additional Surcharge on captive consumers is a lever that is being innovatively pushed for by different stakeholders – DISCOMs, State governments and Regulatory Commissions, across different states. On the other hand, with the way AS is defined11 in the E-Act, it may not be a viable lever. Going forward, with muted capacity addition, move towards more renewables (with must-run status), increasing energy demand and less instances of a power-surplus or backing down of thermal capacity; the magnitude of additional surcharge (if levied) may also be negligible.

Way forward

From the orders highlighted above, it is evident that the litigation hinges very much on the way the E-Act is worded. Further, the recent Draft Green Open Access Rules12 released by MoP specify that there shall be no AS on Green Open Access going forward. This creates more uncertainty, given that state agencies are keen on utilising AS as a lever for compensating DISCOMs, imposing it not just on OA, but also on Captive. The rules also encroach upon states’ jurisdiction, conflicting with the powers vested to state regulators under Section 42 and Section 86 of the E-Act. It would be unfortunate if such fundamental decisions related to sector transition are taken through litigation rather than deliberative policy processes. To provide clarity, it remains critical that the E-Act is amended to effectively address the prevailing concerns of the sector.

To address the issue of DISCOM compensation, an alternative mandate could be introduced, ideally via an E-Act amendment, replacing both CSS and AS with a single surcharge, at say Rs. 2.5 per unit for the next five to seven years. The surcharge should be later phased out, taking into context the state realities. This proposed surcharge is already comparable to the sum of CSS and AS presently being levied in many states. This surcharge should be fixed (in Rs/unit) in nature to provide clarity and certainty to investors, and thus, should be delinked from cross-subsidy as well as the amount of power surplus within the state. The fixed nature of the surcharge would help the regulators avoid complicated methodologies for calculation of the surcharge. The surcharge, though fixed in nominal terms, would reduce over time in real terms. This reduction in compensation, with inflation would provide signals to improve efficiency and incentivise DISCOMs to shift to a viable revenue model in five to seven ears. Moreover, it will also provide certainty to investors.

Till the Act is amended to allow for a fixed surcharge, the states can leverage another lever – Electricity Duty (ED), to recover revenue for DISCOMs from captive power plants. Many states such as Maharashtra, Madhya Pradesh, Karnataka, and Chhattisgarh have revised their duties within the past five years. The duty on captive units in these states ranges from Rs. 1 to 1.5 per unit. While these duties vary significantly across the states, it is clear that some states are indeed using this lever actively to compensate the DISCOMs.

Such a levy could also be charged after two years from the date of announcement, giving necessary time for adaption for captive consumers who have migrated. The power sector is transforming rapidly in India, thus, it is imperative that levy of any surcharge on captive consumers does not just depend on the present-day scenario, but is progressive in nature, taking into account the forthcoming developments in the sector. In this case, care should be taken that there is no retrospective applicability of open access charges, where explicit concessions have previously been given to certain projects.

Moreover, revenue from this surcharge should ensure sufficient revenue recovery for DISCOMs, but the basis of the same should be justifiable. Currently, the nature of AS is such that it provides no disincentive to DISCOMs for inefficient capacity addition. Therefore, the surcharge must also nudge DISCOMs to become more efficient, giving signals for effective power procurement.

Endnotes

1. Authors thanks their colleagues, Ashwin Gambhir and Maria Chirayil, for their valuable comments on the drafts.

2. This article is part of an ongoing series called Power Perspectives which provides brief commentaries and analyses of important developments in the Indian power sector, in various states and at the national level. Comments and suggestions on the series are welcome, and can be addressed to

3. Report on Performance of Power Utilities 2019-20, Power Finance Corporation

6. https://aptel.gov.in/old_website/judgements/Judg2019/A.No.%20311%20&%20315%20of%202018_27.03.19.pdf

9. Sub-Section 42(2) of the E-Act provides a clear exemption from CSS for captive; however no such categorical exemption is given for ‘Additional Surcharge’ under Section 42(4).

11. Section 42 (4) of the E-Act “Where the State Commission permits a consumer or class of consumers to receive supply of electricity from a person other than the distribution licensee of his area of supply, such consumer shall be liable to pay an additional surcharge on the charges of wheeling, as may be specified by the State Commission, to meet the fixed cost of such distribution licensee arising out of his obligation to supply.” A person other than the distribution licensee could include all migrating consumers, both open access and captive.