|

States have been promoting investments in the solar sector, given its low price of generation and ongoing technological improvements. In this context, it is crucial to study the solar-related provisions in the recent renewable energy policies in detail. Gujarat and Maharashtra have been the pioneers in renewable energy (RE) deployment in India and therefore, their RE policies tend to become a benchmark for the policy-makers in other states. The focus of these states, however, is divergent. While Gujarat primarily aims to manage the solar-based sales migration (induced by falling prices); Maharashtra emphasizes on tracking progress to achieve their unaltered capacity addition targets. Contrary to their stated policy objectives of RE development, closer examination shows that many of the provisions create unnecessary ambiguities and barriers. Given the pricing and technology developments, upcoming state policies need to be ambitious and forward-looking, while balancing the interests of all stakeholders. |

1. Introduction

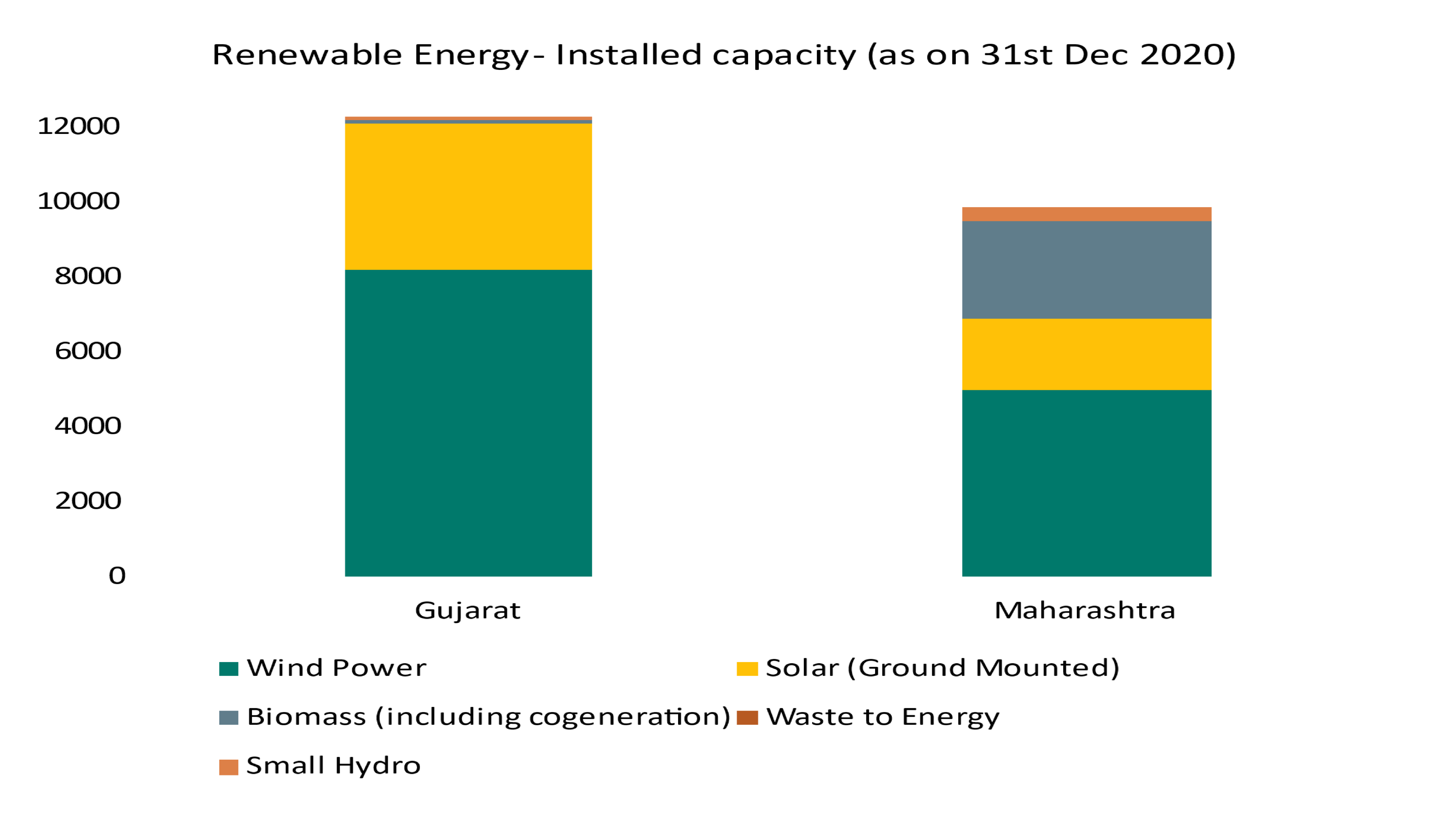

Gujarat and Maharashtra, two of the leading states in terms of renewable energy deployment, recently unveiled their solar and renewable energy (RE) policies respectively, for the next 4-5 year period. Both states, with significant solar and wind potential as well as installed capacity3 (shown in Figure 1), are known to be pioneers in innovative approaches and incentives for large scale promotion of RE, especially solar and wind in the past decade. Thus, there is an expectation that the policies would be ambitious in their targets and clear in their efforts to promote renewable energy investments by the electricity distribution companies (DISCOMs), consumers and investors in the state. However, both policies with divergent thrust areas and priorities do not match up to this expectation. On the contrary, it is likely that many provisions may be challenging to implement and thus will not adequately incentivise RE deployment . We analyse the major provisions of the two state policies and provide a commentary on the same. The aim of the commentary is not to compare the two policies, as both states also have distinct realities. Rather, it is to contextualise and underscore major RE policy provisions so that states can learn from one another.

Figure 1: Installed RE capacity in Gujarat and Maharashtra

Source:PEG compilation from data published by MNRE

The Gujarat policy and management of solar based sales migration

