|

Electricity Duty (ED) is a charge that falls under the exclusive ambit of state legislation and thus, is a lever that can be actively utilised to raise revenue. At present, many states do adjust their subsidy payments against ED revenue collected from DISCOM consumers. This article specifically focuses on whether a higher ED revenue collected from captive consumers can be used as an explicit instrument to finance revenue losses for DISCOMs. While sales migration is dominated by captive consumption in most states, captive consumers remain exempt from paying charges such as Additional Surcharge and Cross Subsidy Surcharge. Thus, DISCOMs lose out on a potential source of revenue compensation. This article cites a few states such as Gujarat and Maharashtra which are charging a relatively higher rate of ED, and makes a case for ED to be used as a more effective instrument by states. It focuses on how the nature of ED rate varies across states and pitches an ED rate that could be utilised efficiently to adequately compensate the DISCOMs. |

Taxes and duties on electricity amount up to Rs. 40,917 crores3 which is comparable to 6% of the total revenue billed of DISCOMs4. While all states allot a certain portion of their budget for the subsidy, in states like Maharashtra, Rajasthan, Uttar Pradesh and Punjab, state governments also adjust their subsidy payments against the electricity tax or ED revenue from DISCOM consumers5. Here, we explore whether ED collected from captive consumers can be used as an explicit instrument to finance revenue losses for DISCOMs. In particular, we explore whether a higher and differential rate of ED on captive can be used as a significant source of revenue recovery, especially given that captive is exempt from sales migration surcharges such as cross subsidy surcharge (CSS) and additional surcharge (AS). This article explores the reason why ED could be a more effective instrument of revenue recovery, how the nature of ED charged varies across states has changed, and what range of ED should the states charge to recover considerable revenue to compensate the financially stressed DISCOMs.

Existing compensating mechanisms are insufficient

Given falling RE prices and other techno-economic nudges, many commercial and industrial (C&I) consumers are migrating away from the DISCOMs towards open access (OA) and captive routes (known as sales migration), which aggravates the existing financial vulnerability of DISCOMs. Further, present charges and tariffs fail to be effective revenue compensating mechanisms for the DISCOMs as they are insufficient. Many DISCOMs have also been charging industrial consumers at cost of supply in a bid to retain C&I consumers, losing out on any potential cross-subsidy revenue from them. But with rising cost of supply for DISCOMs and therefore, rising savings for migrating consumers, tweaking tariffs would not be enough to retain these consumers. Efforts towards adequate cost compensation for DISCOMs, at least for the medium term are necessary and current charges do not seem to be effective in this respect.

While OA consumers pay charges such as Cross-Subsidy Surcharge (CSS) and Additional Surcharge (AS), captive consumers do not. Captive consumers are exempt from paying CSS under Section 42 (2) of the Electricity Act, 2003. A few states pushed for levy of Additional Surcharge on Captive6, a move that proved to be quite litigious. Ultimately, the Supreme Court, in a recent order7, ruled that captive consumers are not liable to pay the AS under Section 42 (4) of the Act, 2003.

Without AS and CSS on captive, by design, DISCOMs receive limited compensation from migrating captive consumers. This is also particularly the case as only a few states have levied charges incidental on captive units such as parallel operation charges. Where they are being levied, they are not significant to compensate DISCOMs adequately.

As compared to the DISCOM tariffs, industrial consumers find power from captive consumers approximately 30% cheaper8 on a per-unit basis. In contrast, due to levy of AS and CSS, the savings from open access contracts have reduced over the years and is negligible in some states.

Going forward, with changes in sector realities, the revenue from AS and CSS are likely to decrease even further. Most sales migration takes place through the captive route which is exempt from most charges. PEG’s indicative analysis shows that in most states, sales migration is increasingly getting dominated by captive. As of 2018-19, the average share of captive consumption stood at 70% of the total sales migration across states. In 2019-20, captive consumption stood at about 20 BUs, and grew at 14% since 2018-19. Going forward, with rising cost of supply and availability of competitive options of supply, it is likely that cross-subsidy recovery would reduce.

Even if open access based sales migration picks up due to changes in market structure, rules and regulations, the revenue from CSS and AS may not be significant. CSS is linked to cross subsidy revenue from the migrating consumer. In a bid to retain existing C&I consumers, many states are already charging these consumers either at par, or lower than Average Cost of Supply (ACOS)9. Thus, there is limited cross-subsidy revenue being recovered which limits the revenue recovery from CSS. It also does not necessarily result in rise in revenue from tariffs as many of these consumers find captive power more competitive even as compared to DISCOMs cost of supply.

