As part of its capital investment plan (CIP), for the Multi Year Tariff control period FY20 to FY22, TANGEDCO submitted its projected demand and installed capacity details till FY27. As per these estimates, by FY27, the installed conventional1 and renewable capacity in Tamil Nadu will be 30 GW and 24 GW, respectively. This is double the installed capacity in the state as on 1st April 2019 and the conventional capacity alone is 5 GW in excess of the projected demand for FY27. Further, as part of this anticipated capacity addition, the CIP details thirteen projects that will mostly be taken up by TANGEDCO. These projects amount to capacity addition of 20 GW, and coal based capacity accounts for 85% of it. This substantial addition of long term, round-the-clock thermal capacity and the significant role of renewable power in the state is likely to result in Tamil Nadu facing a sustained power surplus with low utilisation of avoidable high cost thermal capacity. Given the impacts of the anticipated capacity addition, this article outlines the CIP’s main proposals with respect to capacity addition and traces its key assumptions and implications.

1. Anticipated capacity addition and delays

Table 1 captures the fuel-wise proposed capacity addition listed in the CIP. As is seen, the capacity addition projects presented in TANGEDCO’s CIP petition include projects that are under construction and those that are in the pipeline. The petition does not clearly indicate the anticipated date of commissioning for each of the projects listed. Without this clear commitment, there is uncertainty about the plant’s availability, which in turn makes power procurement planning challenging.

Table 1. Projected fuel-wise capacity additions

| Sl. No. | Plant | Capacity (MW) | Status | Anticipated year of commercialisation | Fuel |

| 1. | ETPS Expansion TPP (1 unit) | 660 | Under construction | FY23 | Coal |

| 2. | Ennore SEZ TPP (2 units) | 1,320 | Under construction | FY21 | Coal |

| 3. | North Chennai TPS Stage III (1 unit) | 800 | Under construction | FY20 | Coal |

| 4. | Uppur TPP (2 units) | 1,600 | Under construction | FY23 | Coal |

| 5. | Udangandi TPP Stage I (2 units) | 1,320 | Under construction | FY22 | Coal |

| 6. | Kundah pumped storage HEP (4 units) | 500 | Under construction | FY23 | Hydro |

| Total capacity under construction | 6,200 | Under construction | |||

| 7. | Ennore Replacement TPP (1 unit) | 660 | In the pipeline | FY25 | Coal |

| 8. | Udangundi Expansion Project Stage II(2 units) | 1,320 | In the pipeline | FY27 | Coal |

| 9. | Udangundi Expansion Project Stage III (2 units) | 1,320 | In the pipeline | FY27 | Coal |

| 10. | Cheyyur Ultra Mega Power Project (5units) | 4,000 | In the pipeline | Not mentioned | Coal |

| 11. | Sillahalla pumped storage HEP (4 units) | 2,000 | In the pipeline | FY26 | Hydro |

| 12. | Kadaladi Supercritical TPP (5 units) | 4,000 | In the pipeline | Not mentioned | Coal |

| 13. | Kadaladi Ultra Mega Solar PV park Power Project | 500 | In the pipeline | FY21 | Solar |

| Total capacity in the pipeline | 13,800 | In the pipeline | |||

| Total capacity additions | 20,000 |

Source: Prayas (Energy Group) compilation based on TANGEDCO’s 2019 CIP petition

Additionally, without a detailed timeline of project milestones, details of delays from the project schedule, and issues in obtaining statutory clearances, it is infeasible to arrive at a reasonable estimate for when the capacity will be available. It is imperative that a systematic assessment based on comprehensive tracking takes place as TANGEDCO’s plants have faced significant slippages and time and cost overruns in the past. For instance, as per TNERC’s order for approval of capital cost of Mettur Thermal Power Station Stage III, the unit’s commissioning faced a delay of 24.5 months owing to stoppage of works due to technical complications, which resulted in a 191% increase in interests during construction (IDC).

In addition to causing cost overruns, which impact consumer tariffs, delays in construction in the absence of requisite capacity could also increase dependence on high cost, short-term procurement to avoid load shedding. In fact, 45% of the anticipated capacity under construction, which is slated to come online by FY23, have already faced delays due to lapsed clearances, litigation, contractor issues, and corporate insolvency as per the Central Electricity Authority’s (CEA) monthly broad status report for December 2019. Table 2 lists some of TANGEDCO’s ongoing projects and the reported cause of their delays.