The Gujarat Solar Power Policy 2021 was released by the state government on 29th December, 2020. This policy is operative for the following five years up to 31st December 2025. In the three months following the release of this policy, much of the discourse has hailed it as a game-changer, most notably for removing the capacity ceiling for setting up a solar project. While the policy deserves due credit for some of the provisions, there are also fundamental issues with certain proposals. Therefore, it is imperative that loopholes are questioned and ambiguities are addressed, most of which tend to tilt the policy in favour of the DISCOM.

Capacity restrictions and definition of ‘captive’

The highlight of the policy is indeed that no capacity restrictions are applicable for residential, captive and third-party projects4. Removal of restrictions would provide more flexibility in capacity sizing and widen the opportunity of investing in behind-the-meter storage options. Earlier, the cap of 50% of contracted demand/sanctioned load applied to all consumers other than MSME (Manufacturing) Enterprises. This is a welcome initiative and can perhaps encourage other states in removing their capacity ceilings for solar power projects. Although, for unclear reasons, the policy retains its capacity ceiling up to sanctioned load specifically for projects under REC (Renewable Energy Certificate) mechanism.

One of the major ambiguities in the policy is the way a ‘captive plant’ has been defined. As per the Electricity Rules 2005 (under the Electricity Act 2003), not less than twenty-six percent of the ownership is to be held and not less than fifty one percent of the aggregate electricity generated is to be consumed for captive use (determined on an annual basis), to qualify as a captive plant. Yet, the new policy emphasizes that only a consumer having 100% ownership of SPS (Solar Power System) shall be considered as ‘captive’ use. As a result, anyone having less than a 100% ownership of SPS may become liable to pay cross-subsidy surcharge (CSS) and additional surcharge (AS). This is an unnecessarily restrictive step which will lead to uncertainty among consumers, generators and investors. Policies are not binding, rules are. This definition does not have legal tenability, but it remains to be seen whether the regulator or the DISCOMs adopt the same definition remains to be seen. If they do, the sector will potentially get mired in increased litigation.