Additional surcharge is linked to unutilised or backed down contracted thermal capacity due to open access sales. In the upcoming years, with more RE integration and the commitment to not adding additional new coal-based capacity, existing thermal capacity will be utilised at higher PLFs to satisfy future demand. Thus, in an increasingly likely scenario where there is no backing down of thermal capacity, an additional surcharge can no longer be justified.

Therefore, the issue of how best to adequately compensate the DISCOMs remains an urgent policy priority. Multiple, interconnected approaches are needed to address this issue including efforts to reduce the cost of supply of DISCOMs, rationalising tariffs and cross subsidy design and reinventing sales migration charges. Many of these efforts will require time for implementation and some might even require legislative changes to be introduced. In the interim, mechanisms are needed to ensure cost compensation for DISCOMs steadily losing consumers shifting to competitive captive supply. This compensation should be limited, both in its magnitude and duration of application but should also be adequate to meet costs incurred by the DISCOMs.

Electricity Duty as one such effective lever

ED differs from other migrating charges (such as AS and CSS) as it has its genesis through state legislation and the respective state duty acts which pre-date E-Act (2003). Thus, the levy, design and the principle for ED can be revised in a straightforward manner by the state government, by amending their respective ED Acts.

Yet, there is variation among how effectively the states are utilising this lever. While many have amended their ED Acts and revised rates in the past five years, there are states that have last amended/revised their ED on or before the enactment of Electricity Amendment, 2003. There is also variation in the absolute charge of ED among DISCOM, Open access and Captive consumers, as can be seen in Table 1.

Table 1: Electricity Duty rates across states

| State | Year of latest ED revision | DISCOM HT Industrial | Open Access | Captive |

| Andhra Pradesh | 2022 | 1 Rs/kWh | 1 Rs/kWh | 1 Rs/kWh |

| Gujarat | 2020 | 15% | 20% | 20% |

| Maharashtra | 2016 | Not more than 15% | Not more than 15% | Not more than 150 p/kWh - 120 p/kWh |

| Madhya Pradesh | 2016 | 15% | 15% | 15% |

| Rajasthan | 2019 | 6 p/kWh | 6 p/kWh | 60 p/kWh |

| Karnataka | 2018 | 9% | 9% | 20 p/kWh |

| Tamil Nadu | 2003 | Not less than 5% and not more than 10% | Not less than 5% and not more than 10% | 10 p/kWh |

| Haryana | 1995 | 10 p/kWh | 10 p/kWh | 10 p/kWh |

Source: Electricity Duty acts and amendments of respective states, commercial circulars of DISCOMs. (ED in terms of % refers to % of total billed amount)

There are states that treat OA and Captive differently in terms of the rate of ED charged (such as Maharashtra and Rajasthan). This difference in treatment is needed in order to move towards parity in charges for the two routes in the near future. While it must be ensured that these charges adequately compensate the DISCOMs, yet at the same time in the spirit of robust market development, the charges alone should not dissuade the adoption of one option. The cumulative sum of per-unit charges paid by an OA consumer (AS+CSS+ED) should be at par with the per-unit charges paid by a Captive consumer (say, ED + Parallel Operation Charges (POC)). Any levy of duty should pay heed to harmonisation of charges to maintain competitiveness and to ensure that different business models grow on their own economic proposition. Thus, ED can also be a tool to achieve this parity in the medium-term.

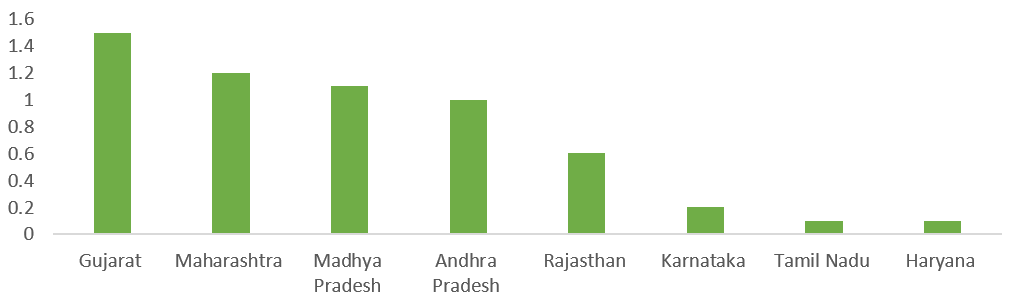

Figure 1: Currently applicable Electricity Duty rates for a captive consumer (Rs/unit) across states

Source: Electricity Duty acts and amendments of respective states, commercial circulars of DISCOMs.