Table 2. Delay in TANGEDCO's ongoing projects

| Project under construction | Capacity (MW) | Cause of delay/potential delay |

| ETPS Expansion TPP (1 unit) | 660 | Corporate insolvency and bankruptcy process were initiated against the EPC contractor and the existing environmental clearance (EC) has expired |

| Ennore SEZ TPP (2 units) | 1320 | Work was temporarily suspended due to litigation between September 2015 and October 2016 |

| North Chennai TPS Stage III (1 unit) | 800 | Structural works were kept on hold due to issues with the contractor for boiler and bunker erection and validity of its EC is subject to litigation |

| Uppur TPP (2 units) | 1600 | Litigation regarding land acquisition has been ongoing and the issued EC has been challenged |

Source: Prayas (Energy Group) compilation based on CEA’s broad status report (Dec 2019) and TANGEDCO’s 2019 CIP

The projects in the pipeline, which are expected to come online by FY27, are also affected by delays. The anticipated capacity in the pipeline includes many projects which will be subject to procurement of clearances and acquisition of land, which can often be long-drawn processes. The status of these new projects as listed in the CIP are presented in table 3. However, calling these projects ‘new’ is a misnomer of sorts as some of these plants, such as Cheyyur UMPP and Ennore replacement TPP, have featured on TANGEDCO’s new projects list as early as FY12, with little to no updates on the progress of these projects.

Table 3. Status of projects in the pipeline2

| New project | Unit x Capacity (in MW) | Environmental Clearance status | Land acquisition status |

| EnnoreReplacement TPP | 1x660 | EIA under process | Not mentioned |

| Udangundi ExpansionProject Stage II | 2x660 | Will approach MOEFCC | Under progress |

| UdangundiExpansion Project Stage III | 2x660 | Will approach MOEFCC | Under progress |

| Cheyyur Ultra MegaPower Project | 5x800 | EC awarded on 30.9.13 | Completed |

| Sillahallapumped storage HEP | 4x500 | Getting clearance outsourcedto M/s WAPCOS on 23.1.19 | Not mentioned |

| Kadaladi SupercriticalTPP | 5x800 | MOEFCC directed TANGEDCO to explore new sites | Site not confirmed |

| KadaladiUltra Mega Solar PV park Power Project | 500 | CRZ demarcation done | Under progress |

Source: Prayas (Energy Group) compilation based on CEA’s broad status report (Dec 2019) and TANGEDCO’s 2019 CIP