Concerns with energy banking provisions

Banking is essentially a service provided by DISCOMs which allow renewable energy based open access (OA) and captive users to inject excess energy at a particular time, and draw it at a later time for a pre-specified charge In the absence of suitable and accessible market instruments, this service becomes integral to the development of RE, which is variable in nature. Nevertheless, this service is a cost to the DISCOM and should be priced such that the DISCOM is not disproportionately burdened. Earlier, Gujarat allowed the banking of energy within one billing cycle of the consumer. The new policy has retained this monthly banking facility only to LT consumers5, who are not eligible for open access. HT/EHV consumers can only avail it on a daily basis, between 07.00 hours to 18.00 hours. On the other hand, the policy allows for the surplus energy, not used by the consumer after set off, to be compensated6 by the DISCOMs at reasonable rates. While these provisions are enough to provide certainty to the DISCOMs and limit their burden of providing the banking service; the new policy goes an extra mile to couple it with prohibitive banking charges. It sets a banking charge of ₹ 1.50 per unit for demand-based consumers and ₹ 1.10 per unit on solar energy consumed, rather than solar energy banked. Therefore, irrespective of whether the consumer avails of the banking service, there is a charge levied on all units consumed. This is an implicit consumption-based tax, a stringent measure that will likely hamper the progress of solar open access and captive projects. Thus, it is a peculiar carrot and stick approach adopted by this policy where the penalties or restrictions outweigh the incentives and are inconsistent with the overall objective of promoting solar. A better approach would have been to value banking service based on costs and risks incurred by the DISCOM. This approach is discussed here.

While we commend the policy for having no explicit concessions are given to open access charges (wheeling, transmission, CSS and AS), it must be noted that parallel operation charges (POC) are not applied to captive SPS. This is an implicit concession and will essentially have to be cross-subsidised by other users of the grid.

It is paramount that going forward, Gujarat moves away from this rather conflicting outlook on renewable energy, and instead adopts a nuanced and forward-looking approach, giving due consideration to all stakeholders. The policy could have urged the regulator to adopt a framework for compensating DISCOMs for costs incurred due to open access, captive and grid interactive systems while ensuring provisions to foster retail competition and consumer choice. Rather than clearly promoting the development of the RE sector (by setting clear capacity addition targets or by having provisions to encourage new technologies such as storage) in a balanced manner, the new policy has encroached upon regulatory subject matters. The provisions such as the captive definition and the nature of banking charges, will only lead to increasing litigation processes, reduce ease of doing business, increase transaction cost of consumers opting for retail competitive and hurt investors’ confidence.