Note: For EDs that are on a percentage basis, the per unit ED rate is calculated as a percentage of the ABR of the DISCOM Industrial consumer.

Figure 1 depicts the variation in electricity duties charged across eight states. States such as Gujarat, Maharashtra and Madhya Pradesh are already charging a duty within the range of Rs. 1.1 – 1.5 per unit on their respective Captive consumers, and earning a considerable amount of revenue that can be utilized to compensate the DISCOMs. We can see in Figure 2 that Gujarat10, for example, charges an ED of ~ Rs. 1.5 per unit, and earns close to Rs. 3390 crores in revenue, which is comparable to 7% of its Annual Revenue Requirement (ARR) and 56% of its tariff subsidy. At the other end of spectrum is Tamil Nadu, with a significant quantum of captive sales (~6500 MUs), yet charges only a negligible rate of ED at Rs. 0.1 per unit, and therefore, earns merely Rs. 64 crores in revenue. This is comparable to just 0.1% of its ARR and 0.8% of its tariff subsidy. Other states such as Haryana and Karnataka similarly charge a fairly insignificant rate of duty, and potentially lose out on a substantial source of revenue.

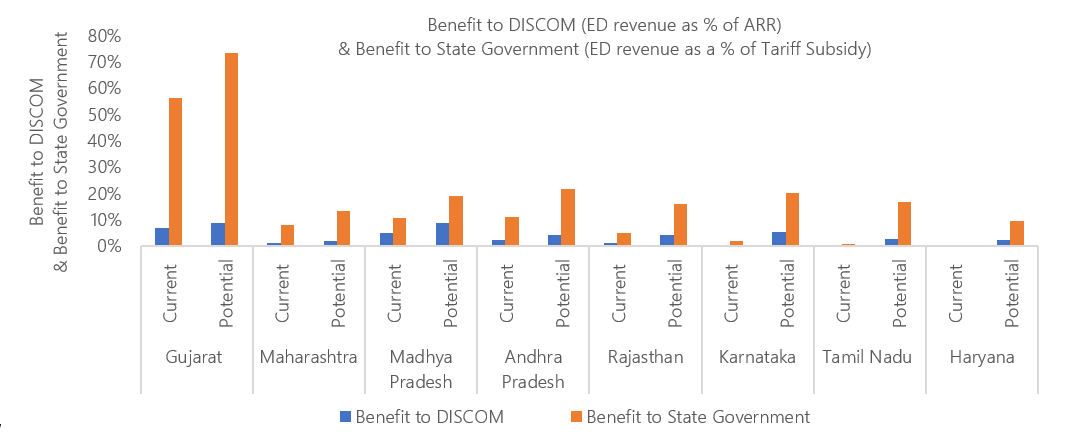

Figure 2: Benefit to stakeholders by potentially increasing ED to Rs. 2 per unit

Source: Based on PEG’s calculations. ARR, tariff revenue and tariff subsidy numbers are as per reported in the latest tariff orders, tariff petitions, Power Finance Corporation’s ‘Report on Performance of Power Utilities’.

We propose that states should charge an ED at the rate of Rs. 2 per unit on Captive. While this proposal may seem radical at first glance, this is still lower than the sum of AS and CSS charges per unit that OA consumers presently pay on average (~ Rs. 2.5 per unit on average). In Figure 2, we compare the present scenario (ED revenue at the current rate) with the potential scenario (ED revenue at Rs. 2 per unit) across states. The augmentation in revenue is plotted from two different perspectives – as a proportion of DISCOM expenses (benefit to the DISCOM, in terms of potential compensation) and as a proportion of Government Revenue Subisdy (benefit to the state government, in terms of a reduced subsidy burden). There is a considerable increase in revenue across all states; and not surprisingly, we see the steepest rise in states that presently charge the lowest rates of ED – Tamil Nadu, Karnataka and Rajasthan. These states should follow the footsteps of Andhra Pradesh11, which is the latest state to revise its ED rate. From as low as 6 paise/unit, Andhra Pradesh substantially revised it upwards to 1 Rs/unit (in April 2022) for all industrial and commercial consumers. With such a revision, if the captive sales are assumed to be same as 2018-19, then the additional revenue which could be accrued would be to the tune of ~ 800 crores.

Way Forward

While ED is a relatively easier lever for states to amend, revise and utilise,it needs to be ackowledged that state governments have to tackle various policy priorities at any given point of time.