2. Assumptions regarding availability and demand estimation

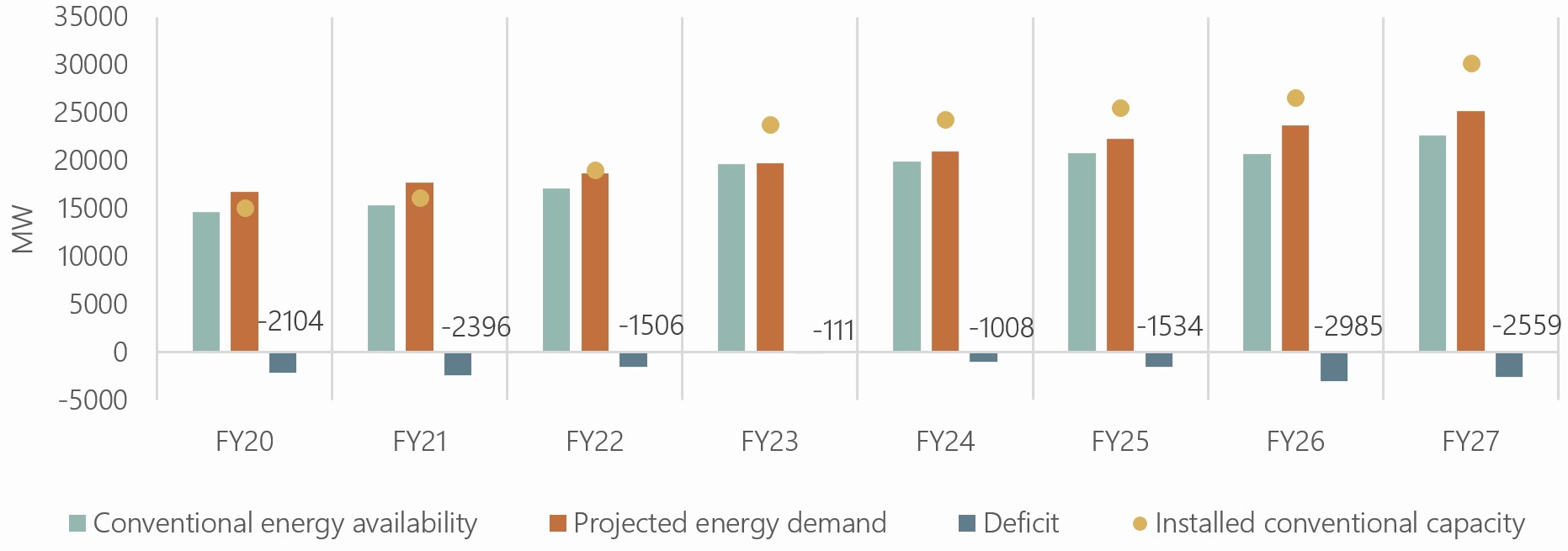

Other than the projects coming online in time, the availability of the listed projects once commissioned also critically influences supply side planning and operation. Figure 2 illustrates TANGEDCO’s demand and end of year availability projections till FY27 for conventional capacity. The figure highlights a deficit of 2,559 MW in FY27 when the projected demand is 25 GW, despite TANGEDCO’s projected installed conventional capacity reaching 30 GW. This deficit is estimated due to the assumed lower availability of conventional capacity “based on the availability on 27.04.2018 to meet the lighting demand of 15440 MW during the offwind season”, as stated in the CIP.

Figure 1. Projected energy demand and availability till FY27

Source: Prayas (Energy Group) compilation based on TANGEDCO’s 2019 CIP petition

Availability is a function of generation and these factors must be accounted for to ensure reliable availability estimates. The use of present “lighting demand” in off-wind months to project availability has not been explained or detailed in the submission. While TANGEDCO has accounted for reduction in availability due to ageing of contracted capacity, it is not clear if the influence of factors such as coal availability and water shortage has been considered.

TANGEDCO’s projections for availability also do not include the state’s substantial renewable resource, on account of its consideration as infirm power. This is despite TNERC notifying regulations for Forecasting, Scheduling and Deviation Settlement of Wind and Solar Generation in 2019 to ensure more accurate scheduling and planning for all RE generators in the state, which is already being implemented in the state. Further, given the significant wind and solar capacity in the state and the increasing financial viability of battery-based storage, investment in such storage alternatives should also be considered in the CIP . This will help integrate RE and manage supply with variations in availability and load without adding base-load capacity. This is particularly relevant given that TANGEDCO is currently considering solar+storage options to manage future capacity. While pumped storage for hydro capacity addition has been considered in TANGEDCO’s CIP plan, battery-based storage for RE has not.

Like availability, TANGEDCO’s demand assessment does not disclose crucial assumptions and the methodology employed to ascertain demand. Firstly, the projected demand is estimated based on the actual demand met by TANGEDCO during FY19 assuming a flat 6% per annum growth rate till FY27. Such an assumption does not capture daily and seasonal variations in load pattern. Secondly, no specific assumptions account for the potential changes in load due to increase in open access and captive consumption, and day-time shift in agricultural load with the implementation of the KUSUM scheme.

3. Reviewing capacity addition

Capacity addition is essential toward meeting the state’s growing energy demand, contingent to effective planning based on realistic estimates. Adding baseload capacity without scientific assessment, influenced by Tamil Nadu’s shortage ridden past, will result in cost and resource sinks which will have impacts on the DISCOM’s finances and consumer tariffs. A crucial measure towards avoiding poor power procurement decisions is to critically evaluate the proposed capacity in the pipeline, and examine whether all the capacity needs to come online.

At a time when state governments like Gujarat and Chhattisgarh are committing to not add any more coal-based capacity, investment in assets which can result in significant resource lock-ins should be taken seriously. Some steps for planning and cost optimisation could include the following:

- TNERC should ensure that future capacity addition takes place only after a comprehensive assessment, like the commitment in Maharashtra and Uttar Pradesh. Tamil Nadu could also take a cue from the Maharashtra ERC3 which, in a bid to control power surplus in the state, directed DISCOMs to “…review its PPAs and explore options to optimise the impact of the fixed cost of the contracted capacity, including deferment in cases where no significant work execution has taken place so far”.

- Such assessment should consider renewable capacity, transmission investment, realistic demand growth, trends in open access, captive, and rooftop, energy efficiency, etc.

- All future capacity addition, including TANGEDCO’s projects, should take place through competitive bidding to ensure efficient price discovery or with provisions in the PPA to ensure mitigation of delays.

Such planning and reassessment of capacity addition, and the resultant action of surrendering contracted capacity or deferring pipeline capacity additions as required, would enable the state to mitigate the burden of sunk costs and resource lock-ins, while ensuring better utilisation of existing capacity.

Endnotes

1. As per TANGEDCO’s treatment conventional capacity covers the state’s hydro, thermal, gas sources, its share from central generating stations, its captive power plants, and the power purchased. Non-conventional generation includes generation from wind, solar, biomass, and co-generation plants.

2. The expansion of the key acronyms used in Table 3 are: Environmental Impact Assessment (EIA), Ministry of Environment, Forest, and Climate Change (MOEFCC), Coastal Regulation Zone (CRZ)

3. MERC Case No. 46 of 2016, dated 30th August 2016, which can be found here.