The Maharashtra policy, muted ambition and potential implementation gaps

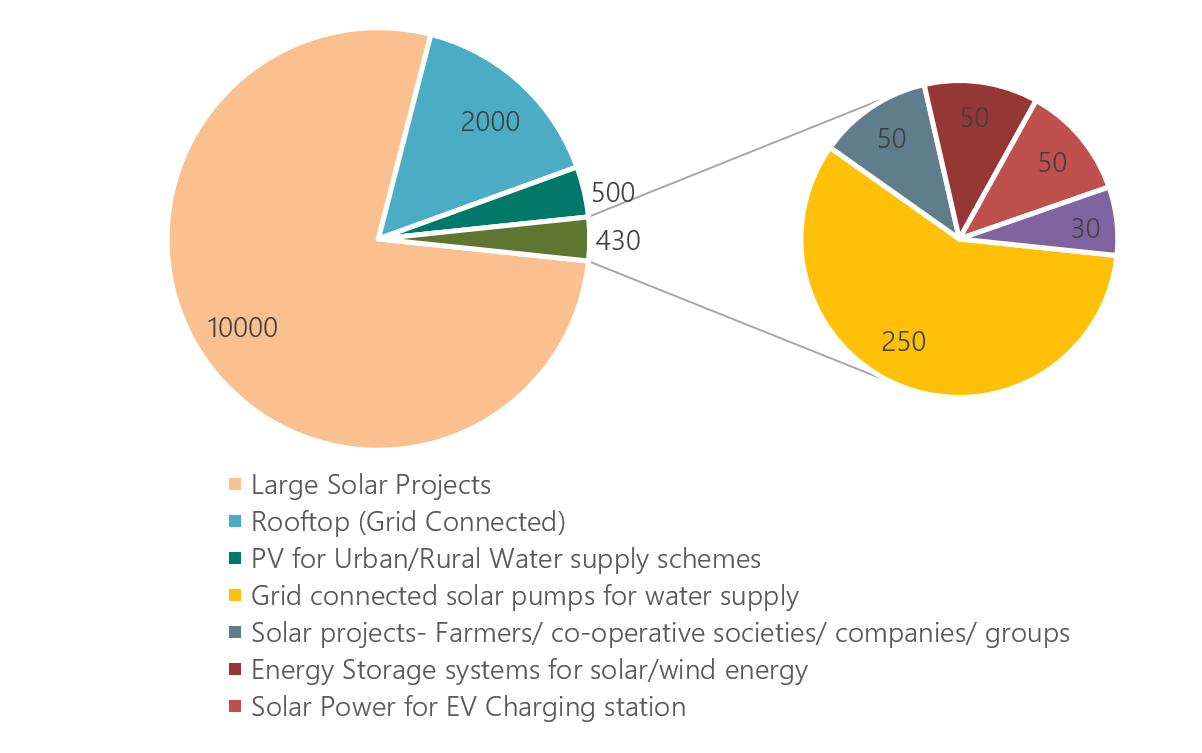

Maharashtra Integrated Non-Conventional Energy Generation Policy 2020 was issued on 31st December 2020 and will remain effective till 31st March, 2025. With respect to solar, the policy targets to add 12.9 GW , in addition to the installed 1.9 GW7 by FY25. Such capacity addition will result in the state transforming from a wind dominated state to a solar dominated one. The 12.9 GW target is in line with the Renewable Purchase Obligation (RPO) targets set for MSEDCL8 by MERC for FY 2024-25 (i.e., Solar RPO target of 13.5%), therefore, there are no additional commitments stated in the policy. While there are specific targets for certain project categories (energy storage, PV for EV charging and hybrid projects), they are not ambitious enough to make a significant difference to the capacity landscape or to nudge investment in these categories. For example, the target for solar projects installed for EV Charging is only 50 MW. Such capacity can only charge 330 e-buses at a time, considering that each bus is charged with 150 kW DC charger. Apart from this, project developer/ investor has to own land, limiting the participation in true sense.

The target breakdown in Figure 2 indicates that the focus remains on deploying utility-scale projects9 (10 GW).

Taking cognizance of falling RE prices, the state has taken the progressive step of not extending any incentives for investment in solar projects. Further, the rebate of electricity duty for first 10 years provided in 2015 policy has also been discontinued.

In addition, there are other progressive provisions in the policy, but without any clarity on these provisions, modes for implementation and a clear framework, it is unlikely that these provisions will bear any fruitful consequences. These are detailed below:

Figure 2: Maharashtra Solar policy targets, MW

Source: PEG compilation from targets in Maharashtra Integrated Non-Conventional Energy Generation Policy 2020

- Measures to track progress in achieving targets: While the high capacity addition targets will indeed promote solar, the policy should have detailed mechanisms to reach this target. This is especially the case as there has been under-achievement in the case of previous policy targets (achieving just 20% out of the previous target of 7500 MW10 ). The policy could have specified yearly targets to give clarity on the trajectory for such addition. Perhaps, given the setbacks of the previous policy, the current policy gives a thrust to a regular feedback mechanism from project owners/developers, regular meetings and progress monitoring by MEDA, constituting a steering committee to solve issues, single window clearance, etc. However, no progress on these fronts has yet been reported in the public domain. Therefore, this raises a question of this being yet another policy that sounds well only on paper but misses the mark on implementation. Beyond these policy provisions, the implementation will also depend on regulatory actions to ensure RPO compliance. Regulatory provision allows targets to be carried froward. This exception clause should not become the norm and should only be carried forward for one year, only in exceptional circumstances.

- Obtaining stipulated environmental clearances: The policy stipulates obtaining an NOC (no objection certificate) from Maharashtra Pollution Control Board (MPCB) for solar projects and from the Department of Geology and Mining in case the project is to be set up within a mineral rich district. This was not specified in the previous policy. However, it remains to be seen whether it is a progressive step for socio-environmental governance or whether it merely translates into another administrative hurdle. Further, the procedure of obtaining this clearance as well as implications of not obtaining the same, are not clear.

- Implementing provisions related to long term open access: For large scale solar projects, the policy promotes availing long-term open access (LTOA) by developers (with a minimum period of 10 years) to make the projects financially viable. The share of LTOA in total OA power consumption in Maharashtra is negligible. For example, in 2018-19, only 5 MUs were consumed under LTOA out of the total 4073 MUs of power consumed by OA consumers within the state. Hence, the provision is expected to provide certainty in long term to both DISCOMs (in terms of demand) and generators (in terms of revenue). Rightly so, the onus of fixing this time limit has been left to MERC, which might decide otherwise. There has been no proceedings initiated to deliberate this provision before the MERC. Thus, there is no long-term clarity for the project owner, as was envisioned by this provision in the first place.