Given that energy is one of the most significant inputs in the manufacturing process, and that state governments are hardpressed to incentivise industrialisation within their own state; many give the incentive via exemptions from paying ED to new as well as existing industries. For example, Jharkhand granted retrospective 100% exemption12 in ED to new and existing units setting up captive plants for five years from the date of commissioning of the power plant. In cases such as these, applicability of ED can be considered, but only at the end of the sunset period of the policy. Rajasthan’s DISCOM, for example, attempted to levy an ED on Solar Captive plants. This was an attempt to retrospectively charge an ED on these plants, as these plants were granted an electricity duty exemption as per Rajasthan’s Solar policy released in 2019. This was challenged by Rajasthan Solar Association in the High Court, which issued a stay order on the demand of DISCOMs for payment of ED from these plants, until the next hearing. The matter now remains sub-judice13. Thus, there should be no retrospective applicability of ED in cases such as these.

Another concern that remains is that it is not necessary that the state governments use the revenue from charging a higher ED to compensate the DISCOMs for their financial woes. The revenue from ED could potentially be directed towards other power sector issues or other sector issues altogether.

An alternative solution is a single surcharge, at about Rs. 2.5 per unit, to be levied on migrating consumers, which can be gradually phased out. This should replace AS and CSS, which presently tend to get mired in regulatory and litigious processes. This requires a clear policy reform, ideally via an E-Act amendment.

Deteriorating DISCOM finances and the sustainability of the power sector are matters of national interest, and states cannot be expected to grapple with these individually. The issue of sufficiently compensating DISCOMs needs to be deliberated upon in a consultative process, with both the centre and states involved.

Endnotes

1. Authors thanks their colleagues, Maria Chirayil and Shantanu Dixit, for their valuable comments on the drafts.

2. This article is part of an ongoing series called Power Perspectives which provides brief commentaries and analyses of important developments in the Indian power sector, in various states and at the national level. Comments and suggestions on the series are welcome, and can be addressed to

3. Reserve Bank of India, (2021), “State Finances, A Study of Budgets of 2021-22” https://rbi.org.in/Scripts/AnnualPublications.aspx?head=State%20Finances%20:%20A%20Study%20of%20Budgets

4. Power Finance Corporation (2021), “Report on Performance of Power Utilities 2019-20” https://www.pfcindia.com/DocumentRepository/ckfinder/files/Operations/Performance_Reports_of_State_Power_Utilities/Report_on_Performance_of_Power_Utilities_201920_1.pdf

5. Prayas (Energy Group), (2018), “Understanding the Electricity, Water, Agriculture Linkages – Volume 2: Electricity Supply Challenges” https://www.prayaspune.org/peg/publications/item/download/929_36803120a3dcb8cf82d02acd90c3d3fa.html

6. Prayas (Energy Group), (2021), “Additional Surcharge on Captive: Bold move, but still is anybody’s game” https://www.prayaspune.org/peg/resources/power-perspective-portal/306-additional-surcharge-on-captive-bold-move-but-still-is-anybody-s-game.html

7. https://main.sci.gov.in/supremecourt/2019/19753/19753_2019_43_1503_32012_Judgement_10-Dec-2021.pdf

8. The per-unit savings of OA and captive are estimated in comparison with DISCOM HT industrial category bill (for a 1 MW consumer, connected to 33kV). For this, applicable energy charge, wheeling charge, ED, tax of sale of electricity, transmission charge, and losses have been considered It is assumed at that OA & captive consumers can procure power at 3.50 Rs/unit.. This estimation was conducted for eight large states accounting for 60% of electricity consumed in India for 2018-19. On average, the savings are 8% for OA consumers and 33% for Captive consumers.

9. PEG’s indicative analysis from PFC reports show that many states, including Andhra Pradesh, Bihar, Jharkhand, Odisha, Punjab, Rajasthan, Tamil Nadu, Gujarat, are already charging Industrial tariffs below ACOS, as of 2019-20.

10. Note that relative to other states in Figure 2, Gujarat’s share of tariff subsidy as a % of ARR is quite low.

11. As per the Andhra Pradesh Gazette notification published on 8th April 2022 (G.O.Ms.No 7), the state revised its ED rate from 0.06 Rs/Wh to 1 Rs/kWh for all commercial and industrial consumers.

12. Jharkhand Gazette No. 497, Notification No. 2252, published on 30th September 2021, accessible at https://jharkhandgazette.nic.in/Notification.aspx

13.Rajasthan Solar Association vs Energy Department (Govt. of Rajasthan), Rajasthan High Court (Jodhpur), Civil Writ Petition No. 12531/2021.