Having discussed few progressive provisions that need careful consideration, let us briefly look at some welcome provisions which can be replicated in other states. First, it provides policy certainty for a 4-year time period. Second, the policy provides a clear transition for projects under implementation as per the previous policy11, ensuring continuity and certainty between two successive policies. Projects which are registered by April 202112 and are commissioned till 30th Dec 2021 are allowed to avail the benefits of the previous policy. Apart from this, a single window web portal will be developed to get permits, approvals, consents, etc. from various administrative departments. This will help in reducing the delays to get the required clearances from various departments, thus making them accountable as well as aiding smoother inter-departmental communication. Further, the policy deals with land availability provisions, detailing different models of procurement of private and public land. It also has provisions to allow the use of seasonal partially submerged lands for project development. In addition, solar projects can be installed to supply water in urban and rural areas, resulting in lesser dependency of local bodies on DISCOM power and shifting such load to day time. Moreover, Maharashtra’s policy currently exists in the vernacular language which does promote better access. Nevertheless, going forward, an additional English version of the policy would also help with better outreach to investors and other states.

Commentary

The approach of these two policies is distinct from one another. While one would expect this given the distinct state realities, the issue here remains that neither state succeeds in prioritising clear and effective policy provisions to promote RE development. Maharashtra is predominantly focused on capacity addition and specification of targets under each category, which in itself is a reiteration of already committed RPO targets of the state. It reads more as a clarificatory document, providing little inducement or impediment to the RE sector. On the other hand, Gujarat is focused on managing sales migration across various categories driven by falling renewable energy prices. Given the DISCOM focused approach in the policy, C&I consumers will have to navigate through plenty of hoops, particularly if the regulator/DISCOMs adopt the suggested approach.

Both the states have an explicit provision to conduct a mid-term review of their respective policies. Given the sector’s dynamic nature, this provides an opportunity for course correction, and the states should utilise it especially if there are changes in technology or any lacunae in its implementation process. With respect to effective implementation of the policy, Maharashtra has detailed provisions to facilitate the application process as well as the completion of projects within the stipulated time. The Gujarat policy remains mute on any such provisions. The Gujarat policy also does not include any provisions for the ‘bridge projects’, i.e projects registered under the previous policy but not yet commissioned. Treatment to be given to such projects must be explicitly mentioned in the policy to ensure continuity. It must be noted that all of the above provisions will hold water only if they are operationalized, instead of just remaining on paper.

The RE-rich states of Maharashtra and Gujarat are often seen as the front-runners in the RE policy and regulatory space. Yet, neither of their current policies succeed in sending the right market signals, responding to emerging technologies and building the investors’ confidence. There seems limited impetus for furthering investment in emerging technologies (such as storage) and limited attention to investments in small scale distributed solar projects (be it rooftop, solar for EVs, solar and storage solutions for public bodies such as hospitals, water works, etc). Another way to cement market enthusiasm would have been to provide certainty and clarity to consumers on various provisions. However, the treatment of captive and banking provisions in Gujarat will impede investors’ confidence. Instead, the policies could have encouraged investment through specific measures such as encouraging regulators to provide relaxation of DT capacity limits, annual banking options with a suitable compensation framework and by specifying targets for storage investments by utilities.

RE prices have fallen rapidly in the recent years, removing the need for any form of RE-specific concessions or incentives on transmission charges and sales migration charges. It is encouraging to see that there are hardly any such concessions being provided in the two policies. While Maharashtra does not give any such concessions, Gujarat gives one of such nature, by waiving off POC for captive SPS. Such a waiver is inconsequential, given the negligible POC charges and the restrictive banking provision.

Therefore, having analysed the provisions of the RE policies of Gujarat and Maharashtra, we draw lessons for other states seeking to enhance their RE development. Taking the market realities into account, ambition should be spelled out along with a clear roadmap via the policy. This clear roadmap could be guided by five principles – Clarity, Certainty, Compensation, Convergence and Choice. There should be clarity by providing ambitious but achievable targets, consistent provisions and transparency in implementation and monitoring processes. There should be certainty of incentives, sales migration charges and processes in the medium-term. For compensation, ensuring DISCOMs and other utilities are compensated adequately for the risks and services provided to promote RE and facilitate sales migration. Over a longer period of time, a convergence of policies can take place between wind and solar, open access and captive, as well as, between LT and HT consumers in terms of applicability. Having similar treatment for RE and non-RE by discontinuing concessions is another aspect of convergence. Finally, choice should be extended to the consumers by providing multiple renewable energy based options for retail competition but also by providing flexibility and implementation options in the policy. In addition, incentivizing new technologies through targets and grants is also necessary as part of policies to encourage investment and mainstreaming in the future. Further, an integrated policy constituting the provisions of land, clearances, provision of hybrid projects and energy storage should be evolved by the states, with a proper due-diligence and consultation of stakeholders’ views. Deliberative process will reduce the need for review and mid-course correction once the policy is finalised.

Government policies are expected to be proactive and reformative. The current policies could have been more ambitious in its vision and more forward-looking in its commitments for a balanced development in the sector. In its place, one can anticipate increased litigation and conflicts between open access, captive consumers and the DISCOM in Gujarat; and hardly any on ground progress due to lack of implementation framework for the policy. It remains to be seen whether state governments learn from their mistakes, and are able to spearhead the development of renewable energy, whilst safeguarding the health of the DISCOMs.

Endnotes

1. The authors would like to thank Akhilesh Magal, Head, Renewable Advisory, Gujarat Energy Research and Management Institute (GERMI) for a valuable review of the draft. Further, the authors would also like to thank Ashwin Gambhir, Shantanu Dixit and Kailas Kulkarni from PEG for their review and assistance.

2. This article is part of an ongoing series called Power Perspectives, which provides brief commentaries and analysis of important developments in the Indian power sector, in various states and at the national level. Comments and suggestions on the series are welcome, and can be addressed to

3. The combined capacity of renewable energy in these two states accounts for more than a fifth of India’s installed RE capacity.

4. As per Gujarat’s Solar Policy, the sale of electricity by the owner of the Solar Power Systems to separate consumers shall be considered as Third-Party Sale.

5. This is only for those LT consumers who are not subject to demand based tariffs. Treatment given to LT demand-based consumers is same as HT consumers.

6. In case of consumers other than MSME, surplus energy shall be compensated at 75% of the simple average of tariff discovered and contracted through competitive bidding process conducted by GUVNL for non-park based solar projects in the preceding 6-month period; the same remaining fixed for the entire term of the agreement. In case of MSME Manufacturing Enterprises, surplus energy shall be compensated at the rate of ₹ 2.25 per unit for the first five years from commissioning of the project, and thereafter, it shall be the same compensation process as non-MSME mentioned above.

7. As of December 2020

8. The Maharashtra Electricity Regulatory Commission (MERC) has approved the requirement of 20,040 MUs of solar power for solar RPO compliance by MSEDCL (Maharashtra State Electricity Distribution Company Limited- the state-owned distribution company) in 2024-25. Considering 19% CUF, the solar capacity requirement will be 12.04 GW

9. Assuming that the capacity addition under Chief Minister Solar Agriculture Feeder Scheme will also be considered under this target of 10 GW. No separate targets have been specified for this scheme under the present policy document, however, there is a separate G.O. stating 5 GW targets for the said scheme. More details regarding the scheme are available here: https://prayaspune.org/peg/resources/power-perspective-portal/267-agriculture-solar-feeders-in-maharashtra.html

10. Comprehensive Policy for Grid-connected Power Projects based on New and Renewable (Nonconventional) Energy Sources – 2015 had target of 7500 MW solar capacity in 5 years’ time. However, the total installed capacity is just over 1600 MW in state till Dec 2020.

11. The previous policy was Comprehensive Policy for Grid-connected Power Projects based on New and Renewable (Non-conventional) Energy Sources – 2015, which was announced in July 2015. As per the present policy document, around 2100 MW capacity projects are under construction phase.

12. The last date of registration was extended from 31st March to 30th April via a recent GO.